House loan method and platform

A house and platform technology, applied in the direction of instruments, finance, data processing applications, etc., can solve the problems of no savings function, no direct problem, etc., and achieve the effect of increasing loyalty and interacting with banking business

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

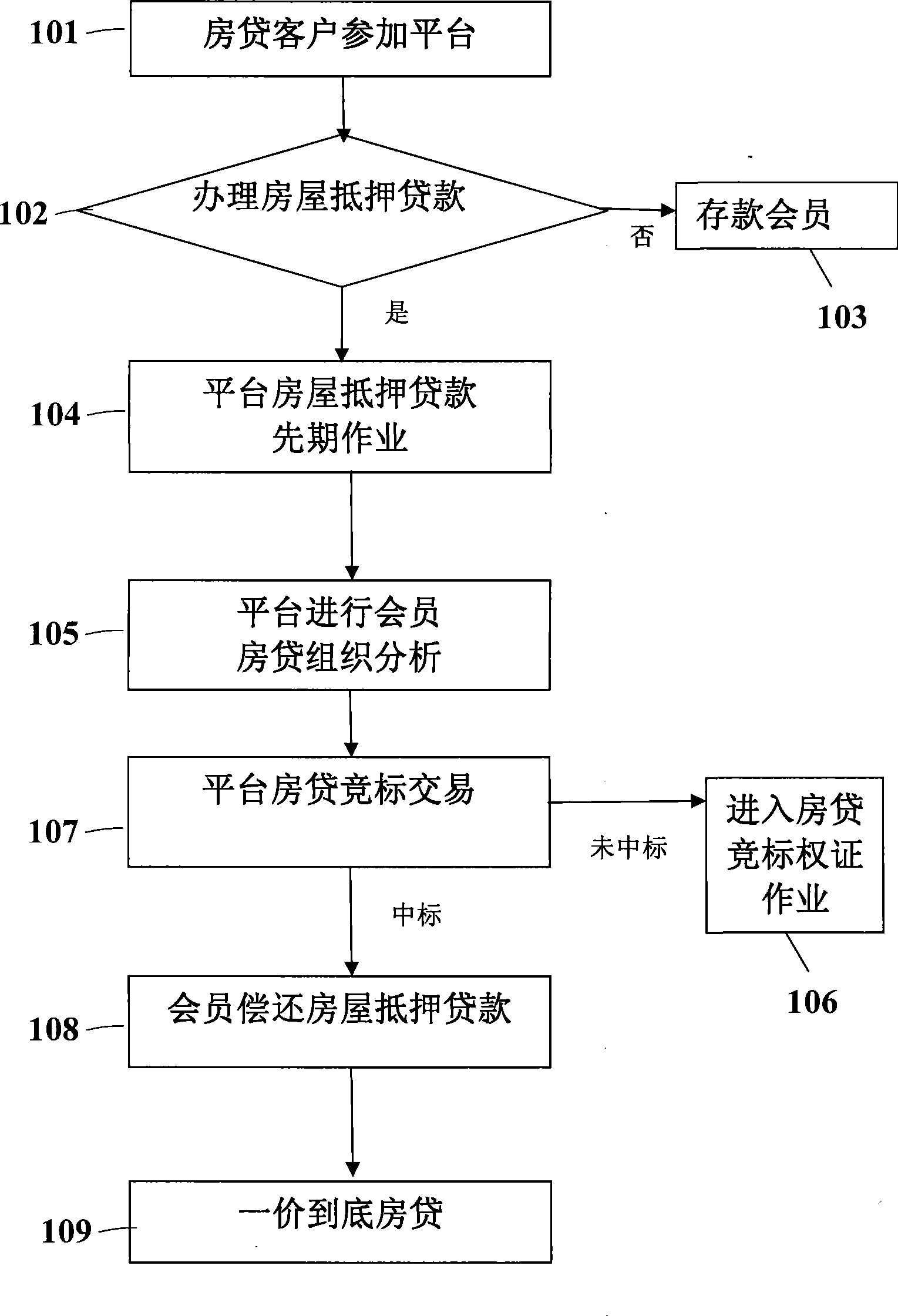

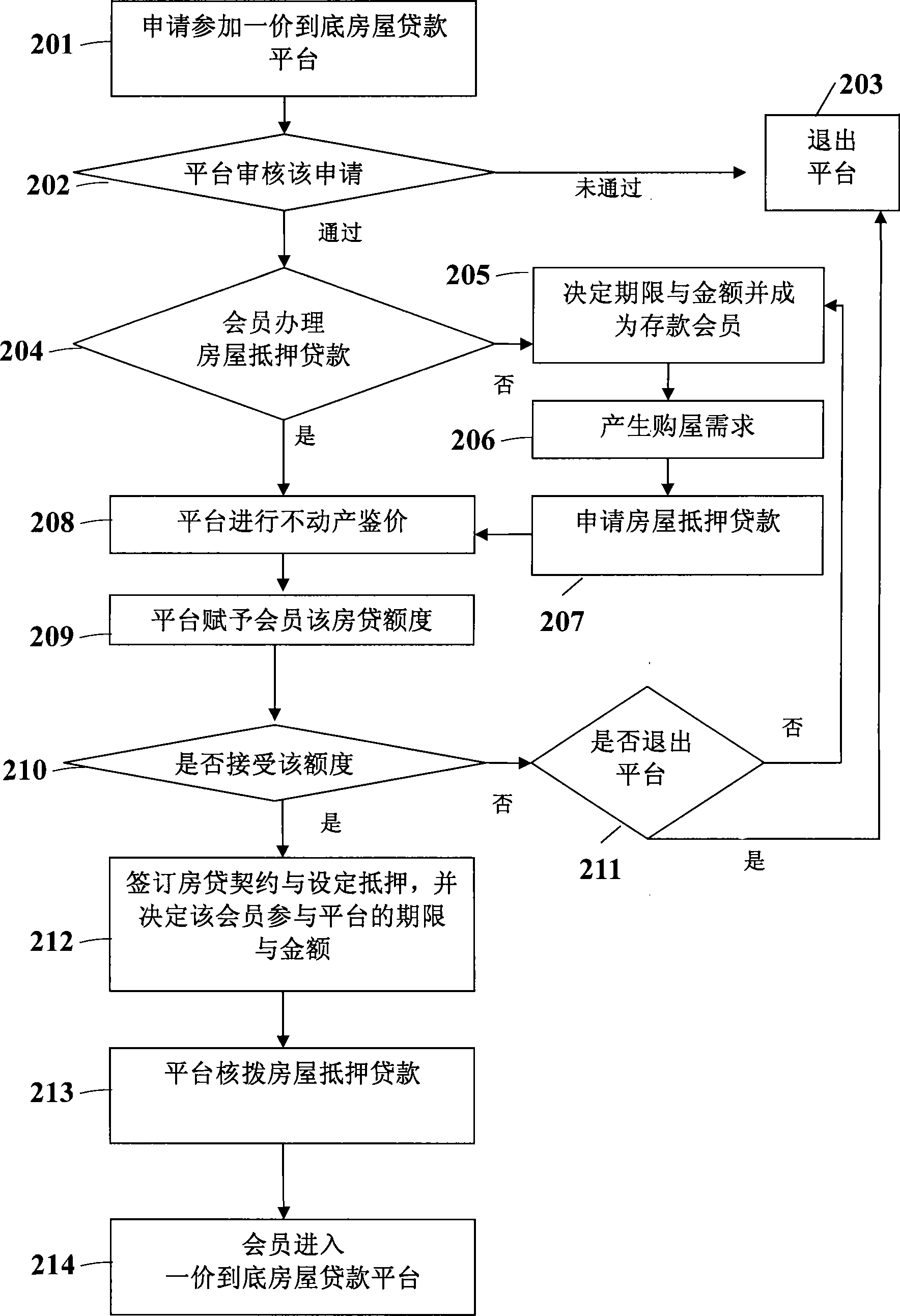

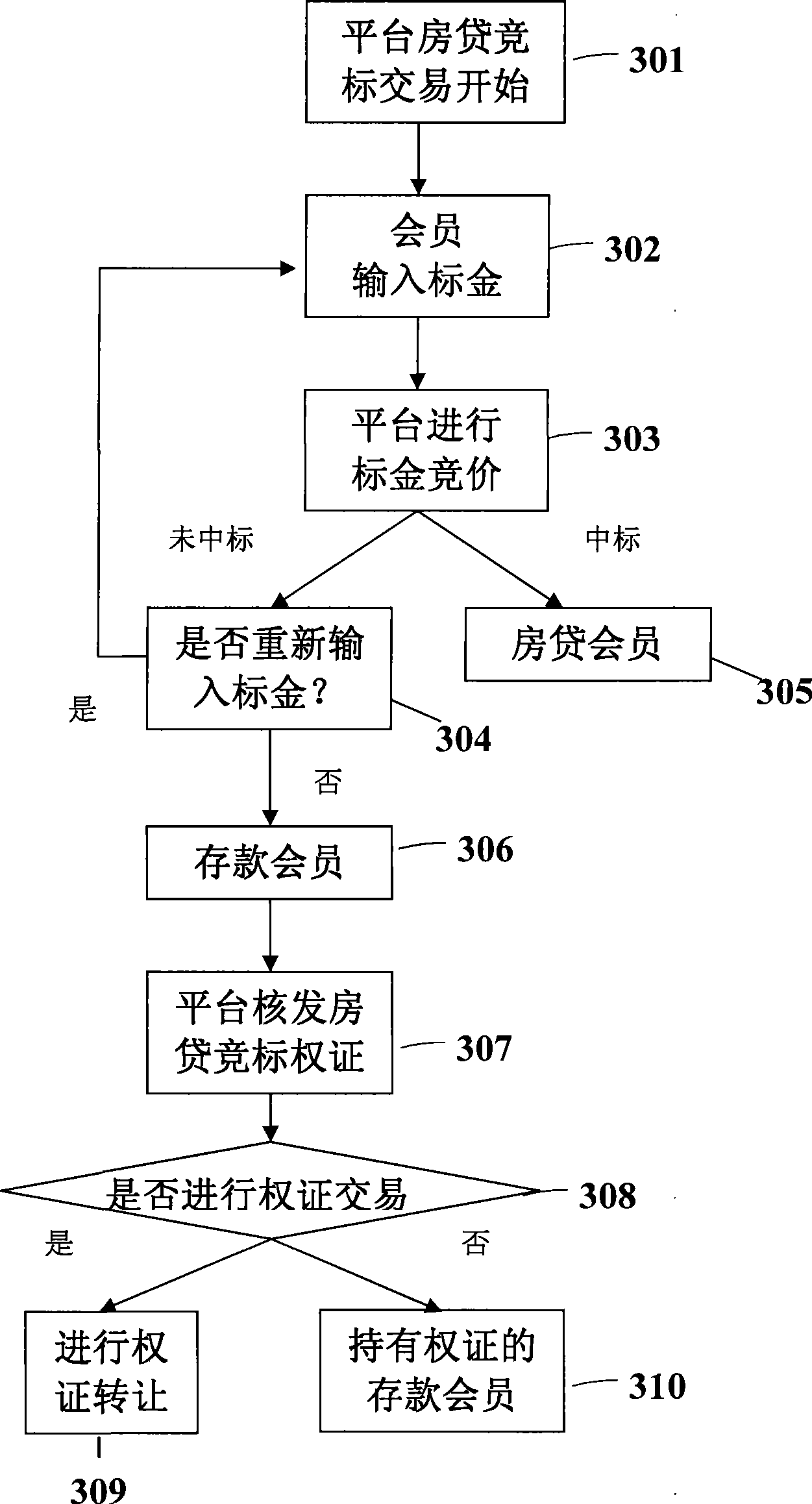

Method used

Image

Examples

Embodiment 1

[0070] A is an office worker who has worked for many years and has a family. He bought a house many years ago and took a bank housing loan with a bank A with a current loan balance of 6 million yuan and a repayment period of 15 years. In view of future interest rate rises and interest rate fluctuations, in order to reduce the interest burden and avoid the risk of housing loan interest rate hikes, decided to join the "one-price housing loan platform" of the present invention. First, A joins the platform through the membership online application process. After the platform reviews and approves his application materials, A can handle the preliminary operations such as house appraisal, mortgage, determination of bidding conditions, and loan approval required for housing mortgage loans. After the house appraisal results, the house currently held by A is worth 6.75 million yuan. According to the credit specification of the financial institution responsible for the operation of the pl...

Embodiment 2

[0090] B is a newcomer in the society, and he joins a new company to work after graduating from school. In order to avoid excessive consumption and think about future life planning, B decides to use forced savings to accumulate "marrying" funds for himself, which will be used for future house purchases. Since B has just entered the society, his own savings are not enough to pay for the self-prepared funds for buying a house, and he has no urgency to buy a house in the short term. In addition, the deposit interest rates offered by general banks are relatively low, which cannot meet their own needs for forced savings to complete future house purchase plans. After learning about the "one-price housing loan platform" of the present invention, knowing that it can help him complete the house purchase plan, he applied to the financial institution in charge of operating the platform to join the platform.

[0091] B applies to join the "One-Price Housing Loan Platform", and formally b...

Embodiment 3

[0097]C is a middle-level executive of a company, and he already owns a self-owned house with a loan that has been paid off. Since the existing house is gradually unable to meet the needs of the family, I joined this platform to accumulate funds for house replacement. After evaluation, the market price of C's own house is about 6 million yuan. Adding his own deposit of 2 million yuan, he still needs 7 million yuan to achieve the purpose of exchanging for a house with a market value of 15 million yuan. After self-analysis, I decided to negotiate with the platform for a housing loan portfolio with a period of 240 periods and a bidding limit of 30,000 yuan. After participating in the 33rd period, C's actual deposited funds have reached 850,000 yuan. But at this time, C was temporarily notified by the company that he had to be sent abroad, so he had to abandon the original plan to change houses. Since the platform will issue bidding warrants (which can be in physical or non-phys...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com