National anti-counterfeiting tax control system based on data security of server

A server-side, data security technology, applied to instruments, cash registers, etc., can solve problems such as wrong design of data flow direction, and achieve good performance

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

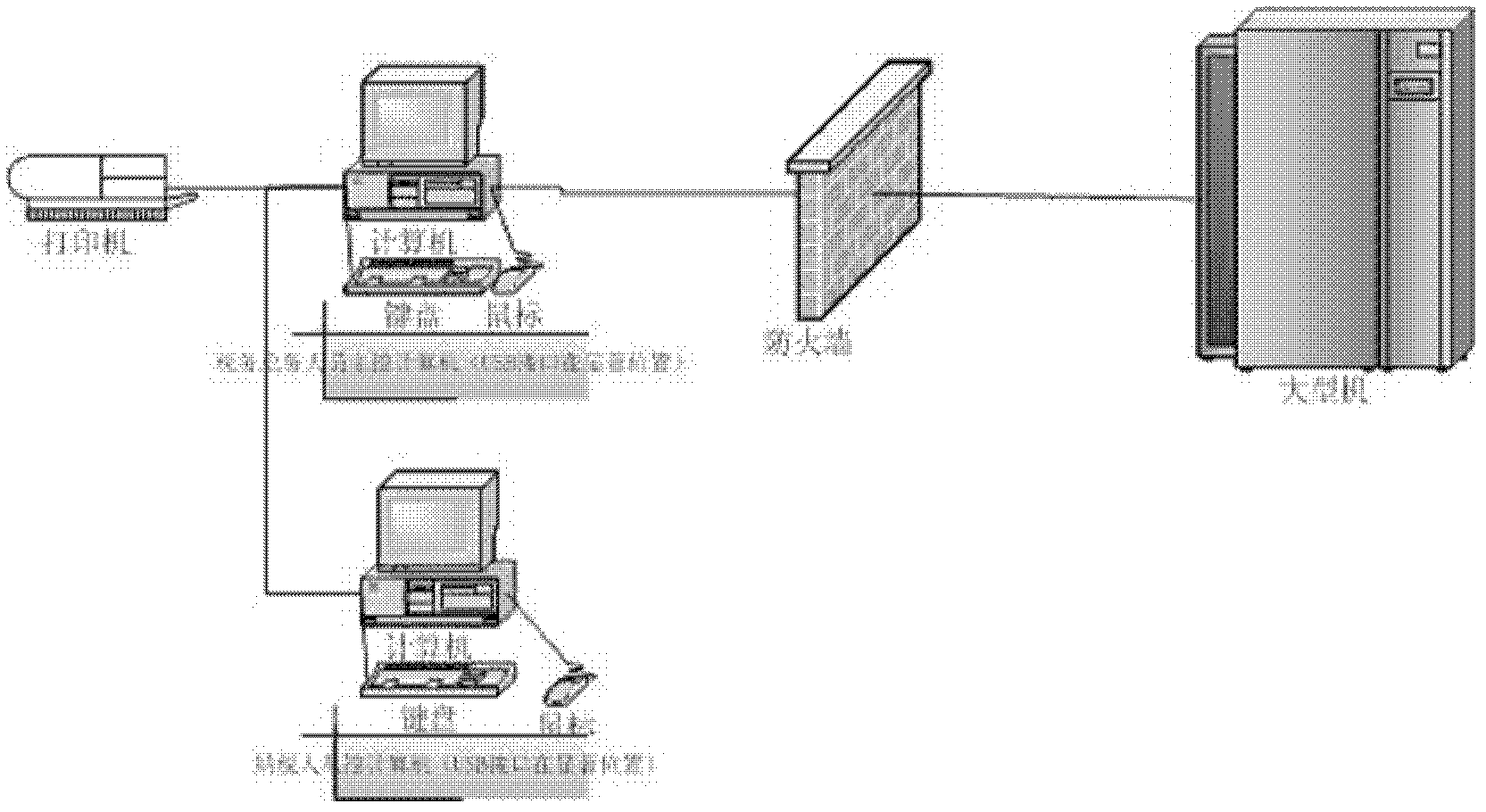

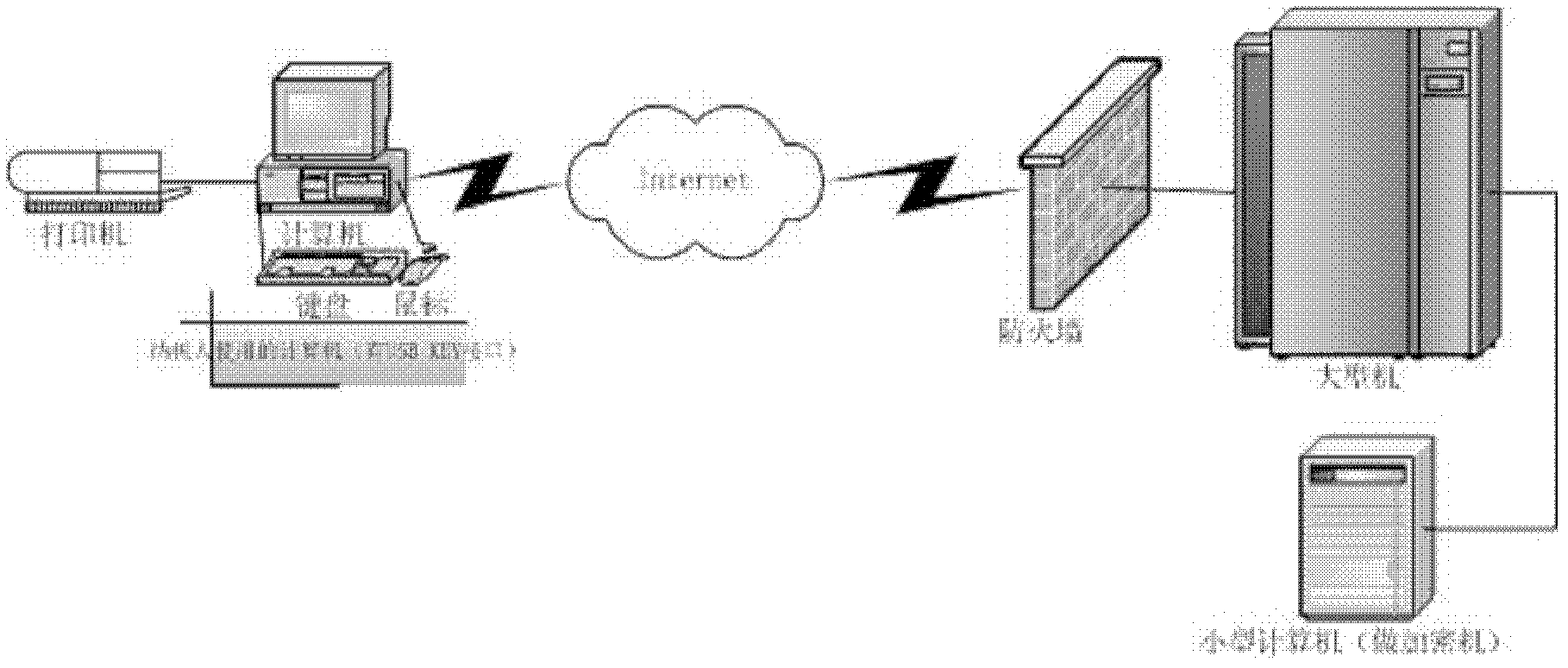

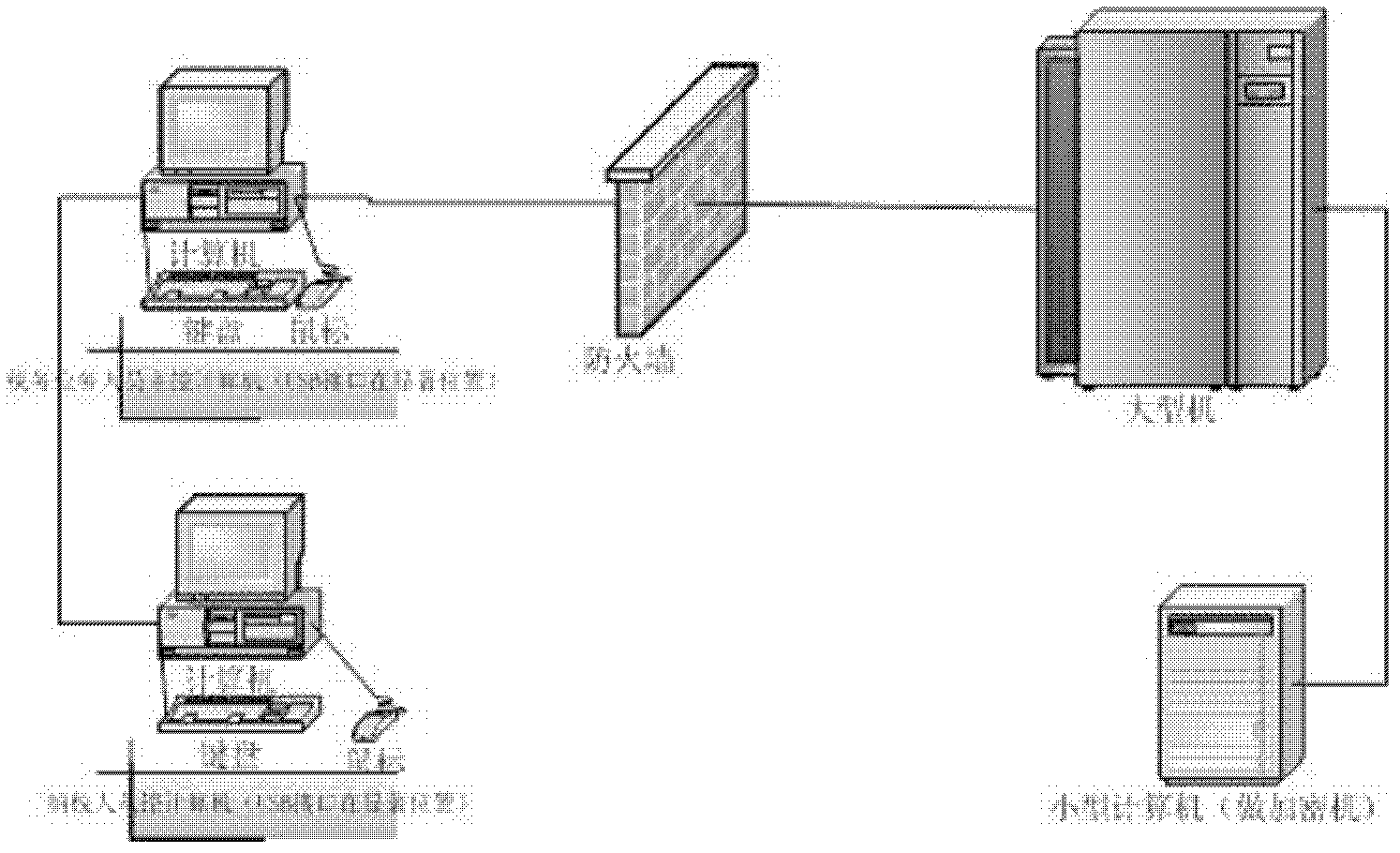

Embodiment Construction

[0032] 1. Basic function modules.

[0033] The national anti-counterfeiting tax control system based on server-side data security includes:

[0034] 1. "Invoice Sales Subsystem" sells invoices to enterprises and handles invalid invoices;

[0035] 2. "Enterprise Online Invoicing Subsystem" allows taxpayers to fill in and print invoices online;

[0036] 3. "Tax declaration subsystem" tax declaration operation of taxpaying enterprises and approval by tax authorities;

[0037] 4. The "Verification Subsystem" checks the issued invoices;

[0038] 5. "Registration, taxpayer exit and enterprise loss reporting subsystem" accepts new taxpayer enterprise registration, taxpayer exit and taxpayer USB KEY (or digital certificate) loss report requests;

[0039] 6. "Taxation Authority Management Subsystem", authorized management by taxation authority.

[0040] Introduction to database design:

[0041] 1. Data fi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com