Loan risk timeliness prediction system and method based on LSTM

A forecasting method and forecasting system technology, applied in neural learning methods, instruments, biological neural network models, etc., can solve problems such as personal financial impact, user attributes are invariable, and time factors are not considered

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

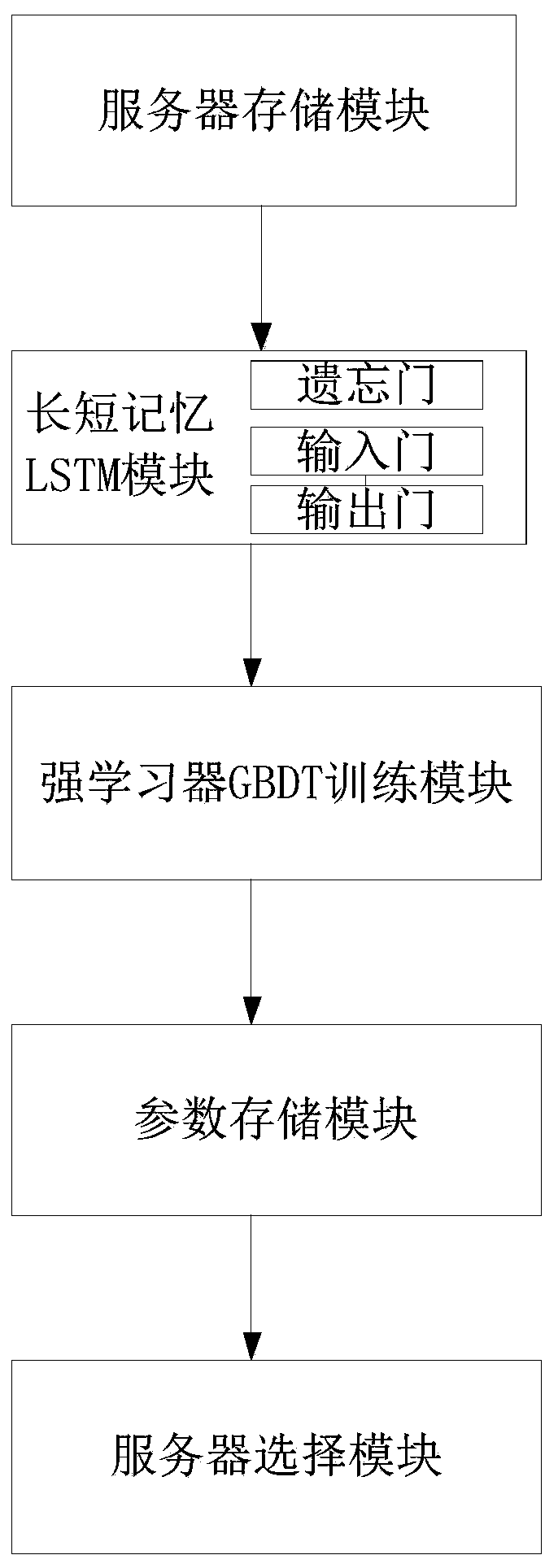

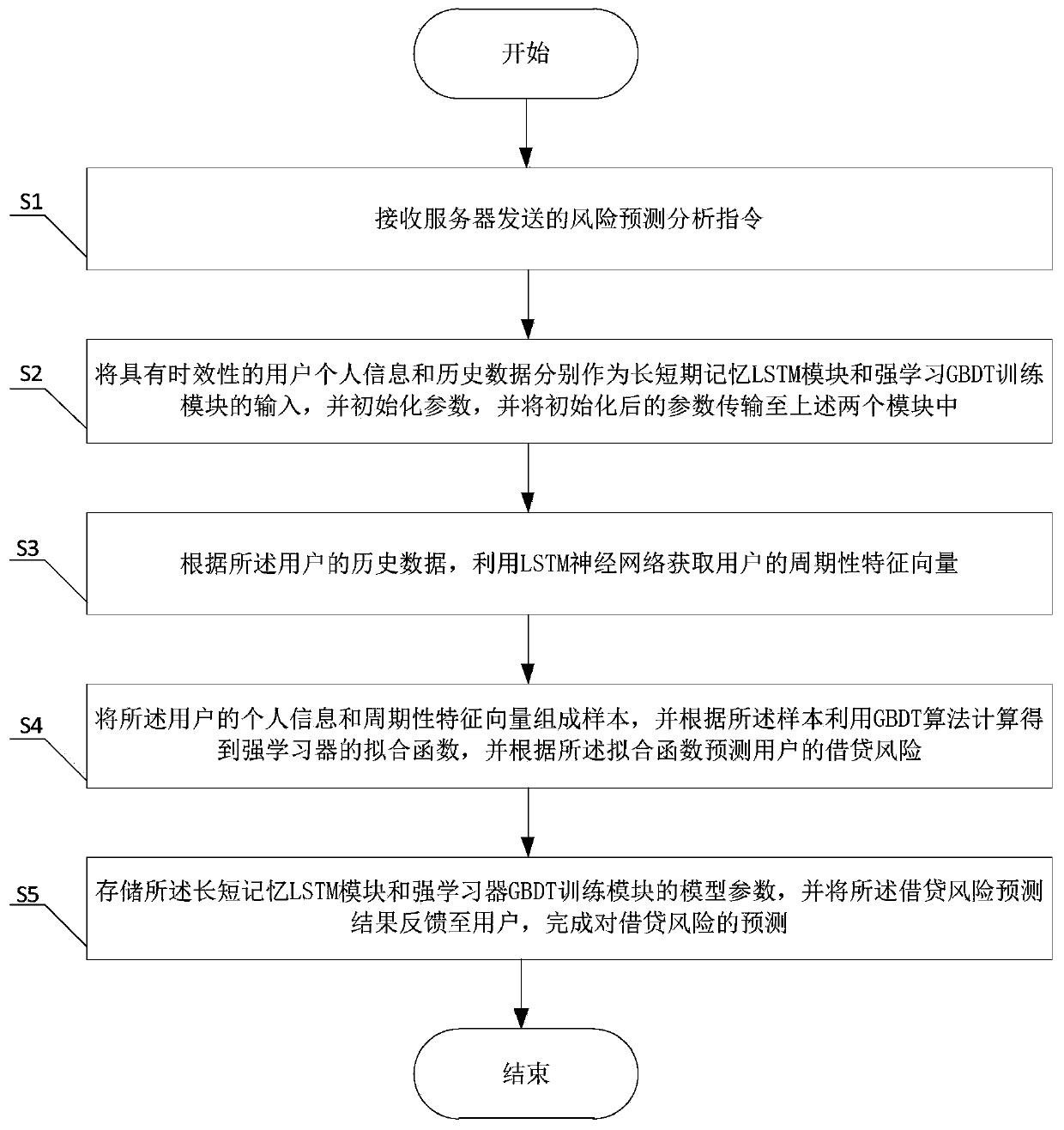

[0067] The present invention provides an LSTM-based loan risk timeliness prediction system and method, which are specially used to predict the risk of user loans, and then provide an index for recommending this loan transaction. Such as figure 1 As shown, the LSTM-based lending risk timeliness prediction system includes a sequentially connected server storage module, a long-short-term memory LSTM module, a strong learner GBDT training module, a parameter storage module and a server selection module;

[0068] The server storage module is used to store time-sensitive user personal information and historical data;

[0069] The long-short memory LSTM module is used to obtain the periodic feature vector of the user by using the LSTM neural network according to the historical data of the user in the server storage module; the long-short-term memory LSTM module includes several long-short-term memory LSTM units; each of the long-short-term memory LSTM units includes :

[0070] The ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com