Large and medium-sized customer credit process monitoring system

A monitoring system, large and medium-sized technology, applied in the direction of instruments, finance, data processing applications, etc., can solve problems such as untimely business connection, lack of unified coordination, and impact on the rapid development of public and medium-sized credit business, so as to improve planning and improve The effect of credit delivery efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] The present invention will be further elaborated below in conjunction with the accompanying drawings of the description.

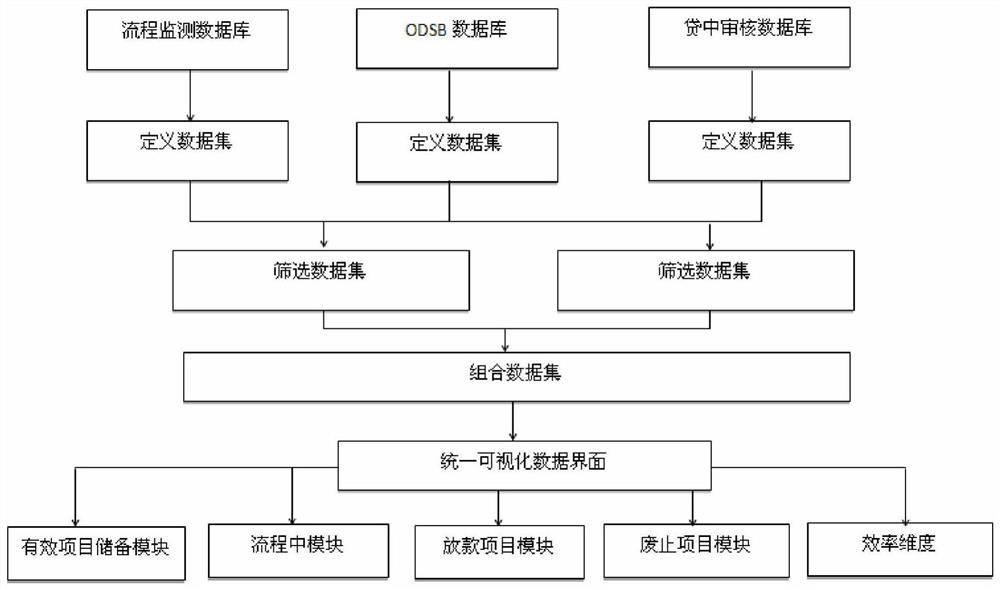

[0033] like figure 1 As shown, the present invention provides a large and medium-sized customer credit process monitoring system, including ledger system server, lending server and ODSB server, a process monitoring database is established in the ledger system server, and a credit review database is established in the ledger system server , establish the ODSB database in the ODSB server, define and screen the data sets in the process monitoring database, loan review database and ODSB database, obtain the combined data set, display it through a unified visual data interface, and set up in the visual data interface Effective project reserve module, in-process module, disbursement project module, abolished project module and efficiency dimension module.

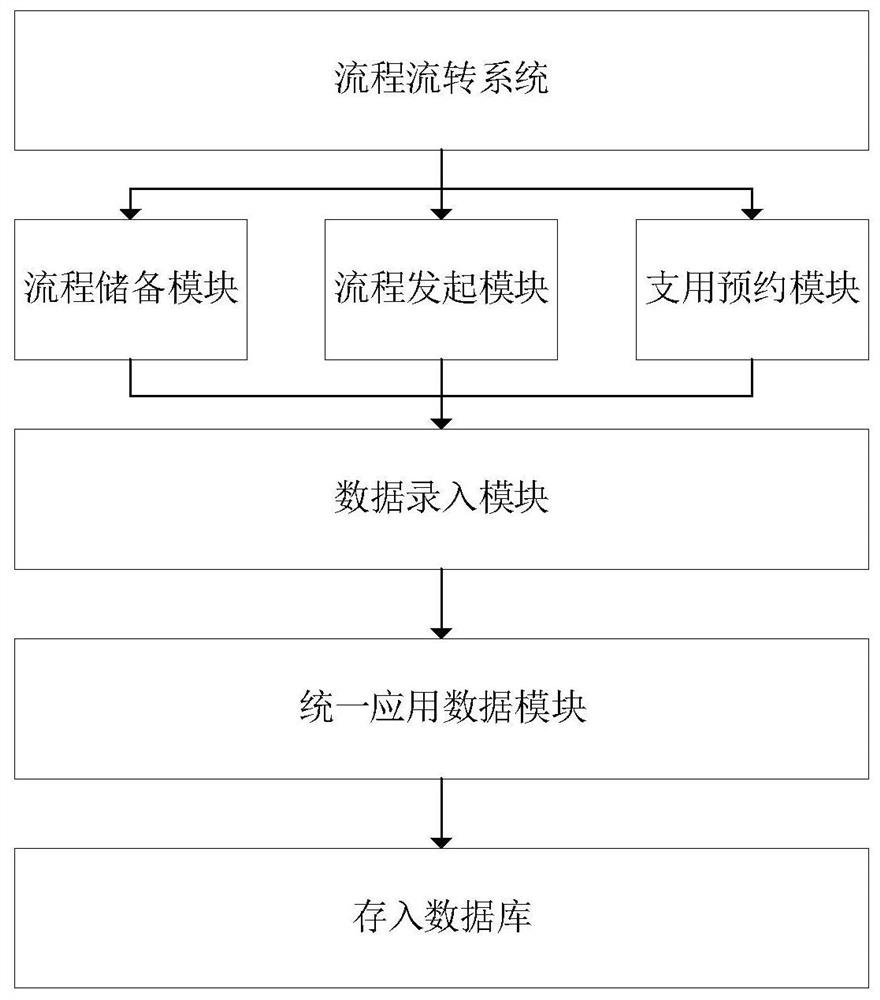

[0034] like Figure 2~3 As shown, the credit process business is monitored in the lending server...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com