Option pricing method and system

An option and pricing technology, applied in the field of financial futures, can solve problems such as high algorithm time complexity and difficulty in realizing microsecond-level option pricing

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0095] The present invention will be described in detail below in conjunction with the accompanying drawings and specific embodiments. Note that the aspects described below in conjunction with the drawings and specific embodiments are only exemplary, and should not be construed as limiting the protection scope of the present invention.

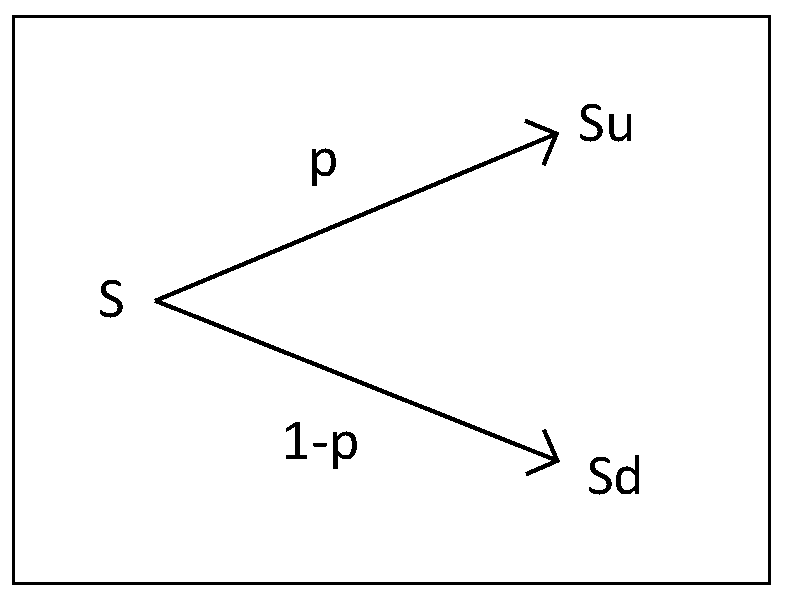

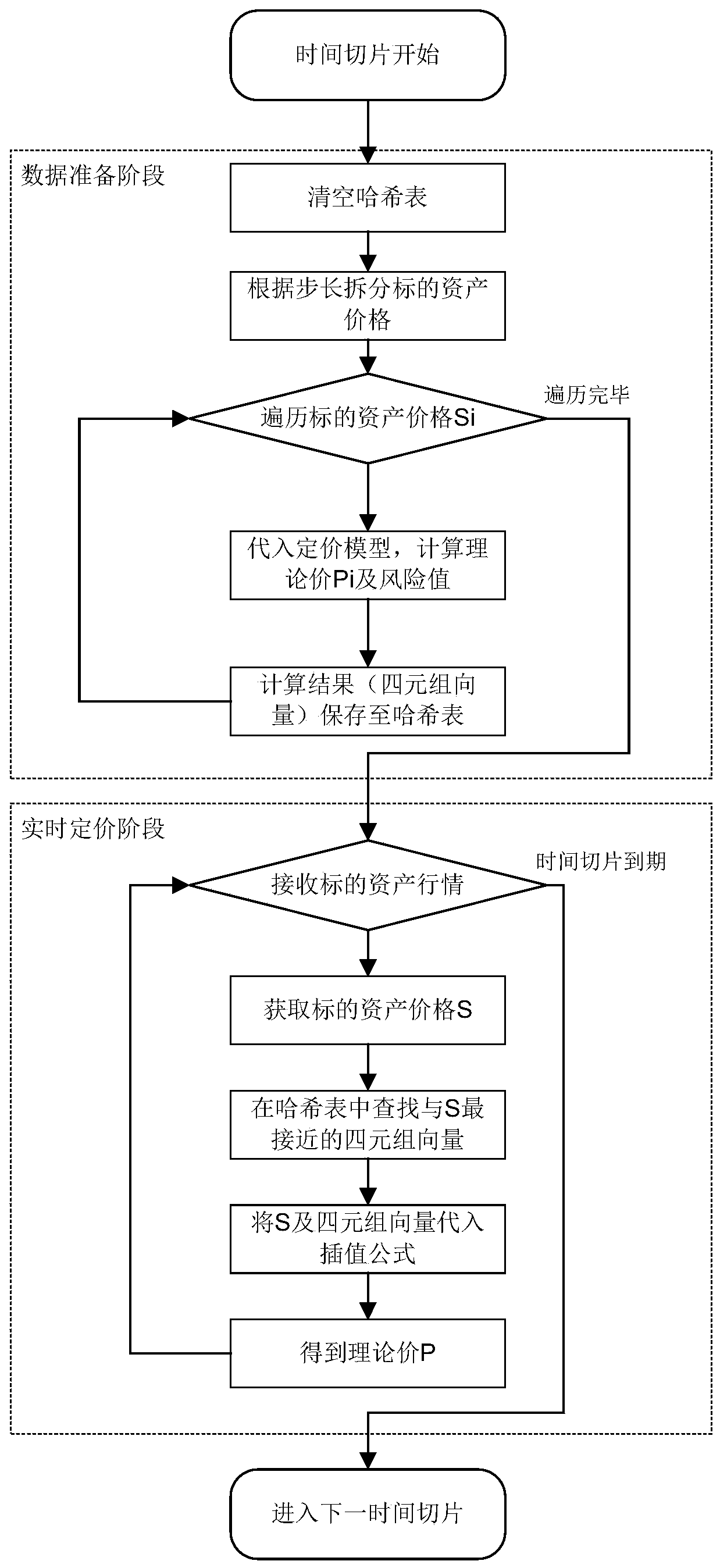

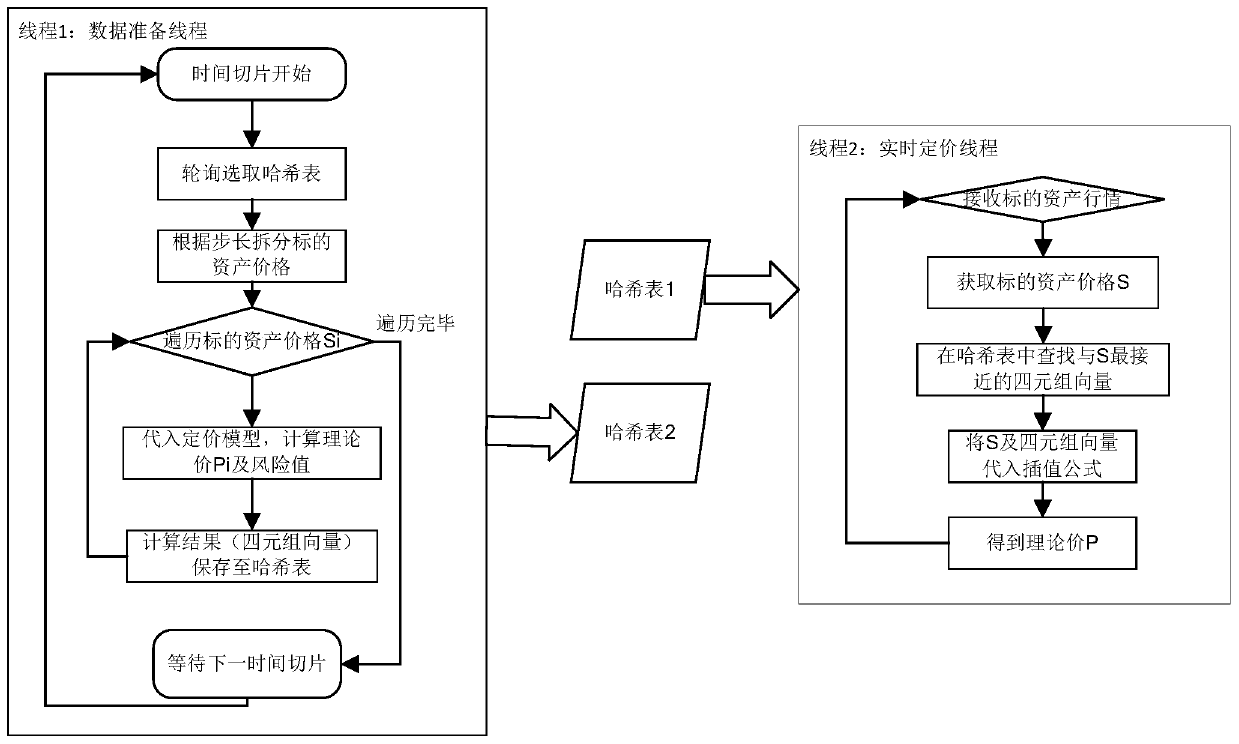

[0096] The principle of the interpolation pricing method based on Taylor expansion of the present invention is: the theoretical price of the option is expanded twice using the Taylor formula, and the theoretical price of the option after expansion can be expressed as a quadratic polynomial about the risk value delta and gamma. Assuming that the delta and gamma of the option remain constant in an extreme time interval, a series of option theoretical prices can be pre-calculated using recent historical parameters, and the theoretical price can be calculated by linear interpolation when pricing options.

[0097] Specifically, the method of the pr...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com