Vehicle insurance rapid claim settlement method and system based on tree model

A tree model and auto insurance technology, which is applied in the field of fast claim settlement methods and systems for auto insurance based on tree models, can solve the problems of omission, reduce the safety and effectiveness of rule models, and cannot meet high precision, and achieves improved efficiency and accuracy. The effect of degree and interpretability

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0049] Further description will be made below in conjunction with the accompanying drawings and specific embodiments.

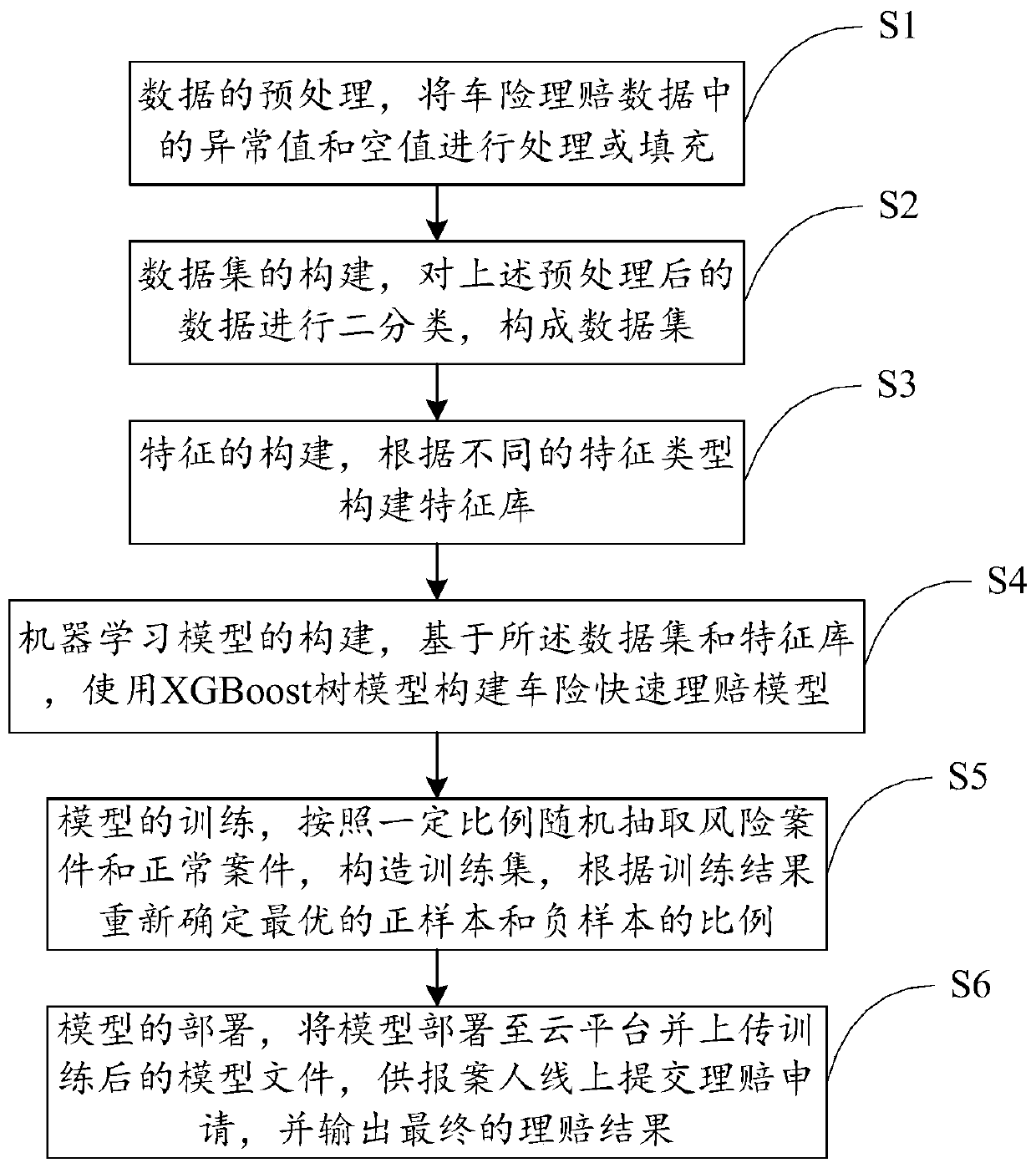

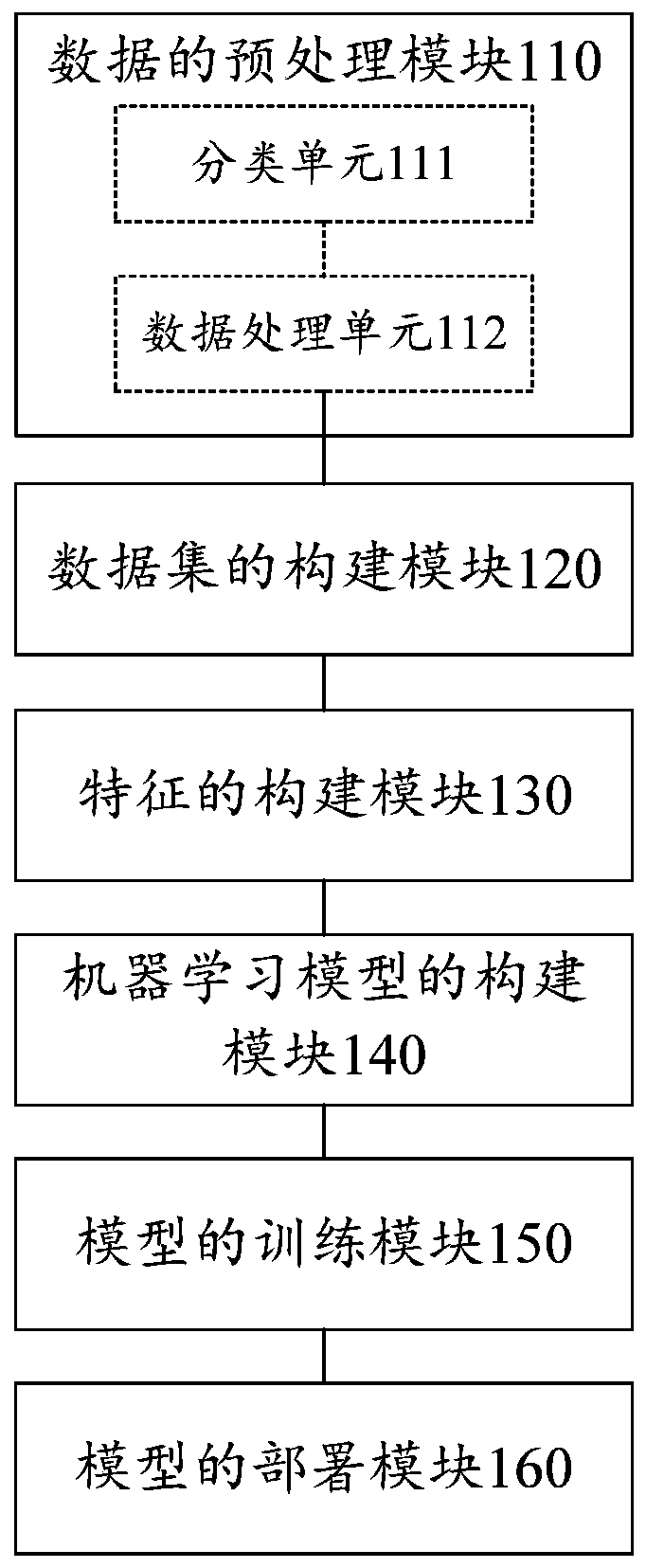

[0050] Such as figure 1 As shown, this embodiment provides a tree model-based method for quick auto insurance claims, which mainly includes the following steps:

[0051] S1: Data preprocessing, processing or filling outliers and null values in the auto insurance claim data;

[0052] S2: Construction of the data set, performing binary classification on the above-mentioned preprocessed data to form a data set;

[0053] S3: Construction of features, constructing feature libraries according to different feature types;

[0054] S4: Construction of the machine learning model, based on the data set and feature library, using the XGBoost tree model to build a fast claim settlement model for auto insurance;

[0055]S5: Model training, randomly select risk cases and normal cases according to a certain ratio, construct a training set, and re-determine the optimal r...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com