Enterprise tax planning system and method based on big data

A big data and basic data technology, applied in data processing applications, instruments, finance, etc., can solve the problems of unpredictable tax planning success rate, no tax planning tools or components, and no distribution of tax planning through enterprise business. The effect of optimizing operation, improving production efficiency and ensuring tax security

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0066] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only some, not all, embodiments of the present invention. Based on the embodiments of the present invention, all other embodiments obtained by persons of ordinary skill in the art without making creative efforts belong to the protection scope of the present invention.

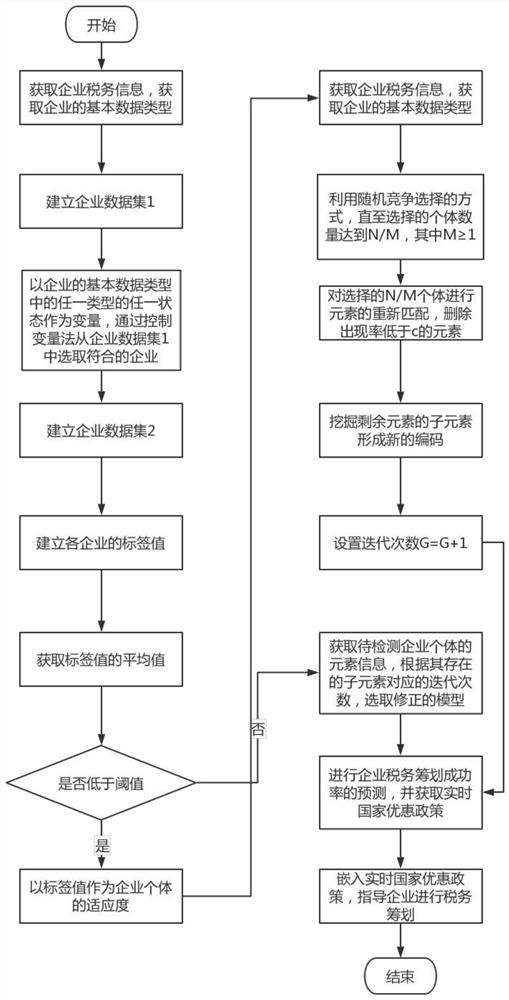

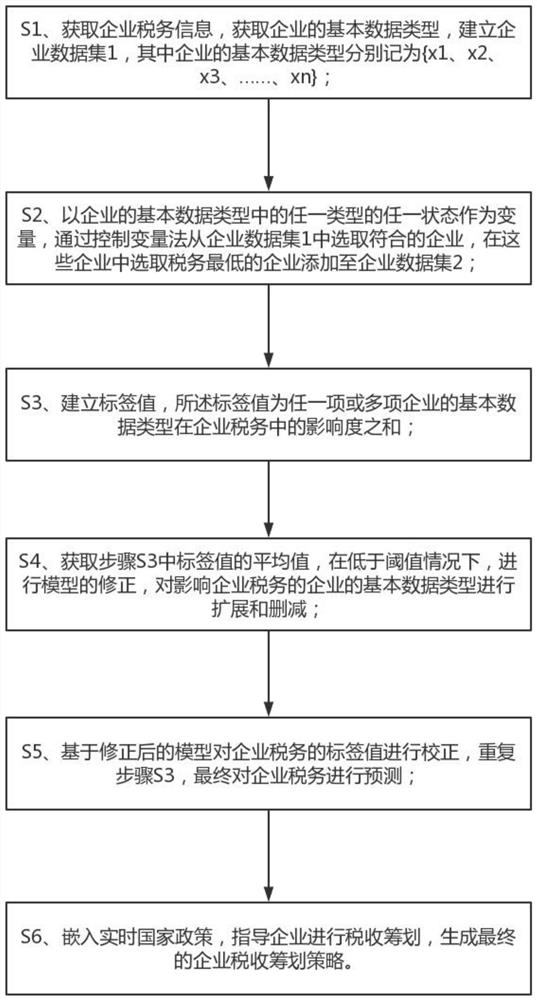

[0067] see Figure 1-2 , the present invention provides technical solutions:

[0068] An enterprise tax planning system based on big data, the system includes an enterprise information collection module, a database classification module, an analysis module, a correction module, a prediction module, and a tax planning module;

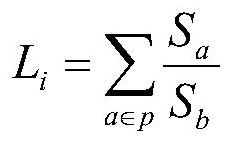

[0069] The enterprise information collection module is used to collect the tax information of the enterprise and the basic data type i...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com