The method of evaluating the value of financial participants based on relational matrix

A value evaluation and relationship matrix technology, applied in the financial field to improve anti-interference ability, realize real-time evaluation, and improve evaluation efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] In order to have a further understanding of the purpose, structure, features, and functions of the present invention, the following detailed descriptions are provided in conjunction with the embodiments.

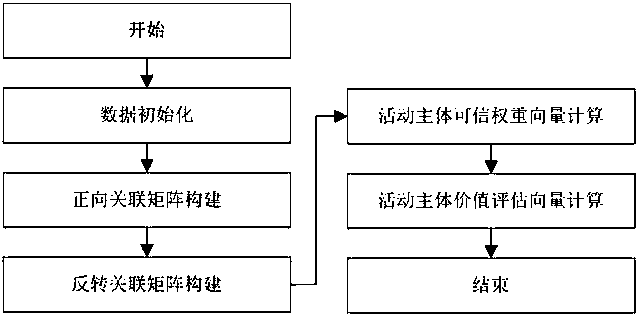

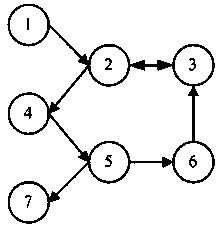

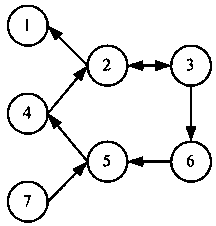

[0023] See figure 1 , figure 2 as well as image 3 ,Such as figure 1 As shown, the steps of this method are:

[0024] S1: Data initialization, including initializing the initial weight vector of the active subject, and initializing the input and output correlation vectors of the existing active subject. The initialization procedure of described system is: let N be the quantity of described active subject, E=(E 1 ,E 2 ,...,E N ) T is the set of active subjects; initialize the weight balance coefficient ɑ, set the credible weight calculation deduction times K of the active subjects, and set the value evaluation calculation deduction times S of the active subjects; initialize the initial weight vector of the active subjects as e 0 =(e 1 ,e 2 ,...,e N ) T , 0...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com