Guarantee software for small-amount loan and repayment

A small amount and software technology, applied in the computer field, can solve problems such as damage to the social reputation system, occupation, and negative impact on social atmosphere, and achieve the effects of reducing security risks, realizing safe circulation, and cultivating reputation awareness

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0025] The specific embodiments of the present invention will be further described below in conjunction with the accompanying drawings.

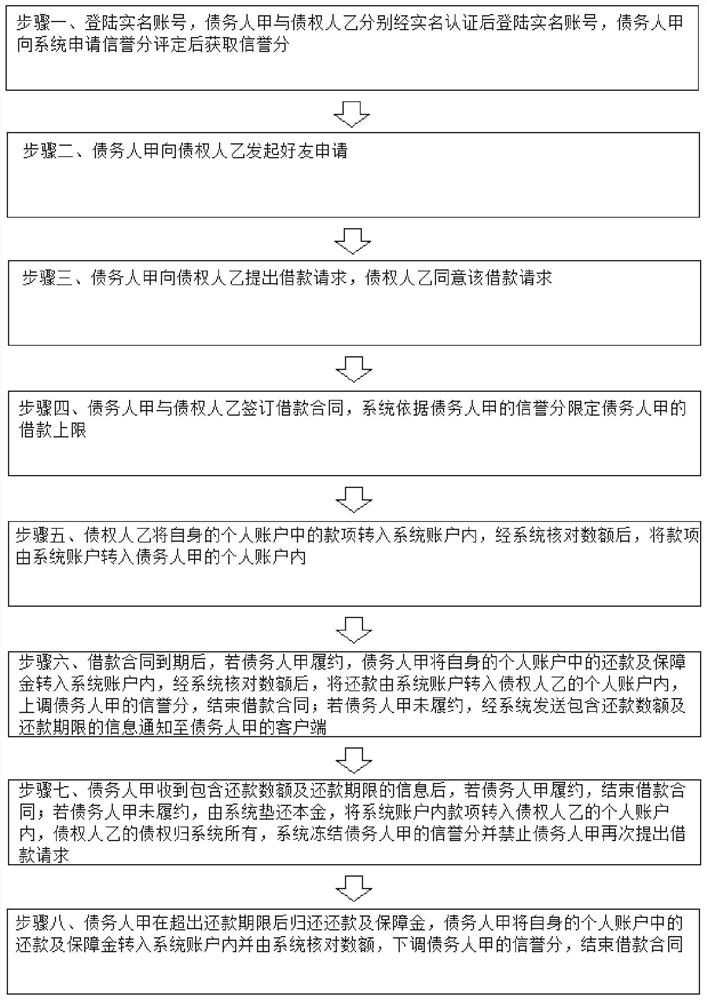

[0026] Such as figure 1 As shown, a security software for small loan repayment, including the following steps: Step 1. Log in to a real-name account. Debtor A and creditor B log in to the real-name account after undergoing real-name authentication. Debtor A applies to the system for credit score assessment. Obtain credit score; step 2, debtor A initiates a friend application to creditor B; step 3, debtor A makes a loan request to creditor B, and creditor B agrees to the loan request; step 4, debtor A and creditor B sign a loan contract, and the system bases the debtor A's credit score limits debtor A's loan limit; step 5, creditor B transfers the money in his personal account to the system account, and after the system checks the amount, transfers the money from the system account to debtor A's personal account; Step 6. After the loan contr...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com