Method for safely replacing bank POS machine

A POS machine and bank technology, applied in the field of payment and settlement, can solve the problems of high equipment cost and management cost of POS machines, achieve the effects of saving equipment investment and equipment maintenance costs, easy operation, and reduced operating costs

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

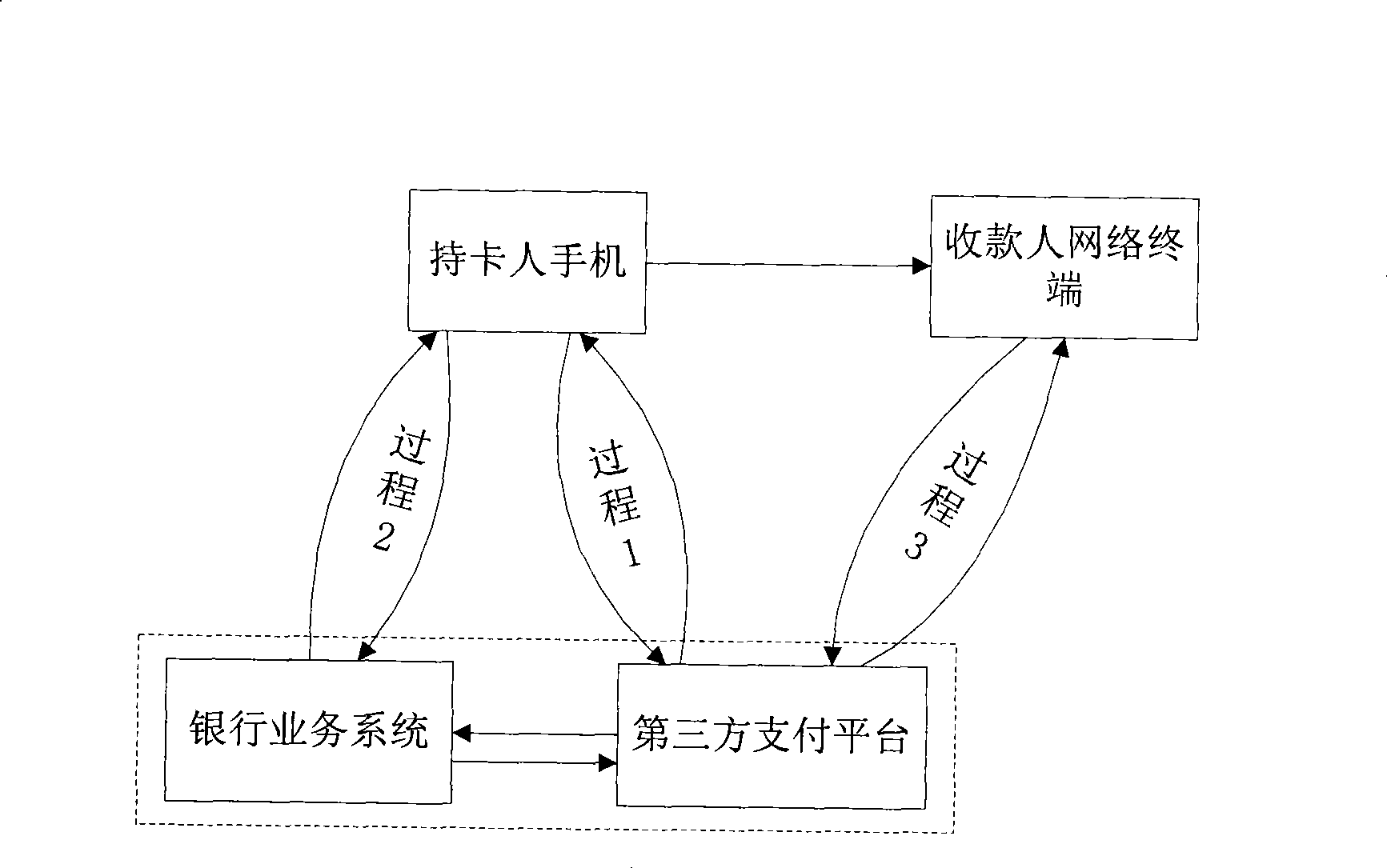

[0016] A safe alternative to bank POS machines, figure 1 In order to realize the structural composition diagram of the present invention, its composition includes four parts: the cardholder's mobile phone, the payee's network terminal, the third-party payment platform, and the banking system. Among them, the cardholder's mobile phone is a mobile communication terminal used by the cardholder or a mobile communication terminal installed with specific transaction information generation software; the payee's network terminal is an independent PC that can access the Internet ; The third-party payment platform is a payment system composed of one or more servers and software established on the Internet; the banking business system is a business system used by banks on a daily basis. The third-party payment platform is connected to the bank's business system through a dedicated line or the Internet.

Embodiment 2

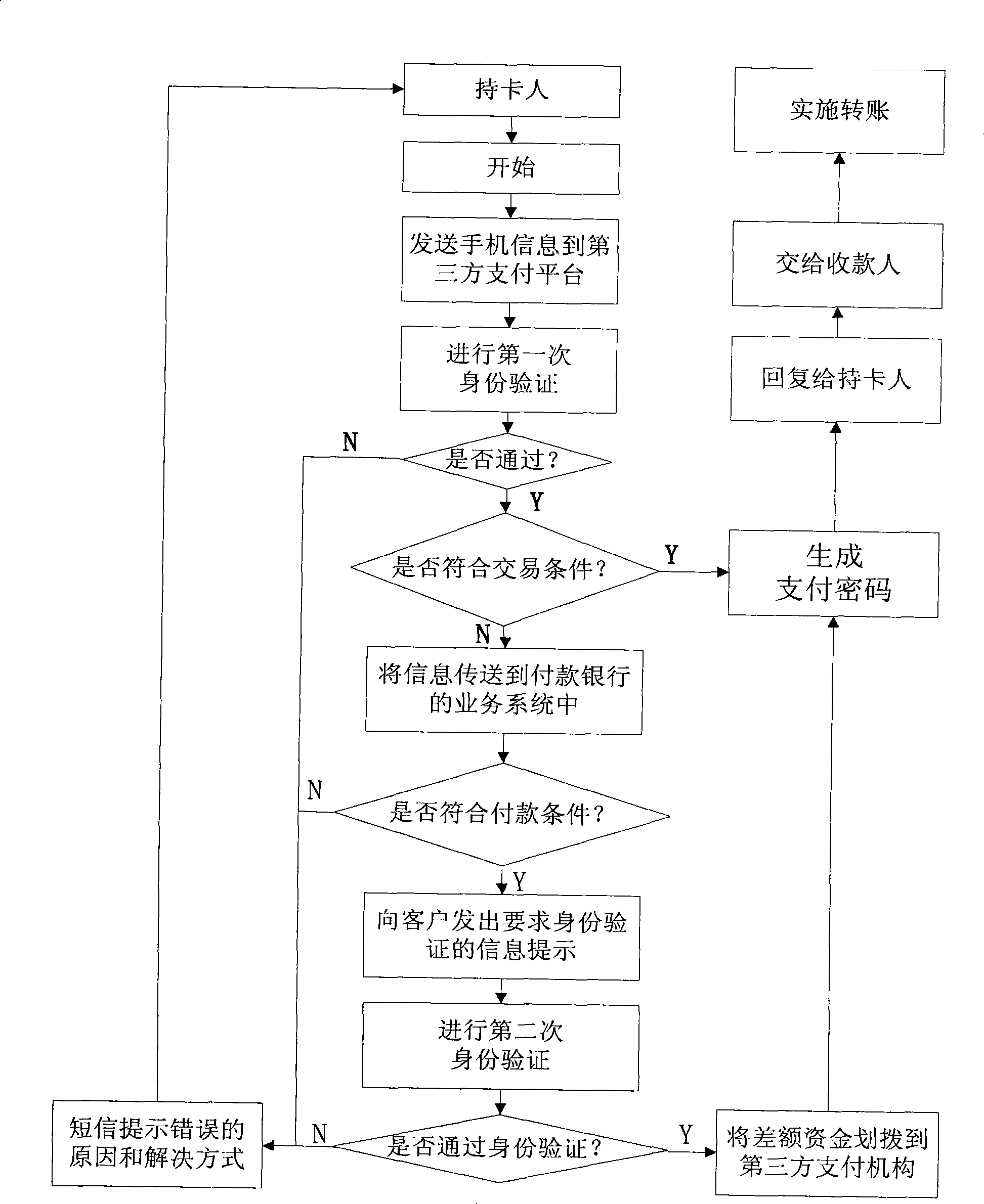

[0018] A safe alternative to bank POS machines, figure 2 To realize the flow chart of the present invention. When a cardholder conducts a commodity transaction at the transaction site, he first uses a mobile phone to edit or use specific software in the mobile phone to generate "transaction amount, identity verification password" and other information, and send it to a third-party payment platform. The third-party payment platform comprehensively verifies whether the cardholder’s identity is legal based on the received customer information. If the cardholder passes the identity verification, the third-party payment platform will subtract the transaction amount applied by the cardholder from the deposit amount or credit limit on the third-party payment platform, and form a difference fund. If the difference fund If it is less than zero, it means that the cardholder has enough transaction amount in the third-party payment platform and can enter the next payment settlement normally. ...

Embodiment 3

[0020] A safe alternative to bank POS machines, figure 2 To realize the flow chart of the present invention. If the balance of funds described in Example 2 is greater than zero, it means that the cardholder’s transaction limit or credit limit stored on the third-party payment platform is insufficient, and the third-party payment platform will use the cardholder’s relevant information, including , Name, mobile phone number, ID number, transaction date, and the stated balance of funds and other information are transmitted to the paying bank via a dedicated line or the Internet. Based on this information, the paying bank firstly determines whether the cardholder’s book balance is greater than the stated balance of funds. If it is greater, the paying bank will send the customer a mobile phone message requesting verification of the customer’s identity. This information includes the cardholder’s bank card password. These passwords can be static or dynamic. The specific requirements are ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com