User credit score calculation method and system

A calculation method and credit technology, applied in the field of data analysis, can solve problems such as increased risk of user default, difficulty in truly reflecting the credit status of users in credit scores, and incomplete data collection dimensions, etc., to achieve the effect of reducing risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0032] The present invention will be specifically introduced below in conjunction with the accompanying drawings and specific embodiments.

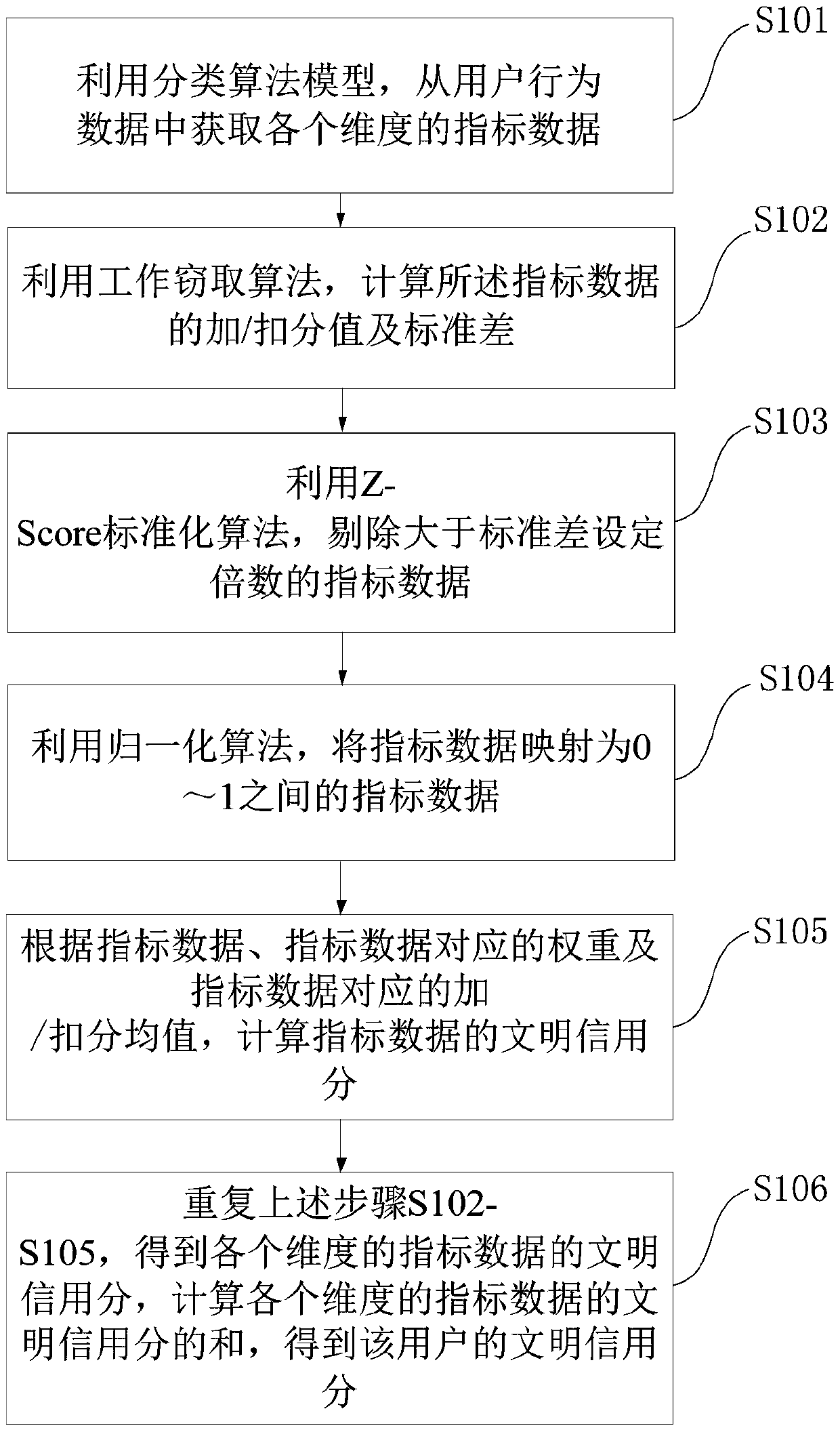

[0033] like figure 1 As shown, the user credit calculation method provided by the embodiment of the present invention includes the following steps:

[0034] S101. Obtain index data of various dimensions from user behavior data by using a classification algorithm model.

[0035] S102. Using the work-stealing algorithm, calculate the plus / minus points and standard deviation of the index data, wherein the formula for calculating the plus points is: The formula for calculating the deduction value is x is index data, max is the maximum value of all user index data with the same dimension as the index data, and min is the minimum value of all user index data with the same dimension as the index data.

[0036] S103. Use the Z-Score standardization algorithm to eliminate index data that is greater than the set multiple of the standard deviat...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com