An automatic branching VAT invoice issuing terminal and an invoicing method

A value-added tax and invoice technology, which is applied to instruments, typewriters, printing, etc., can solve the problems of inability to realize the automatic sub-linking of invoices and the verification of the biller's identity verification in the bookkeeping link, and achieve the effect of reducing manpower input

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

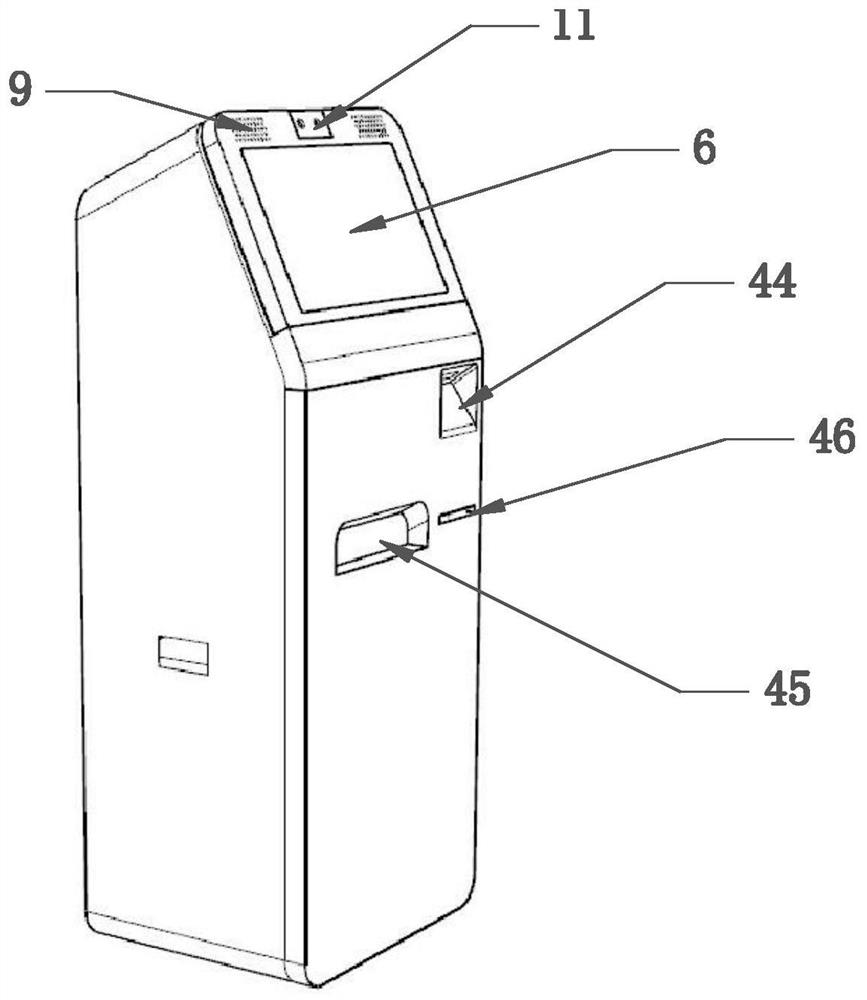

[0046] In this embodiment, an automatic sub-linked value-added tax invoice billing terminal, such as figure 1 As shown, it includes an identity verification module 1, a basic module 2 and a printing and stamping module 3, and the basic module includes a network communication module 4, an information processing module 5, a display screen 6, a power supply module 7, a receipt printer 8 and a speaker 9. The display screen displays relevant processes and steps and reminds users what to do. The speaker broadcasts relevant information of the display module in voice mode. The power supply module provides continuous and stable power supply for the internal hardware of the terminal. The network communication module communicates with the terminal and the enterprise billing settlement system. For the transmission of related information, the information processing module is responsible for the information collection or sending processing of other modules, and the receipt printer prints the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com