Small and medium-sized enterprise network financing system and method

A small and medium-sized enterprise and network technology, applied in the field of network credit, can solve the problems of no risk management, no intelligent financing products for small and medium-sized enterprises, and achieve the effect of improving loan financing efficiency, solving financing difficulties, and reducing management costs and risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

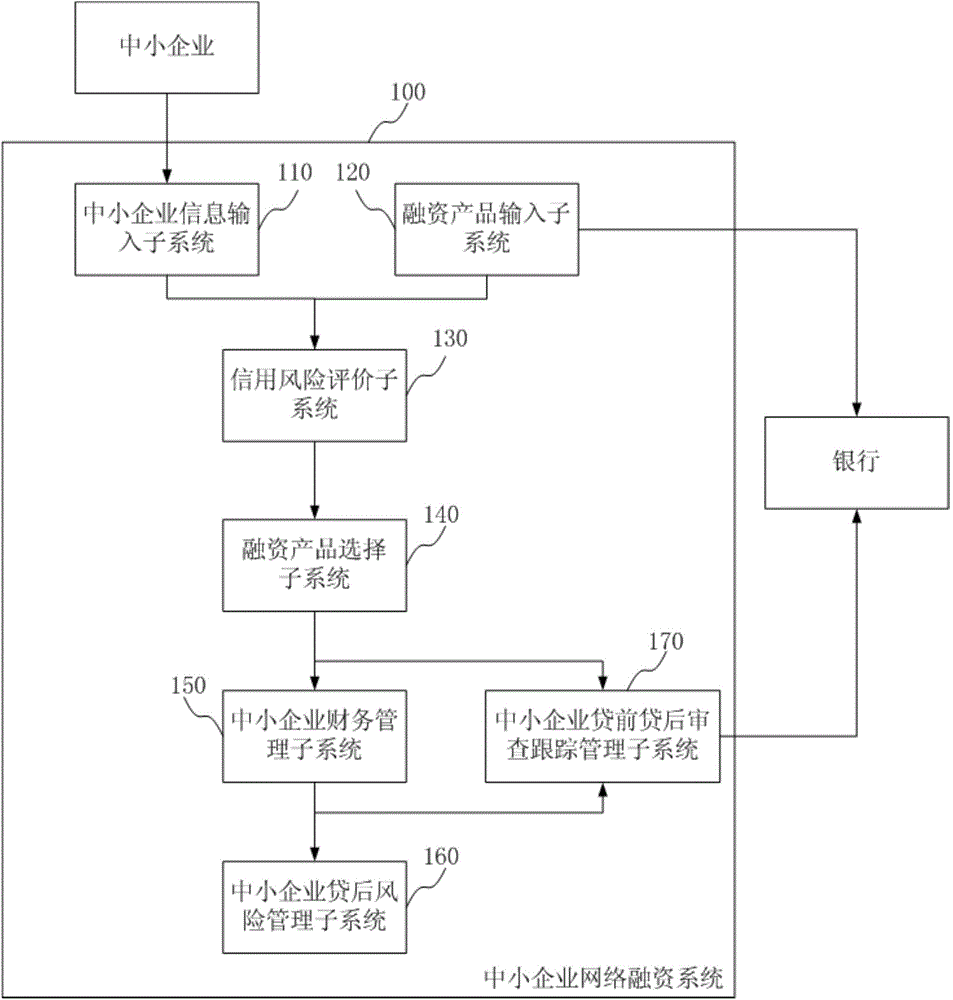

[0035] This embodiment discloses a network financing system 100 for small and medium enterprises, which is based on a network financing platform, and realizes efficient coordination between small and medium enterprises, banks, and financial intermediaries and management of the entire financing process. Such as figure 1 As shown, the SME network financing system 100 of this embodiment includes an SME information input subsystem 110, a financing product input subsystem 120, a credit risk evaluation subsystem 130, a financing product selection subsystem 140, and a SME financial management subsystem 150. , SME loan risk management subsystem 160 and SME loan pre-loan review and tracking management subsystem 170.

[0036] The SME information input subsystem 110 is located on the side of the SME, and is used to input the basic information of the SME and the financial information of the SME, and make an agency request to establish the SME database. Among them, the basic information of SM...

Embodiment 2

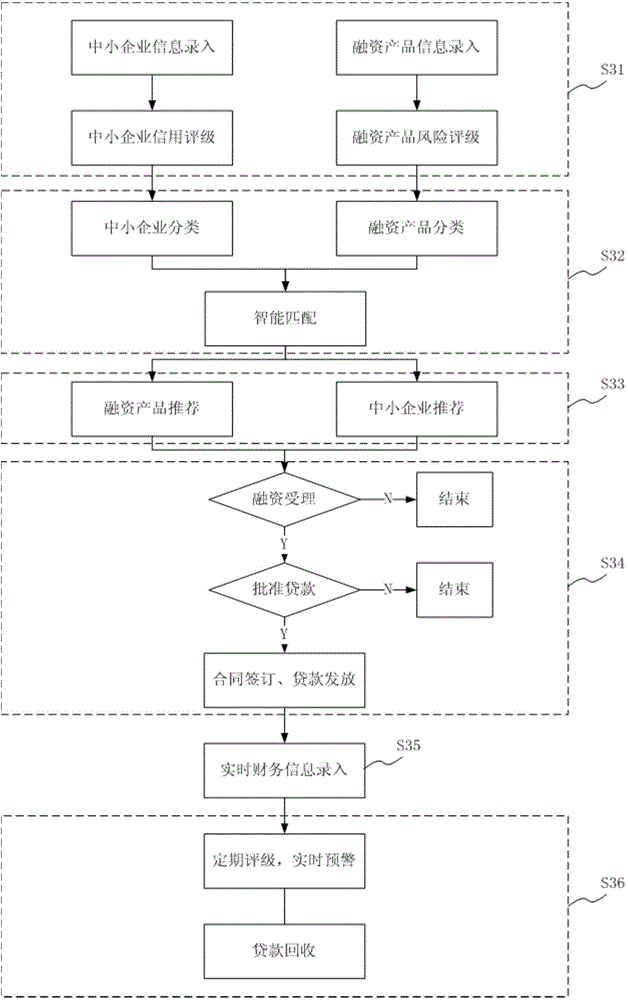

[0054] This embodiment discloses a network financing method for small and medium-sized enterprises, such as image 3 Shown, including:

[0055] Step S31, enter the basic information of SMEs, SME financial information and financing product information, and conduct risk assessments for SMEs and financing products: the credit risk assessment for SMEs is done using the SME credit rating model; for financing products Credit risk assessment is completed by using the financing product risk rating model, and both the SME credit rating model and the financing product risk rating model are established through the Z-score model;

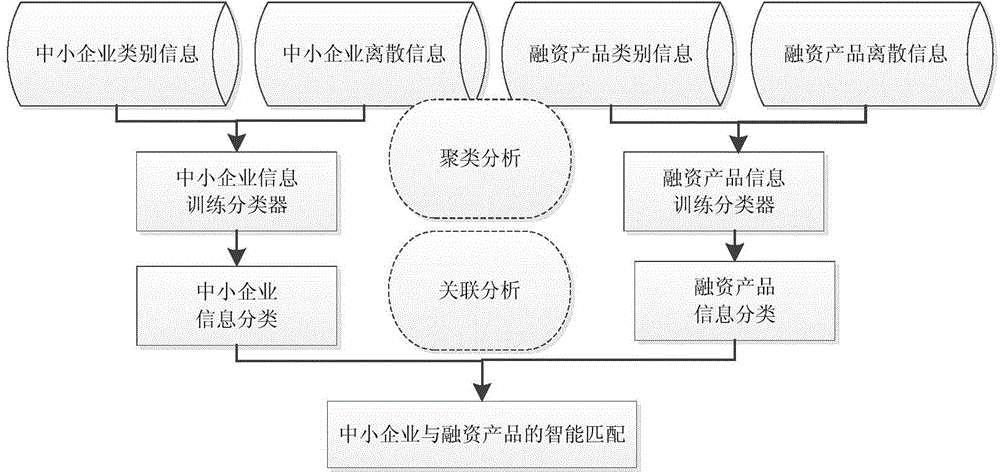

[0056] Step S32, using a clustering association rule mining algorithm to intelligently match the loan request and financing product of the SME;

[0057] Step S33, recommend matching financing products to small and medium-sized enterprises, and at the same time recommend matching small and medium-sized enterprises to the bank;

[0058] Step S34, if the SME and the bank ...

Embodiment 3

[0064] At present, the SME network financing system of the present invention has been implemented through a software platform, specifically as Figure 4 Shown. It includes 7 functional modules: credit risk evaluation management, intelligent financing product selection management, intelligent financial management, pre-loan and post-loan review and tracking management, post-loan risk management, loan management and system management.

[0065] Credit risk evaluation management realizes the two functions of SME credit rating and bank financing product risk rating. The specific functions are as follows:

[0066] Enterprise information management: manage the basic information, business information, asset information and financial information of small and medium-sized enterprises, including total enterprise assets, guarantees that can be provided, capital requirements, registration place, loan period, type of industry and preferred banks, etc.;

[0067] Product information management: mana...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com