Dynamic small and medium-sized enterprise credit scoring method and system based on GRA

A technology for credit scoring and small and medium-sized enterprises, which is applied in data processing applications, instruments, finance, etc., and can solve the problems of difficulty in accurately evaluating the credit status of small and medium-sized enterprises.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

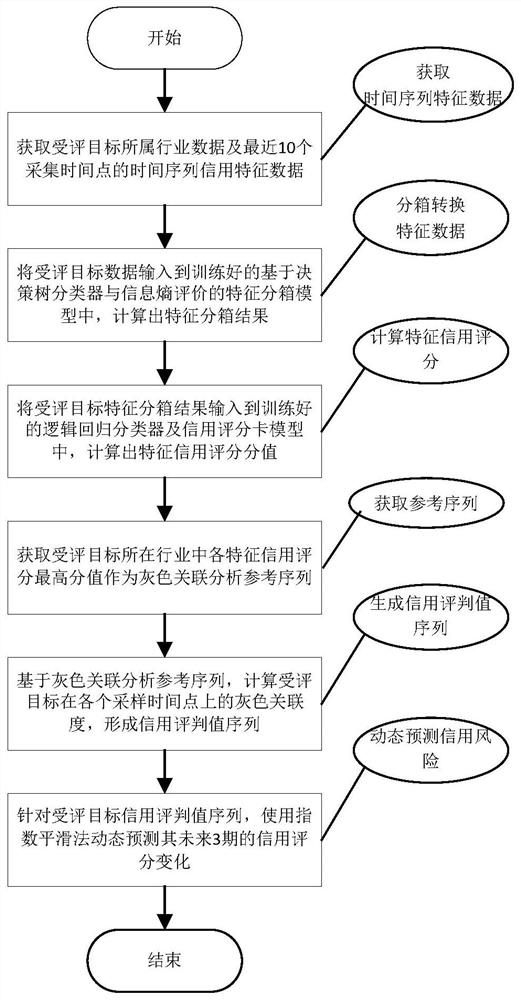

[0100] as attached figure 1 Shown, the dynamic SME credit scoring method based on GRA of the present invention, this method is specifically as follows:

[0101] S1. Obtain time-series characteristic data: obtain time-series credit characteristic data of the industry in which the evaluated enterprise belongs and the evaluated enterprise at / 1 sampling time point;

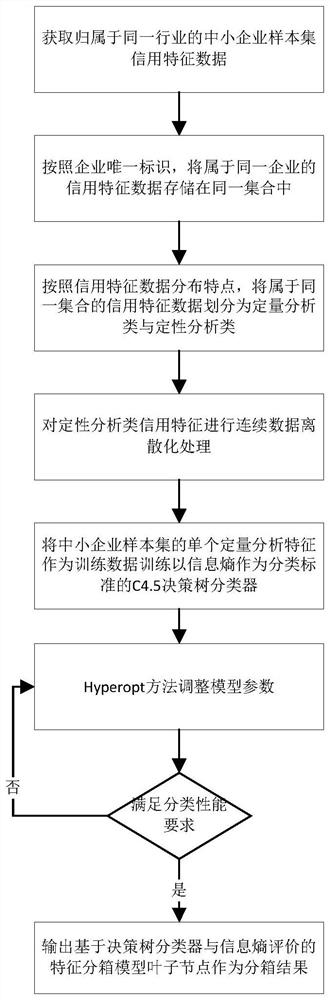

[0102] S2. Binning conversion feature data: use the feature binning model based on decision tree classifier and information entropy evaluation to obtain the binning coding results of credit feature data corresponding to each time series credit feature at each collection time point;

[0103] S3. Calculate the credit feature score: use the logistic regression classifier and the credit score card model to convert each feature binning coding result of the evaluated enterprise into its corresponding credit feature score;

[0104] S4. Calculating the reference sequence: use the highest score of the credit score corresponding...

Embodiment 2

[0166] The dynamic SME credit scoring system based on GRA of the present invention, this system comprises,

[0167] The time series characteristic data acquisition module is used to obtain the time series credit characteristic data of the industry in which the evaluated enterprise is located and the evaluated enterprise at the sampling time point;

[0168] The feature data binning conversion module is used to use the feature binning model based on the decision tree classifier and information entropy evaluation to obtain the credit feature data binning coding results corresponding to each time series credit feature at each collection time point;

[0169] The credit feature score calculation module is used to use the logistic regression classifier and the credit score card model to convert each feature binning coding result of the evaluated enterprise into its corresponding credit feature score score;

[0170] The reference sequence calculation module is used to use the highest ...

Embodiment 3

[0174] An embodiment of the present invention also provides an electronic device, including: a memory and at least one processor;

[0175] Wherein, the memory stores computer-executable instructions;

[0176] The at least one processor executes the computer-executed instructions stored in the memory, so that the at least one processor executes the GRA-based dynamic SME credit scoring method in any embodiment of the present invention.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com