A Realization Method of Enterprise Credit Rating

A realization method and credit technology, applied in the realization method and system field of enterprise credit rating, can solve the group's economic loss, failure to obtain customer credit information, increase the group's operating costs and other problems, achieve high information accuracy, standardized format, reduce The effect of group economic loss

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

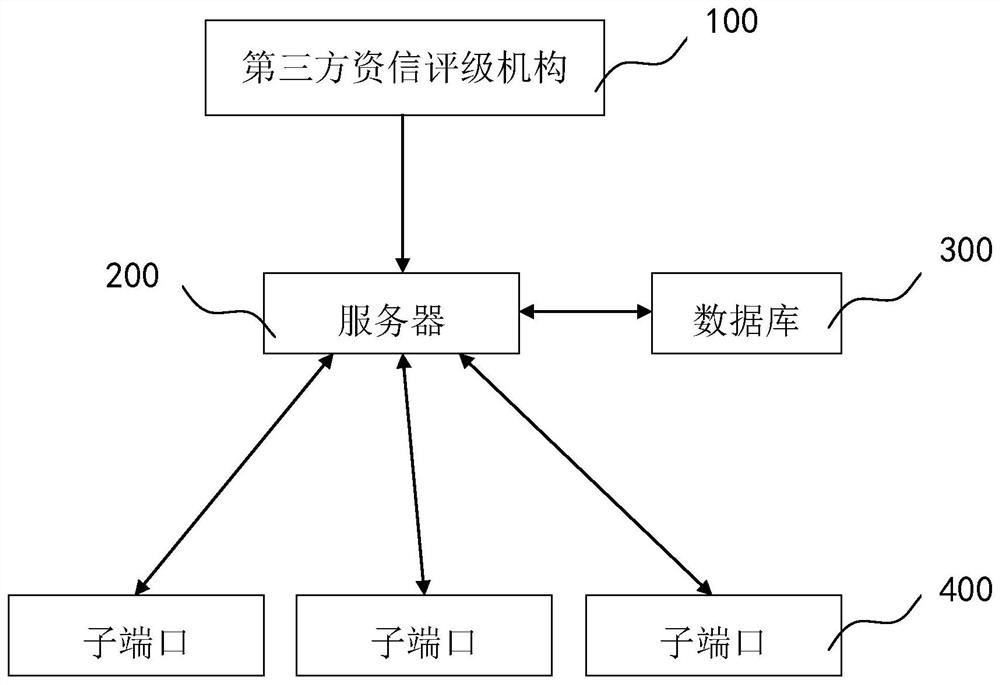

[0058] refer to figure 1, is the implementation environment of the credit rating method in this application, which includes a third-party credit rating agency 100 , a server 200 , a database 300 and several subports 400 . The server 200 can communicate with the third-party credit rating agency 100 , the database 300 and the subport 400 . The third-party credit rating agency 100 communicates with the server 200, and the server 200 receives the data from the third-party credit rating agency 100, and transmits the data to the database 300, and the database 300 records and stores the customer information data. The subport 400 can obtain information inside the database 300 through the server 200 , and the subport 400 can also transmit information to the database 300 through the server 200 . The third-party credit rating agency 100, the server 200, the database 300 and the subport 400 can all be hardware devices such as computers.

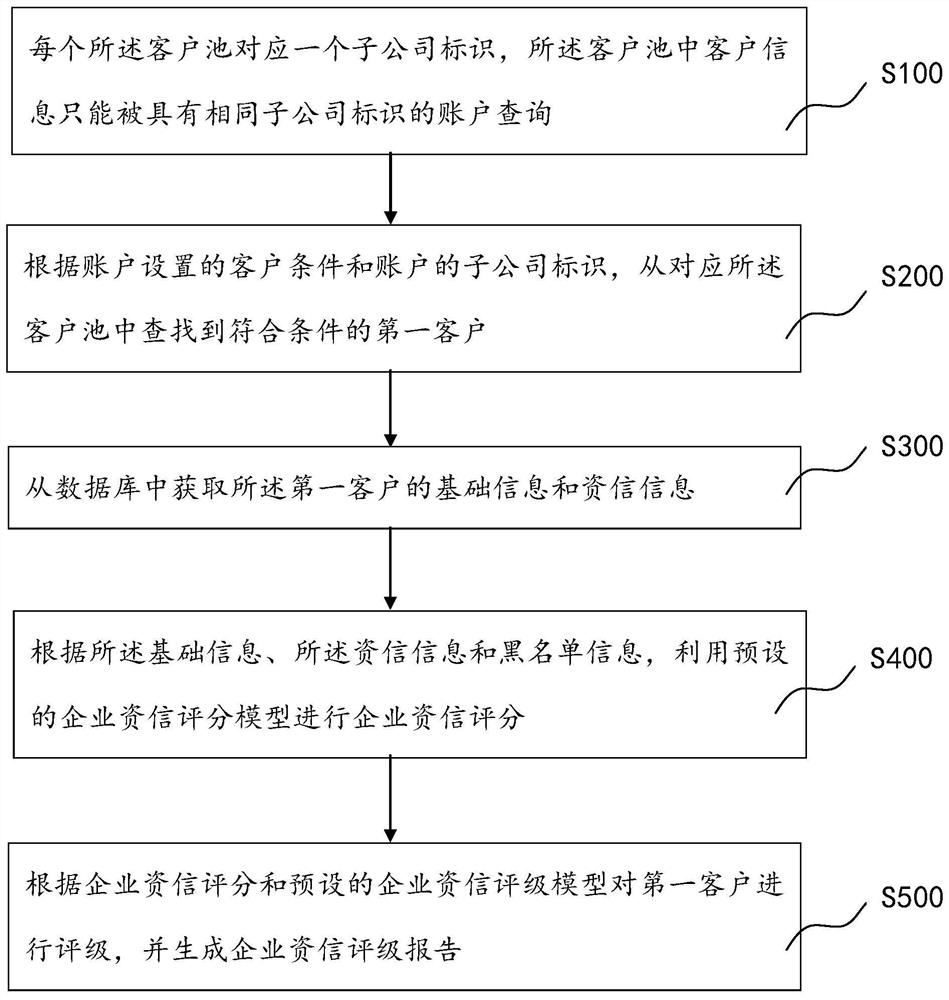

[0059] refer to figure 2 , is a flow chart of ...

Embodiment 2

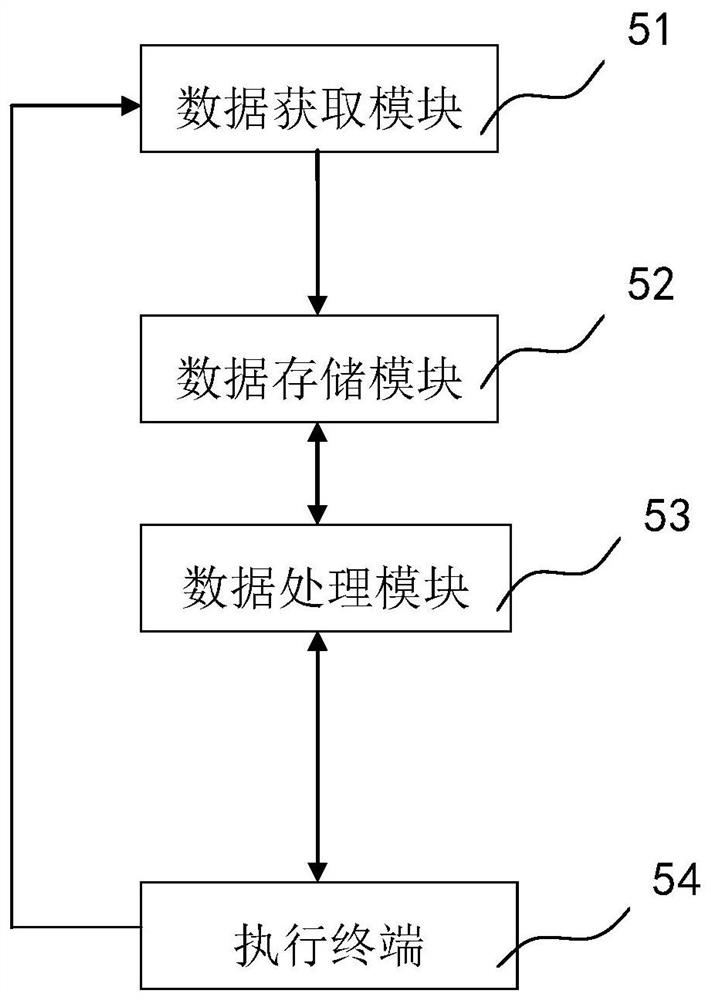

[0074] refer to image 3 , is an implementation system of enterprise credit rating in this application. The system includes a data acquisition module 51 , a data storage module 52 , a data processing module 53 and an execution terminal 54 .

[0075] Wherein, the data obtaining module 51 is used to obtain basic information of customers from a third-party credit rating agency, and transmit the data to the data storage module 52 .

[0076] The data storage module 52 is used to store the basic information of the customer, the credit information and the information of the enterprise credit score, so that each sub-port can query and retrieve the basic information of the customer.

[0077] The data processing module 53 is used to receive instructions from the execution terminal 54 , retrieve relevant customer data from the data storage module 52 for calculation, and transmit the calculation result to the execution terminal 54 .

[0078] The execution terminal 54 is used for communi...

Embodiment 3

[0081] In step S300, the customer's basic information includes basic information, shareholding structure information, shareholder and executive information, corporate background information and risk information.

[0082] Among them, basic information includes customer name, unified social credit code, industrial and commercial registration information, date of establishment, registered address, registered scope, registered capital, etc.

[0083] Enterprise background information includes foreign investment, actual control, enterprise relationship, change information, historical evolution, enterprise annual report, etc.

[0084] Risk information includes litigation-related information, administrative penalty information, equity pledge information, business abnormal information, etc.

[0085] The database summarizes and stores the basic information of customers based on various information, so that in the process of credit rating, the processor can retrieve various information a...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com