Urgent collection method based on credit score and urgent collection device thereof

A credit scoring and credit technology, which is applied in data processing applications, instruments, finance, etc., can solve the problems of high-risk and low-amount customers not using effective collection methods, affecting accuracy, and different collection strategies, so as to achieve accurate collection risk scores, The effect of reducing bad debt losses and saving modeling time

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0029] In order to make the objectives, technical solutions and advantages of the present invention clearer, the present invention will be further described in detail below in conjunction with embodiments, but the scope of protection claimed by the present invention is not limited to the following specific embodiments.

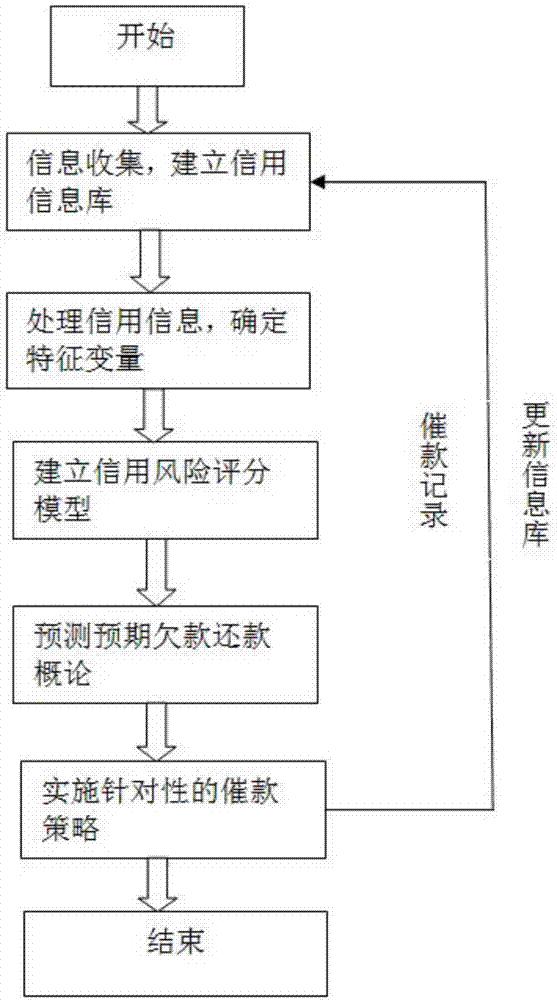

[0030] See figure 1 The present invention discloses a collection method based on credit scoring. The collection method includes collecting the credit information of the collection object, processing the collected credit information, establishing a credit risk scoring model, predicting the probability of overdue arrears and implementing targeted For the collection strategy, preferably, the implemented dunning record is further fed back to the credit information database, thereby updating or perfecting the credit information.

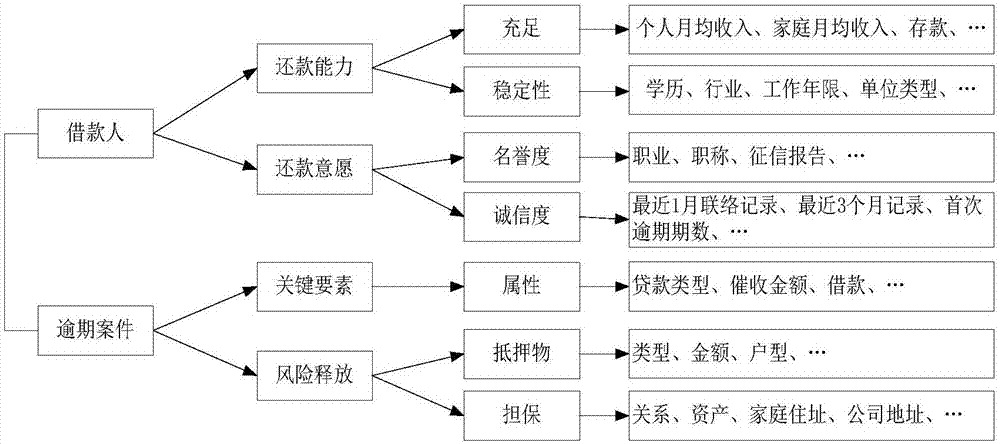

[0031] Specifically, first, conduct information collection and establish a personal credit information database; among them, taking overdue ca...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com