Personal social credit scoring method based on government administration data and application

A credit scoring and social technology, applied in data processing applications, instruments, finance, etc., can solve the problems of single information dimension of credit scoring model, failure to cover the whole population, and single information dimension

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

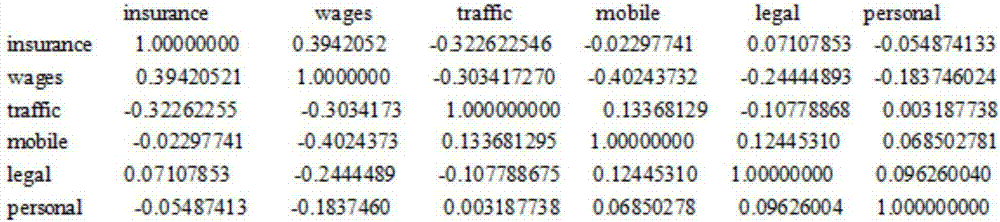

[0016] In order to ensure the accuracy of personal credit score evaluation, the personal credit scoring model based on government affairs data and applications should pay attention to the scientific principles of the mathematical model. First, it is necessary to clarify the target group for prediction and define the quality of the sample group; secondly, regardless of the independent variable The amount of quantity should include important data items and adopt appropriate algorithms; finally, there must be a large enough sample. The difficulty of Logistic regression is that it is necessary to use maximum likelihood to estimate the weight of explanatory indicators, and use nonlinear optimization techniques to solve it. Therefore, we choose to use the method of linear regression and linear programming to model the personal credit status.

[0017] Through the processing and analysis of big data, the calculation formula of credit score is obtained as follows:

[0018] Score=107*I...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com