Investment portfolio optimization method and device based on group decision intelligent search

A technology of intelligent search and combination optimization, applied in the field of financial technology analysis, can solve problems such as unconsidered impact, unresolved, reduced method and equipment accuracy, etc., to achieve the effect of improving robustness, reducing risk, and reducing non-systematic risk

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0023] The specific implementation manners of the present invention will be described in detail below in conjunction with the accompanying drawings.

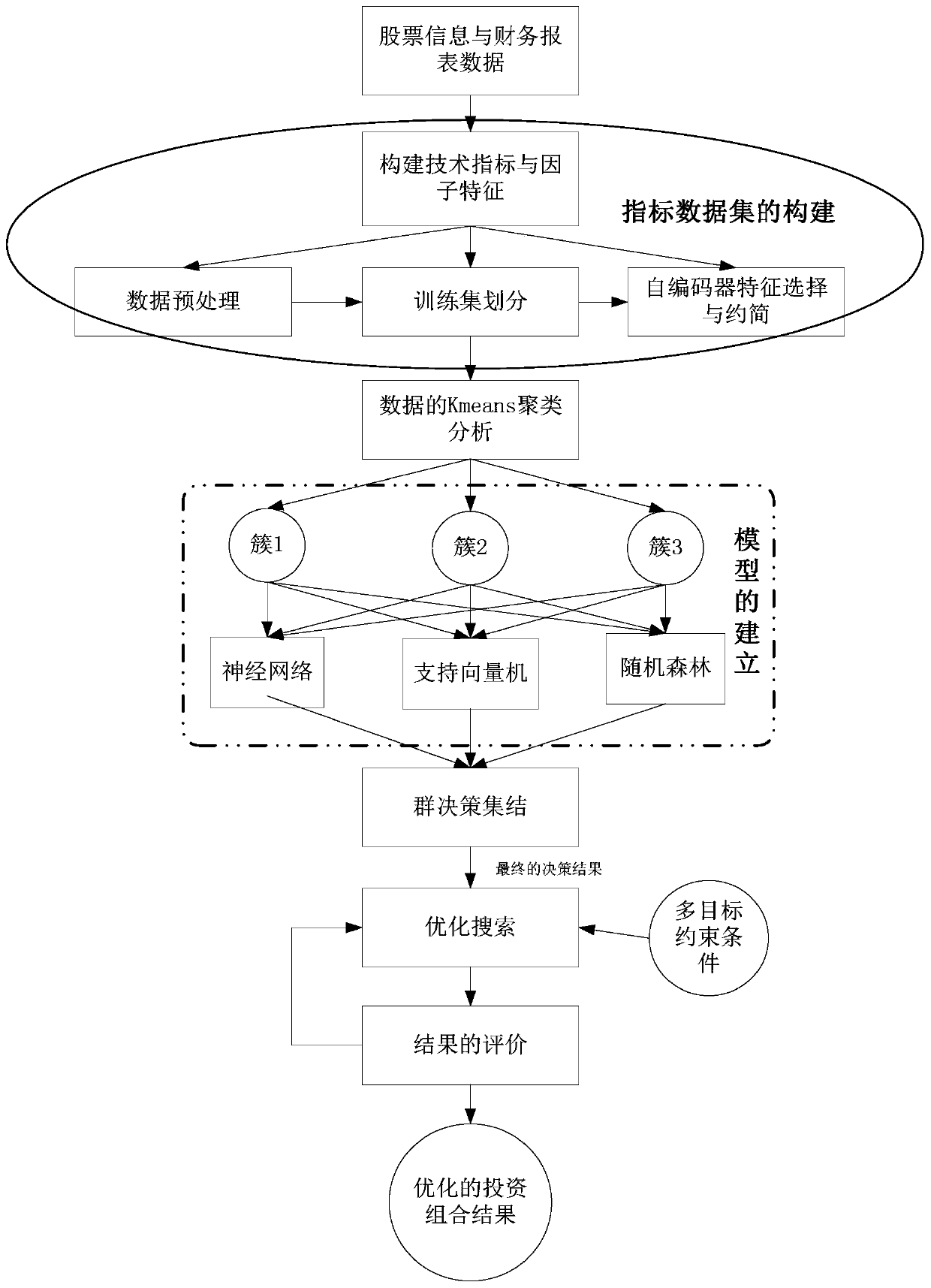

[0024] In some embodiments, the present invention provides an investment portfolio optimization method based on group decision intelligent search, which at least includes the following steps:

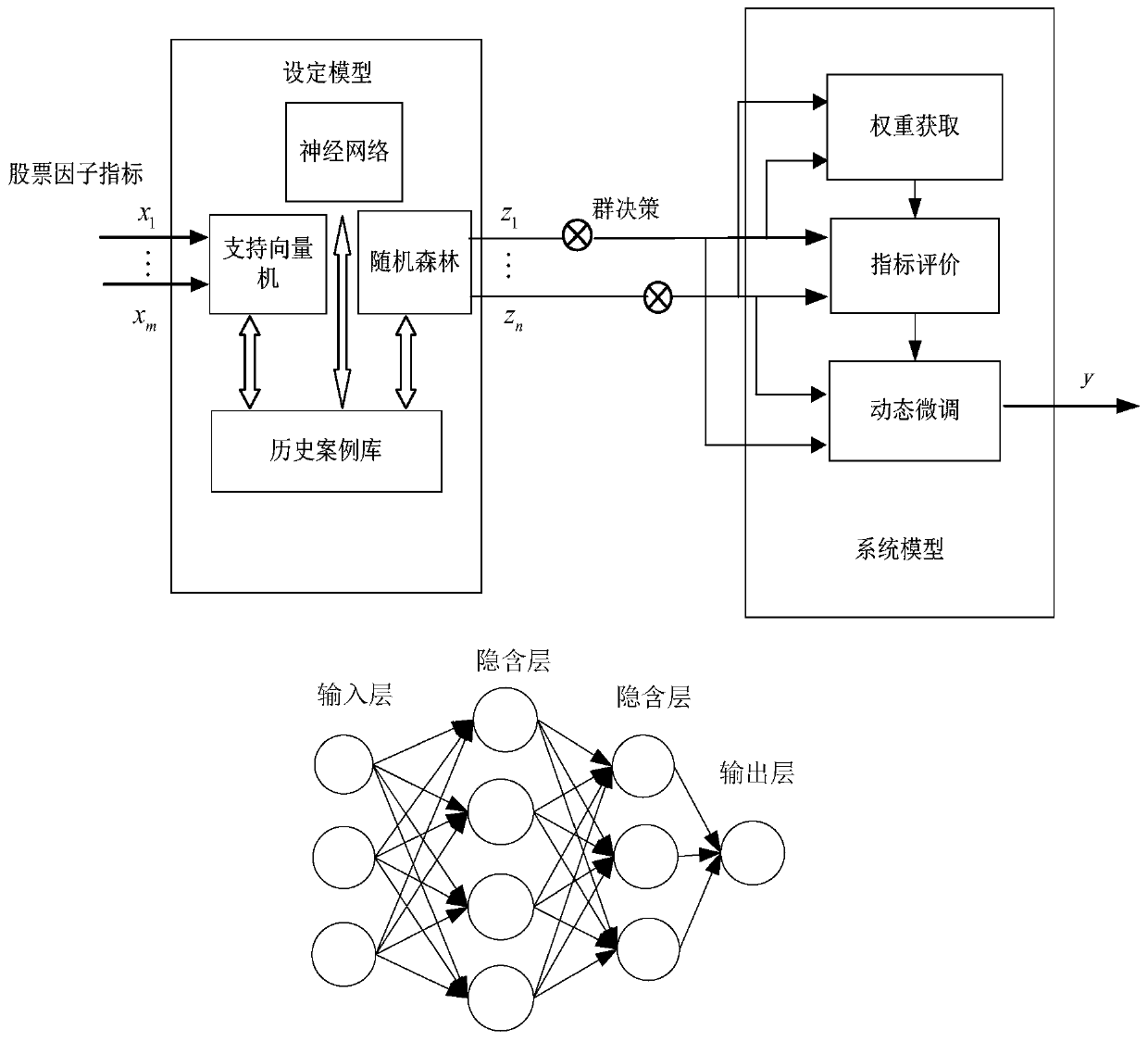

[0025] Based on at least 3 kinds of machine learning models, respectively obtain the descending sequence of stock returns;

[0026] Based on the group decision-making algorithm, the machine learning model is regarded as a decision-making expert, and the cluster aggregation method is used to make a decision on whether a specific stock enters the final investment portfolio;

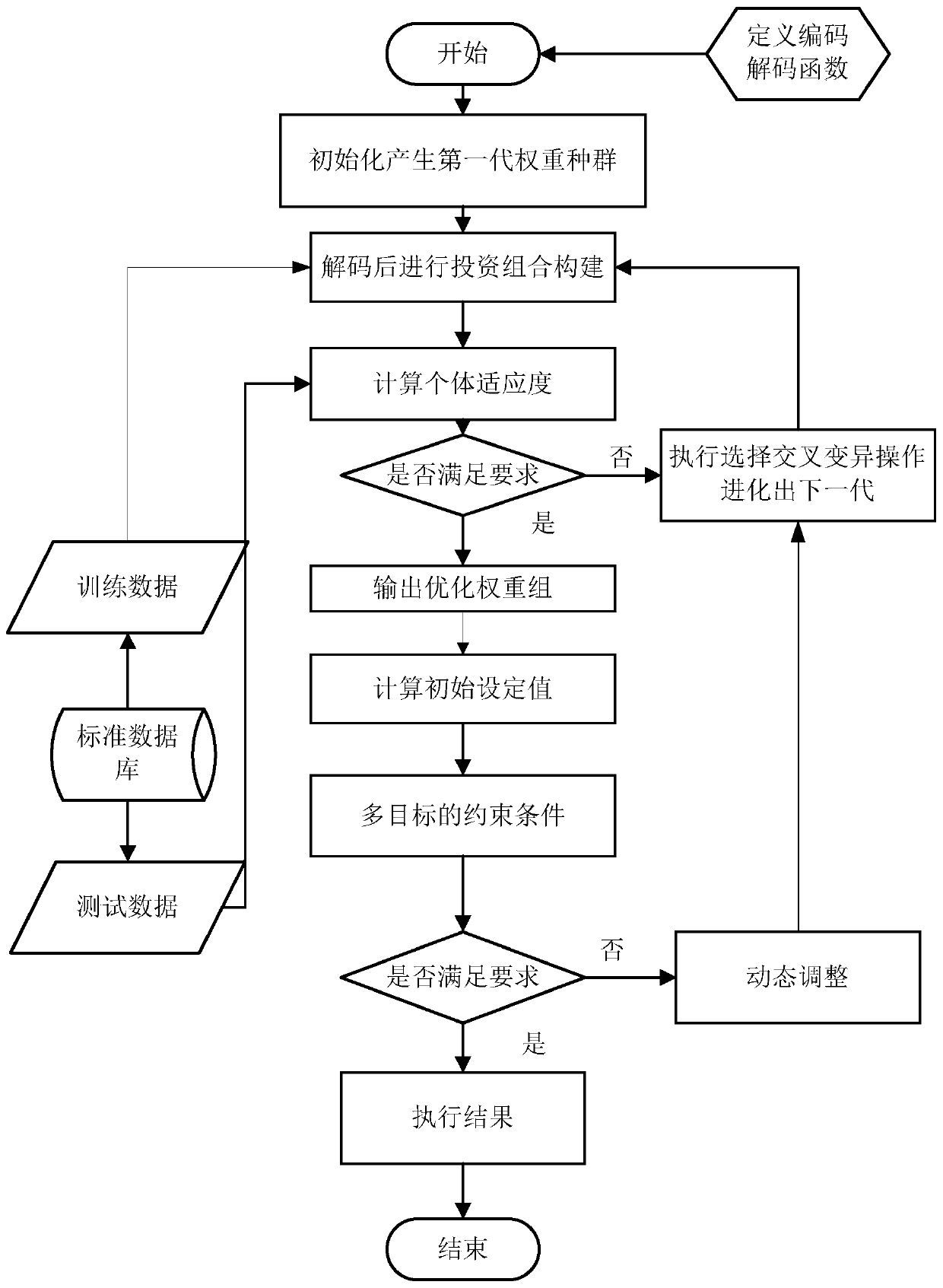

[0027] The genetic algorithm is used to optimize the weight distribution of the investment portfolio.

[0028] Among them, the "machine learning model" includes but is not limited to DNN, RNN, LSTM, support vector machine, random forest, and the models that can output...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com