However, if markets were completely efficient and contemporaneous prices fully reflected all information available, then outperforming the market would become a matter of happenstance.

As a result, if a market could be completely efficient, there would be no information or analysis that could result in over-performance of an expected benchmark.

In other words, technical analysis is unnecessary because market price already reflects that which can be analyzed from a technical standpoint.

In practice, markets are neither perfectly efficient nor completely inefficient.

In markets with substantially low efficiency, more knowledgeable investors can often outperform less knowledgeable investors.

Most researchers consider large capitalization stocks to also be very efficient, while small capitalization stocks and international stocks are considered by some to be less efficient.

Real estate markets and venture capital markets, which do not have fluid or continuous markets, are generally considered to be less efficient because different participants may have varying amounts and quality of information.

Conversely, markets that are considered inefficient such as the real estate market and various venture capital markets are more speculative in nature.

As such, underlying prices may be very unstable.

Accordingly, established derivative and securities markets are lacking.

Accordingly, transaction costs associated with negotiating, maintaining and enforcing forward contracts are often unnecessarily high.

There are disadvantages to

purchasing a futures option.

For example, because one party has the right to refuse delivery of the futures option, the futures option is more expensive to purchase that a futures contract.

The higher price negatively impacts the return of the instrument, resulting in a

lower yield.

Because the yield is lower, it is a more inefficient risk

management tool than a standardized futures contract.

While prices for his

crop remain steady, the farmer is worried that the value of his crops at

harvest time will drop.

Entities typically utilize securities to raise new capital because they are an attractive option relative to

bank loans which tend to be relatively expensive and short term.

However, entities do not hedge against every contingency.

If the risk that needs to be hedged has only a small

impact on an entity's bottom line, it may decide that hedging against that risk is unnecessary.

As such, the total number of contracts available is limited.

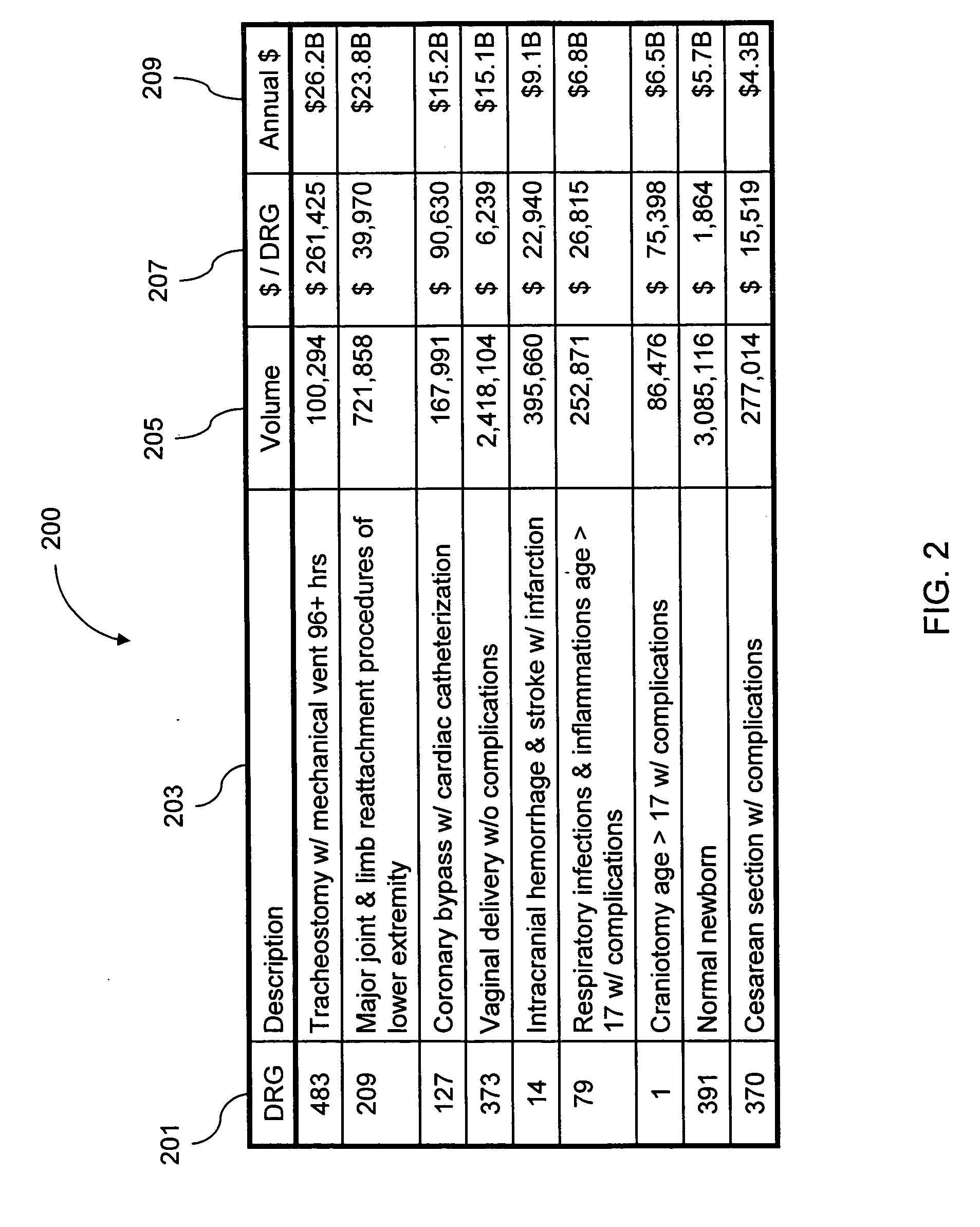

In addition, the CPI index is not an accurate measure of the volatility of uncorrelated products and services (e.g., healthcare) because uncorrelated products and services increase in price at a different rate than inflation.

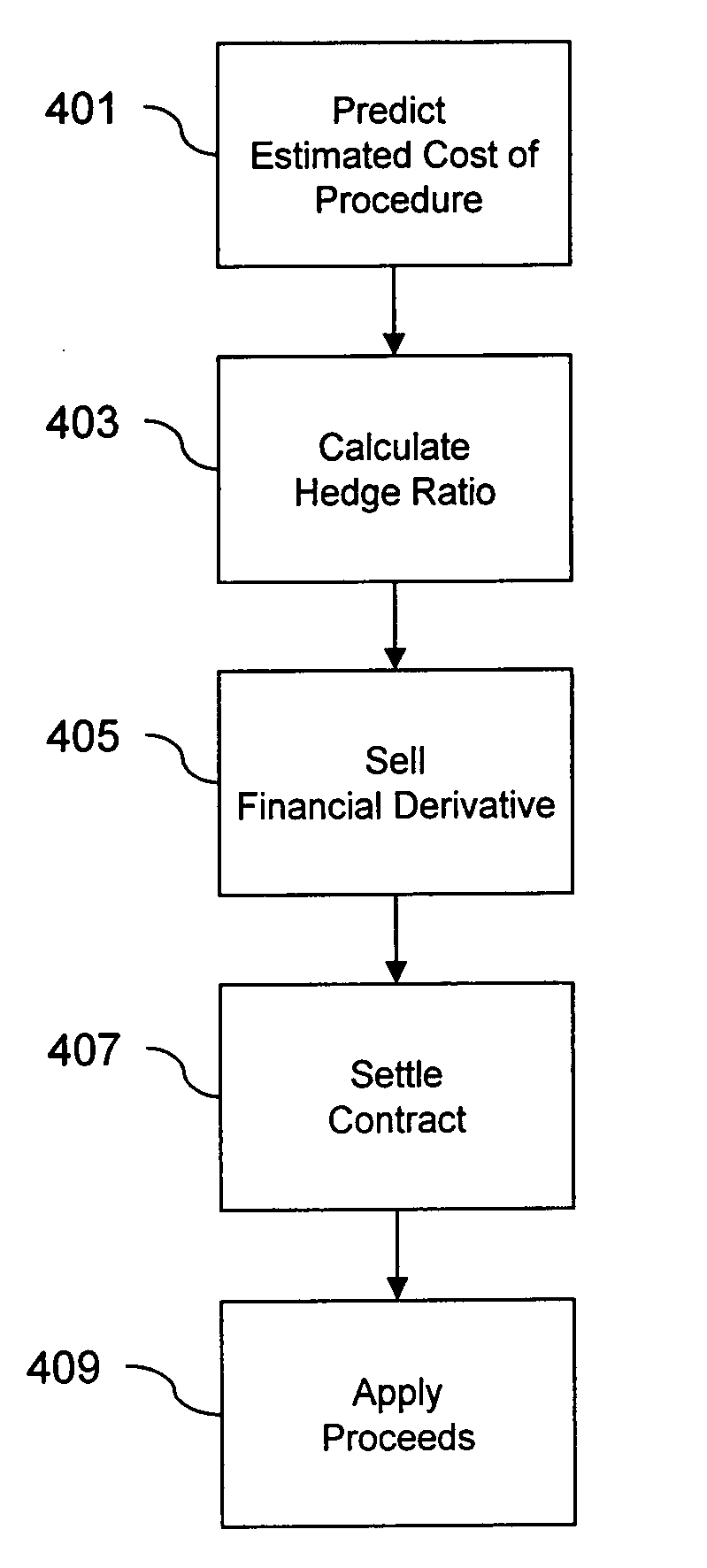

The components of the healthcare trend are highly variable, making the healthcare trend extremely volatile.

Therefore entities that attempt to manage

health related expenditures have difficulty budgeting and forecasting these costs due to this volatility, which affects the entity's bottom line.

For example, a Fortune 100 company like

General Motors has high financial

exposure to such risk factors as currency risk, credit risk from its financing division, interest rate risk from its financing division, and fuel cost risk from the sale of automobiles.

These financial risks are correlated to significant sources of revenue from (or significant expenditures related to), automobile products and services.

However, no such market exists.

There is no market for tangible financial derivatives because the healthcare industry is extremely inefficient.

Further, corporations often alter existing health insurance plans by making benefit adjustments, imposing access restrictions, altering eligibility requirements, and creating alternative healthcare plans.

Insurance premiums associated with such insurance have been rising at an alarming rate due to increasing costs that reflect the inherent variability of the healthcare industry, such as the cost of prescription drugs.

In addition, insurance premiums are inflated, for example, by transaction costs related to contract maintenance and contract negotiations.

Similarly, administration of these plans is extremely costly because plans are not standardized (i.e., they are corporation specific).

As a result, the present

system for managing risk associated with healthcare costs (i.e., health insurance) is inefficient.

While a typical self insured employer can predict the approximate number of doctor visits its employees will have in a given year, it cannot predict the number of “catastrophic events” (e.g., premature births,

cancer, and organ transplants) that will occur in a given year.

The costs associated with these procedures can be devastatingly high to a self insurer so there is a need to hedge against this type of risk.

For example, conservative pricing and limited availability of stop loss insurance policies severely curtails the usefulness of stop loss insurance to small health plans with limited financial resources.

In contrast, large companies can afford the costs associated with a few catastrophic claims, so the steep cost of stop loss insurance becomes economically wasteful.

In addition, like traditional insurance, stop loss premiums are inflated, for example, by transaction costs related to contract maintenance and contract negotiations, as well as costly administrative expenses.

Consequently, stop loss insurance is limited to mid-sized self insured employers because such entities often do not have large enough cash reserves or generate enough income to cover the costs associated with several catastrophic claims.

In addition, stop loss insurance solutions only maintain extreme volatility because typical stop loss plans do not take effect until the incurred claims exceed a 25% threshold.

Thus, current insurance practice is highly inefficient.

The current process of determining pricing associated with healthcare is extremely inefficient.

This process is inherently inefficient because the government necessarily sets higher values for some services and lower values for others than would be established through supply and demand dynamics.

This inefficiency is further compounded by the need for multiple geographic factors.

Additional market inefficiencies exist in regards to private healthcare providers.

Currently, private providers negotiate with each healthcare provider individually, thereby increasing transaction costs such as legal fees and

wasting limited financial resources.

This negotiation process leads to the proliferation of asymmetric information, negatively influencing the efficiency of any

potential market.

As a result, the cost to provide healthcare is inordinately high and volatile.

Login to View More

Login to View More  Login to View More

Login to View More