Credit evaluation method of online borrowers based on multidimensional data

A technology of credit evaluation and data, applied in the field of information technology and credit services

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

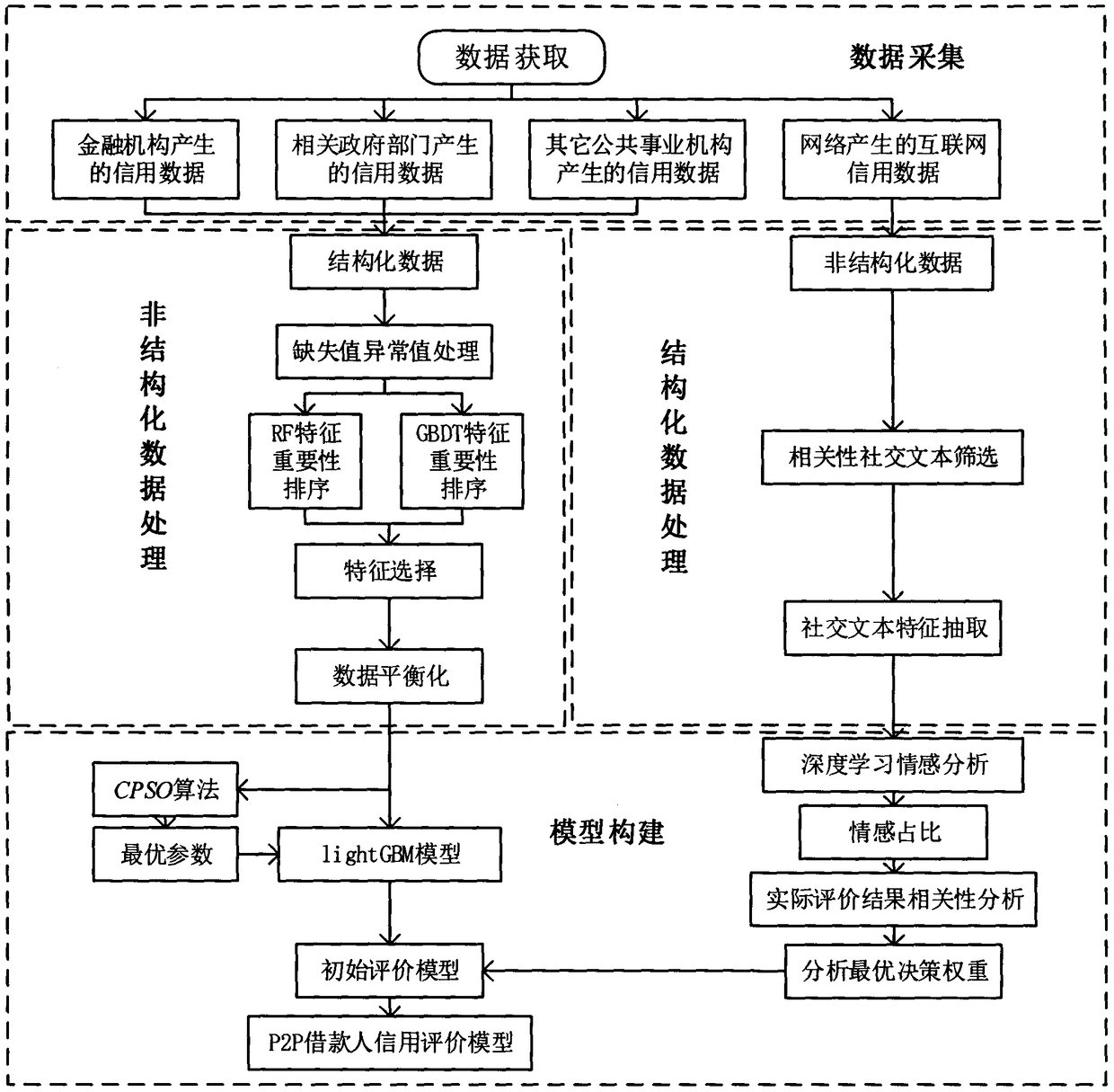

[0046] combine figure 1 , the present invention evaluates the P2P borrower's credit based on information extraction of multidimensional data, including the following steps:

[0047] A. Data collection, the data is mainly divided into four parts: credit data generated by financial institutions, such as personal credit information generated by customers when they handle credit business such as loans, credit cards, guarantees, etc. in commercial banks; credit data generated by relevant government departments, mainly Data collected and organized by government departments at all levels in taxation, industry and commerce, environmental protection, quality supervision and other government credit systems, such as public information such as social security, provident fund, environmental protection, tax arrears, civil adjudication and execution; credit data generated by other public institutions , Public utilities represented by network or TV operators, water companies, power companies...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com