Method for analyzing and optimizing tax system product experience based on taxpayer's behavior

A tax system and behavior analysis technology, applied in the field of big data analysis, can solve problems such as the inability to meet taxpayers' personalized tax handling needs, and achieve the effect of improving experience

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

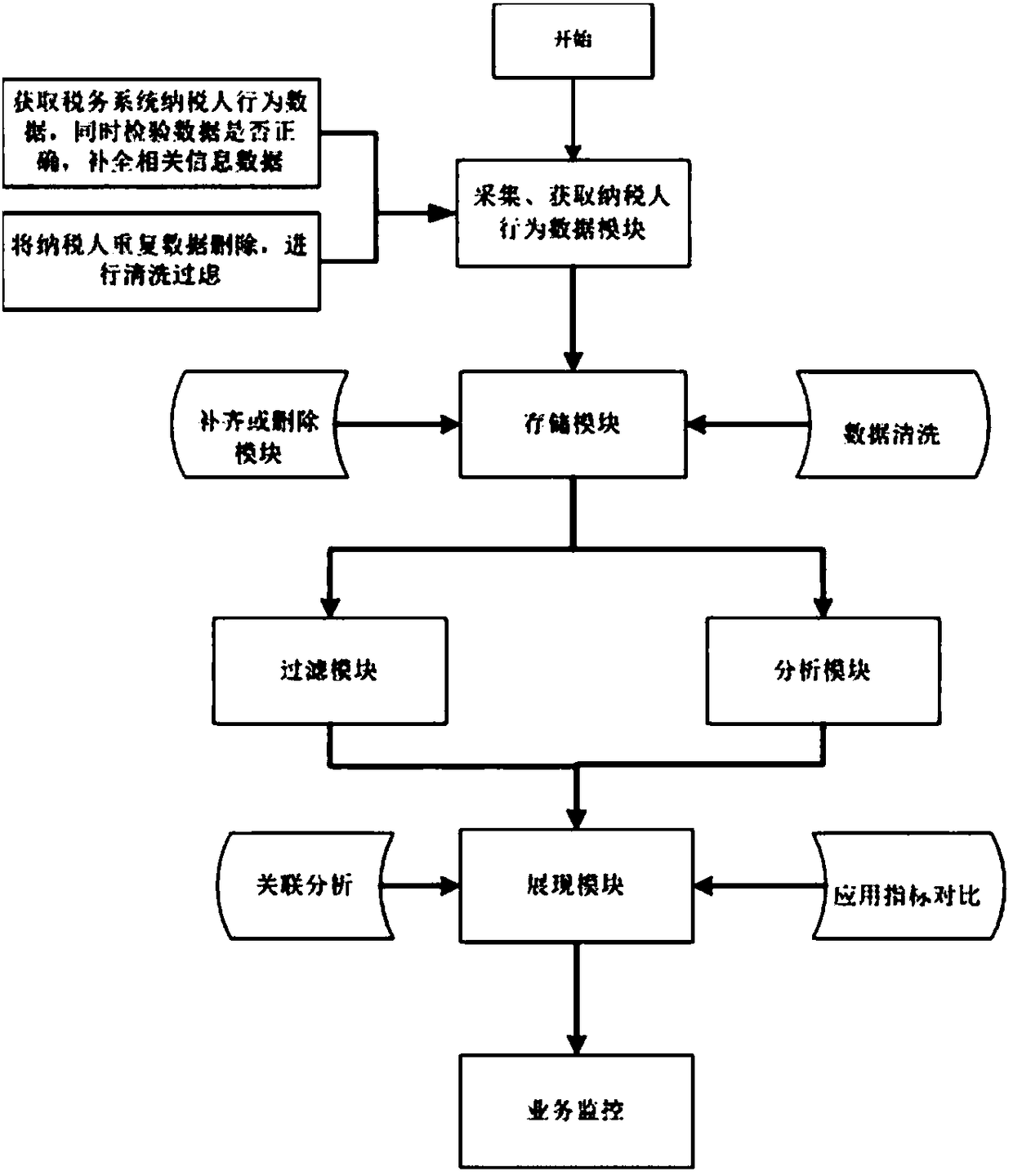

[0029] The following will clearly and completely describe the technical solutions in the embodiments of the present invention with reference to the accompanying drawings in the embodiments of the present invention. Obviously, the described embodiments are only some, not all, embodiments of the present invention.

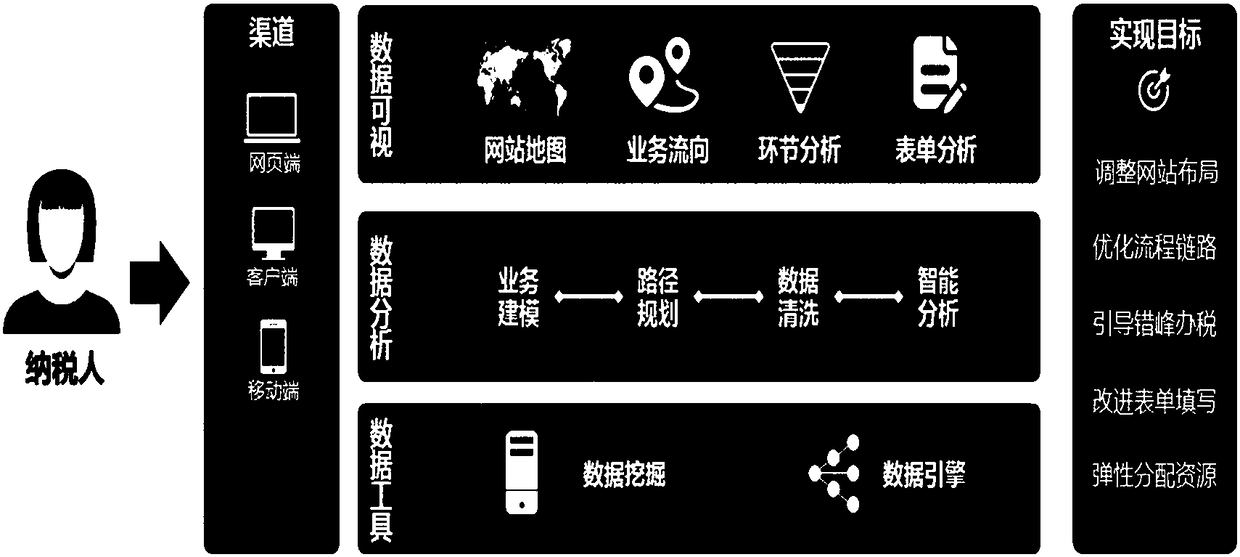

[0030] refer to Figure 1-2 , a tax system product experience system based on taxpayer behavior analysis optimization, including a business access map module, a business flow module, a link analysis module, and a form analysis module.

[0031] The business access map module visually displays the click and browsing popularity of each function menu of the tax system and the access status of each business in the form of a function tree map, and the business access map module includes a business function module, a business access map color module and a traffic module, The business function module is "all" by default, and you can click the button to switch between "tax de...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com