Method for realizing multi-channel tax payment through self-service terminal

A self-service terminal and self-service tax terminal technology, applied in the field of multi-channel tax payment, can solve the problems of increasing the work pressure of the tax hall and unreasonable waste of time and energy, so as to save precious time, promote modernization and convenience, and reduce business The effect of pressure

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment

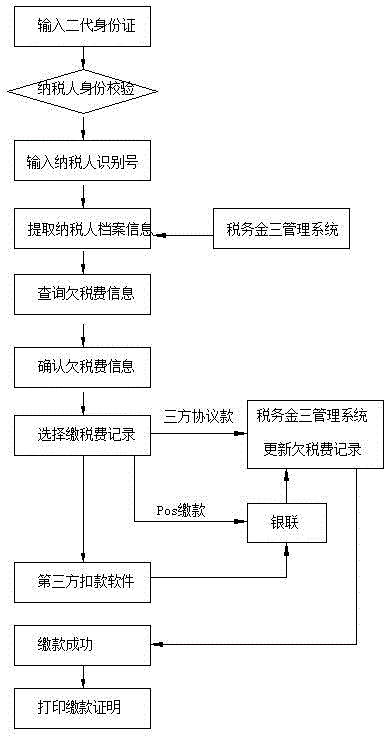

[0012] A method for realizing multi-channel tax payment through a self-service terminal described in this embodiment, through a self-service tax terminal, on the basis of network interoperability between the Jinsan management system, third-party deduction software, and UnionPay on the self-service tax terminal, Taxpayers can handle tax declaration and payment with their second-generation ID cards and bank cards, which mainly include the following steps: 1) Taxpayers register in the tax management system or the online tax office; 2) Taxpayers carry ID cards, 3) Check whether there is any arrears; 4) The taxpayer selects the tax payable and pays; 5) After the self-service tax terminal prompts that the tax is successful, print the tax payment certificate.

[0013] The above-mentioned 3) checking whether there is any arrears means that the taxpayer performs identity verification according to the prompts of the self-service tax terminal, enters the taxpayer identification number aft...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com