Payment method, corresponding portable terminal, third-party payment platform

A portable terminal, payment method technology, applied in the payment system, payment system structure, data processing application, etc., can solve the problems of no motivation to improve technology, third-party payment platform restricted transaction security, etc., to promote payment market competition, convenient Promotion and competition, the effect of reducing dependence

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

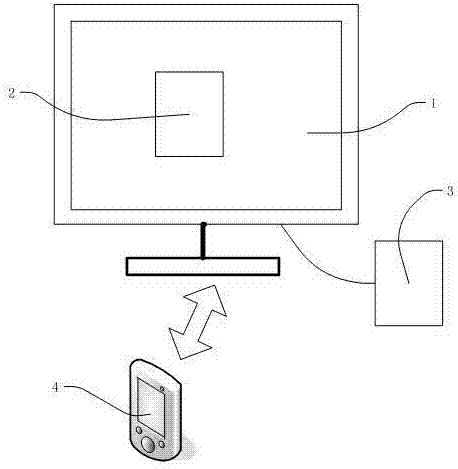

Image

Examples

Embodiment 1

[0036] Figure 5Set up and use the flow chart for the payment method in Embodiment 1. First, the user sets the region of use for various payment methods. Areas of use are generally divided by administrative regions. Assume that there are two payment methods, which are used to set the usage region a of payment method A and the usage region b of payment method B. When the user uses third-party payment to make payment, the third-party payment application program first obtains the location information of the current payment device, and according to the usage region set for the payment method, selects the payment method that uses the area including the current location for payment.

[0037] Taking the payment methods listed above as an example, the region of use for Bank A’s credit card is set to China, the region of use for Bank B’s credit card is set to the United States, and other payment methods are not set. At this time, when the user makes payment in China, the bank A cred...

Embodiment 2

[0044] Figure 9 Set up and use the flow chart for the payment method in Embodiment 2. First, the user sets up payment merchant information for various payment methods. Suppose there are two payment methods, payment merchant a for setting payment method A, and payment merchant b for setting payment method B. When the user uses third-party payment to make payment, the third-party payment application first obtains the current merchant information, and selects the payment merchant information including the payment method of the current merchant according to the payment merchant information set for the payment method by the third-party payment platform for payment.

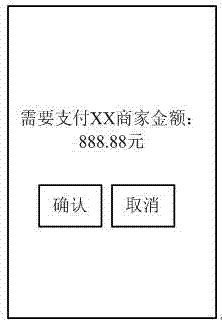

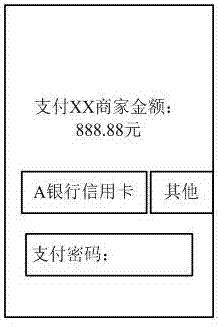

[0045] Figure 10 to Figure 11 It is the application interface of the third-party payment in the second embodiment. When the payment is confirmed, the third-party payment platform obtains the merchant information, Figure 10 The current payment merchant shown is Guangzhou Friendship Store, and the system sets its ...

Embodiment 3

[0051] Figure 12 Set up and use the flow chart for the payment method in Embodiment 3. First, the user sets payment frequency information for various payment methods. Suppose there are two payment methods, which are used to set the payment times a of payment method A and the payment times b of payment method B. When the user uses a third-party payment to make payment, the third-party payment application first obtains the number of times the current payment method A is used, and if the number of times the payment method A is used exceeds a, the payment method B is used for payment. Here, the number of payments can be set on a yearly, monthly, etc. cycle, mainly to meet the demand for no annual fee when paying by credit card, and to facilitate users to manage different credit cards.

[0052] Assume that the user sets the bank A credit card to be used 5 times a year and sets the start date; the user sets the bank B credit card to use 10 times a year and sets the start date. I...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com