Financial lease risk prediction method and device, computer equipment and storage medium

A technology of risk prediction and financial leasing, applied in computer equipment and storage media, risk prediction method and device field of financial leasing enterprises, can solve problems such as affecting the smooth progress of financial leasing projects, low risk assessment efficiency, and too many manual intervention links. , to achieve the effect of reducing non-performing loan ratio, maximizing benefits and avoiding risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

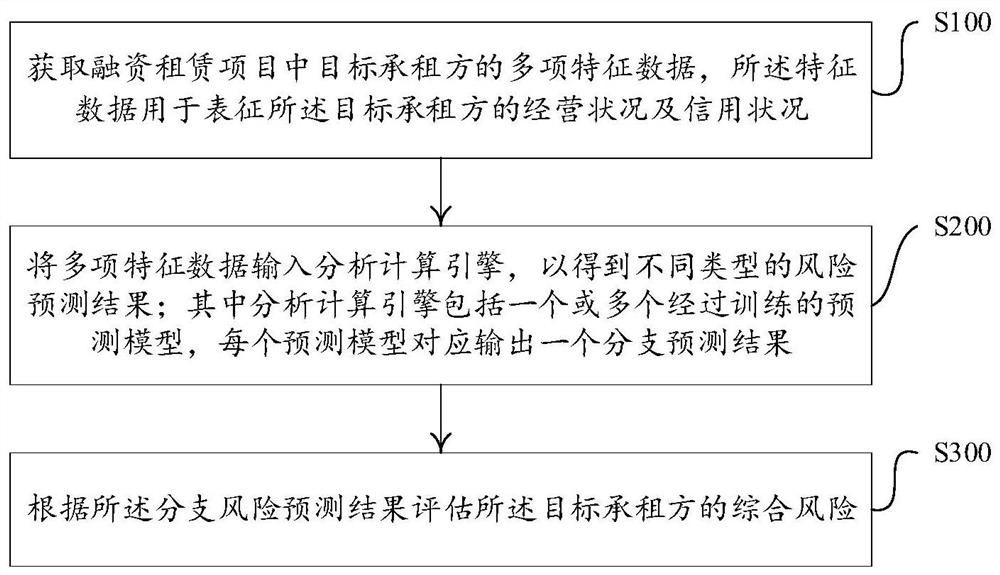

[0046] see figure 1 , this embodiment proposes a risk prediction method for financial leasing, including the following steps:

[0047] S100: Obtain a plurality of feature data of the target lessee in the financial leasing project, the feature data is used to represent the operating status and credit status of the target lessee.

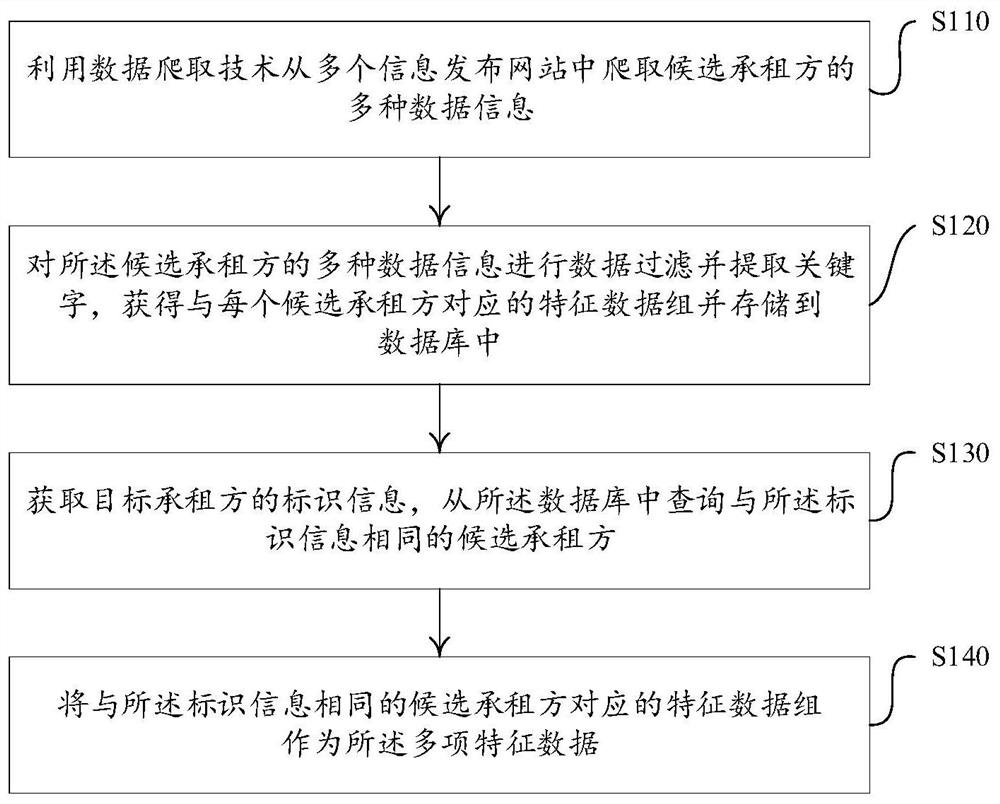

[0048] The target lessee can be the equipment demander in a financial leasing project, and it puts forward equipment usage requirements to the lessor, the financial leasing company, for equipment transactions between the financial leasing company and third-party suppliers. The multiple characteristic data of the target lessee in this embodiment may include multiple data such as the target lessee's financial status, operating status, historical loan records, employee composition, intellectual property ownership, and credit information. The above feature data may be directly provided by the user, or obtained through different information publishing web...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com