Vehicle insurance service data analysis method and system

A technology of business data and analysis methods, applied in the field of vehicle insurance business data analysis, can solve the problems of outdated customer service methods, too much information provided, and claims that cannot meet the legal judgment basis, etc., to avoid dishonest nodes, ensure reliability, The effect of preventing malicious tampering or disruption

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

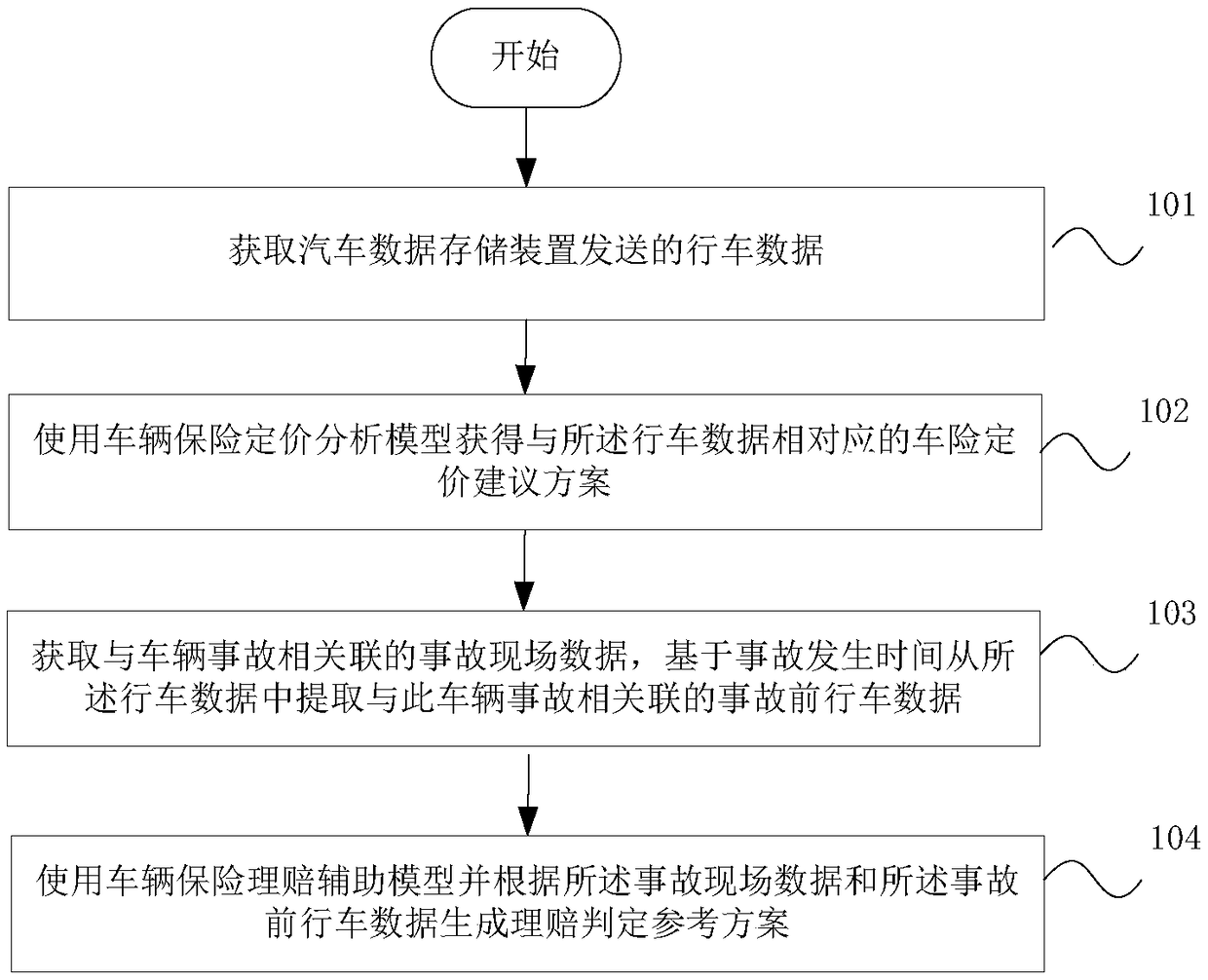

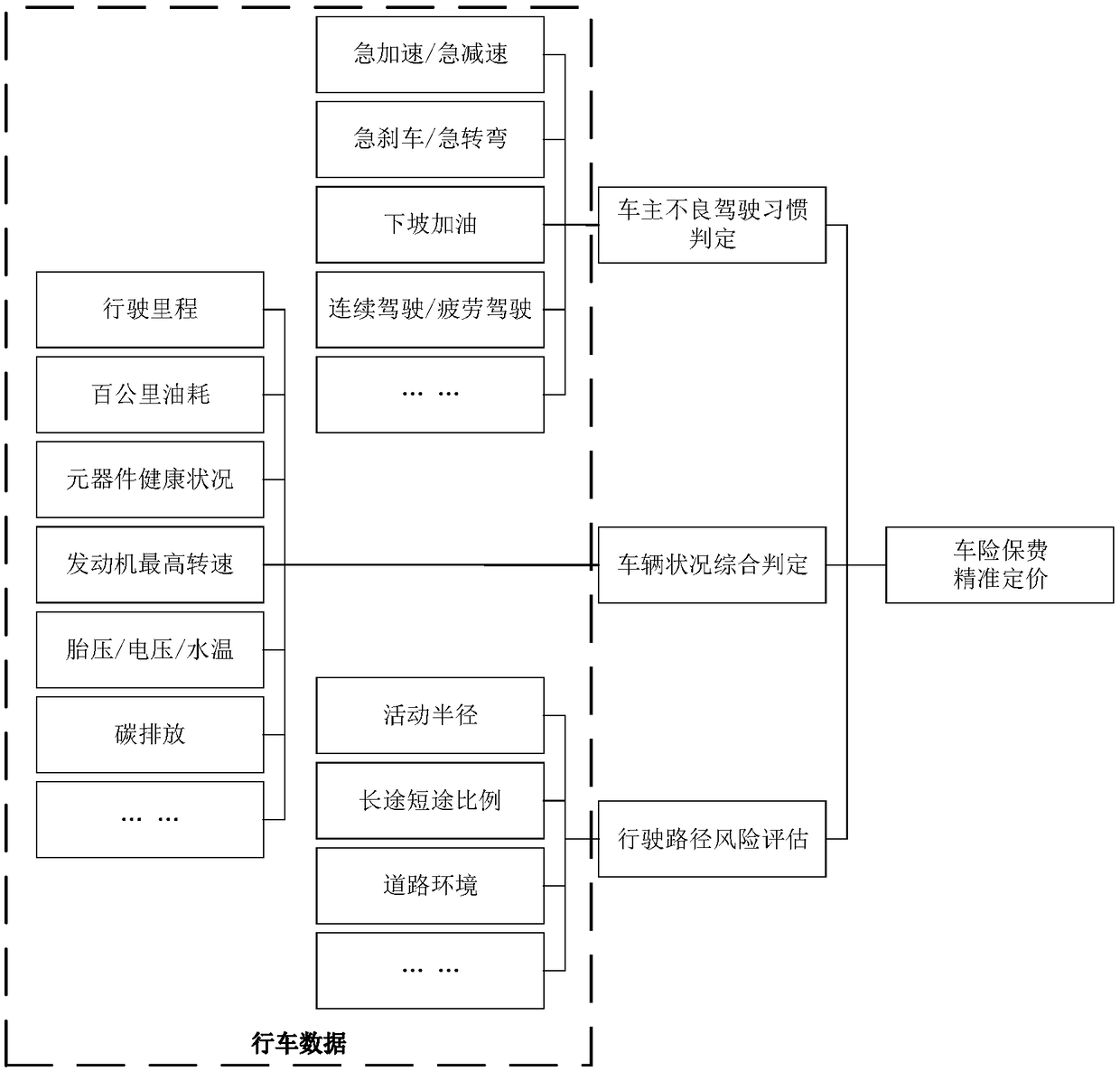

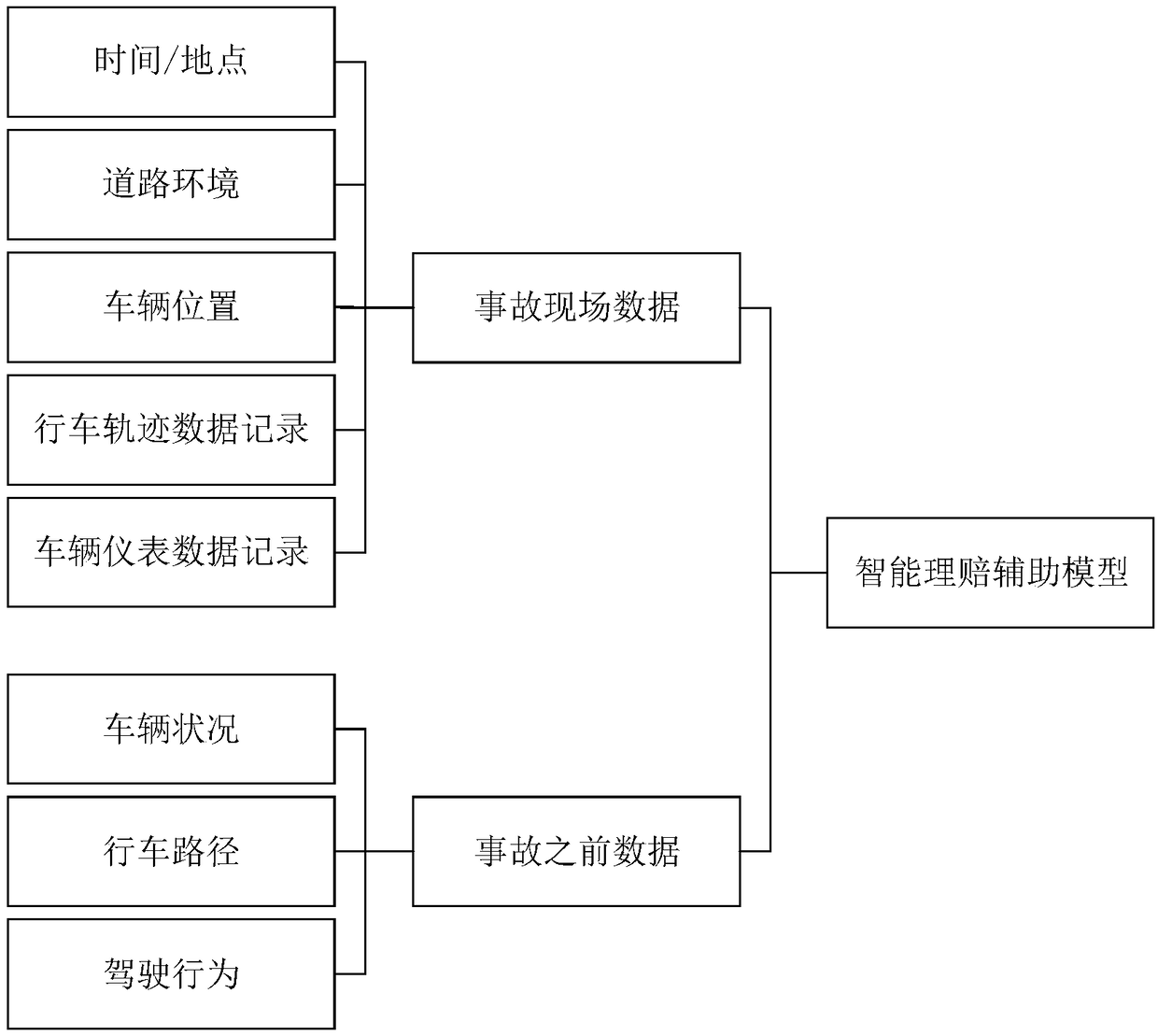

Method used

Image

Examples

Embodiment Construction

[0039] The embodiments of the present invention are described in detail below. Examples of the embodiments are shown in the accompanying drawings, in which the same or similar reference numerals indicate the same or similar elements or elements with the same or similar functions. The embodiments described below with reference to the accompanying drawings are exemplary, and are only used to explain the present invention, and cannot be construed as limiting the present invention.

[0040] Those skilled in the art can understand that, unless specifically stated otherwise, the singular forms "a", "an", "said" and "the" used herein may also include plural forms. It should be further understood that the term "comprising" used in the specification of the present invention refers to the presence of the described features, integers, steps, operations, elements and / or components, but does not exclude the presence or addition of one or more other features, Integers, steps, operations, eleme...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com