Investment portfolio management method based on deep reinforcement learning

A management method and reinforcement learning technology, applied in the field of investment portfolio management based on deep reinforcement learning, can solve problems that affect the application value and generalization ability of the model, and achieve the effect of improving the problem of gradient disappearance, high accuracy, and improving efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

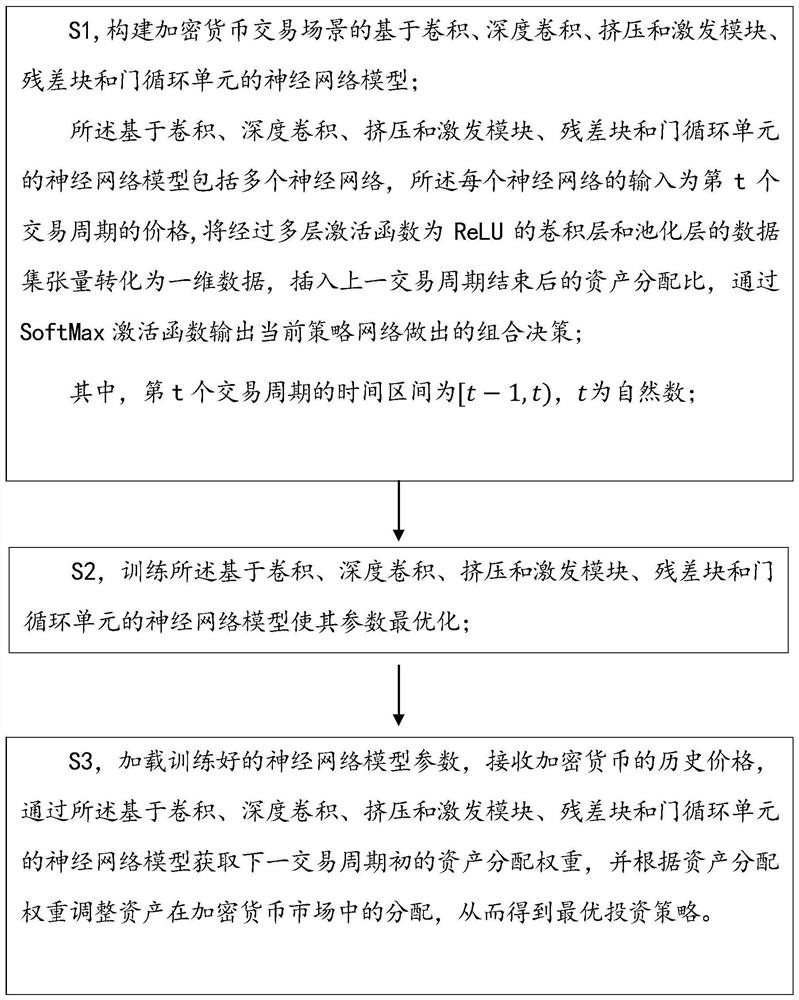

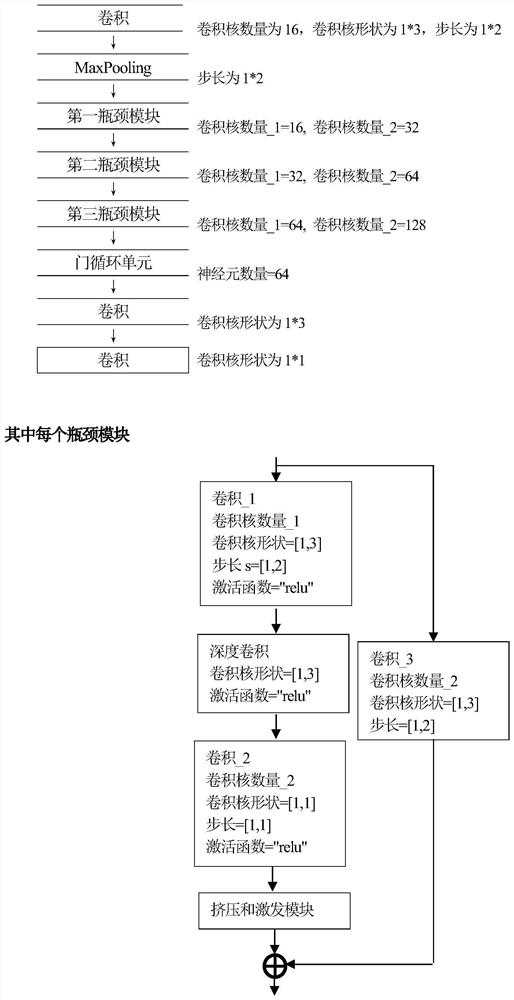

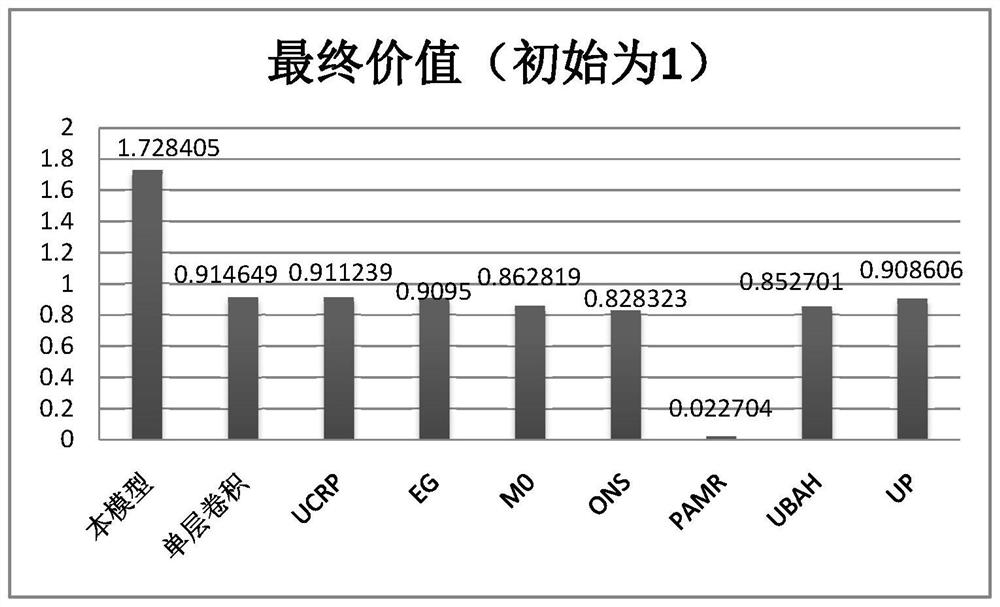

Method used

Image

Examples

Embodiment Construction

[0066] The objects, advantages and features of the present invention will be illustrated and explained by the following non-limiting description of the preferred embodiments. These embodiments are only typical examples of applying the technical solutions of the present invention, and all technical solutions formed by taking equivalent replacements or equivalent transformations fall within the scope of protection of the present invention.

[0067] In the description of the scheme, it should be noted that the terms "center", "upper", "lower", "left", "right", "front", "rear", "vertical", "horizontal", " The orientation or positional relationship indicated by "inside", "outside", etc. is based on the orientation or positional relationship shown in the drawings, which is only for convenience and simplification of description, rather than indicating or implying that the indicated device or element must have a specific orientation , constructed and operated in a specific orientation...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com