Credit investigation method based on Internet behaviors

An Internet and behavioral technology, applied in the field of Internet behavior-based credit reporting, can solve problems such as a small amount of information, narrow access to evaluation reference data, and changes in evaluation results.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

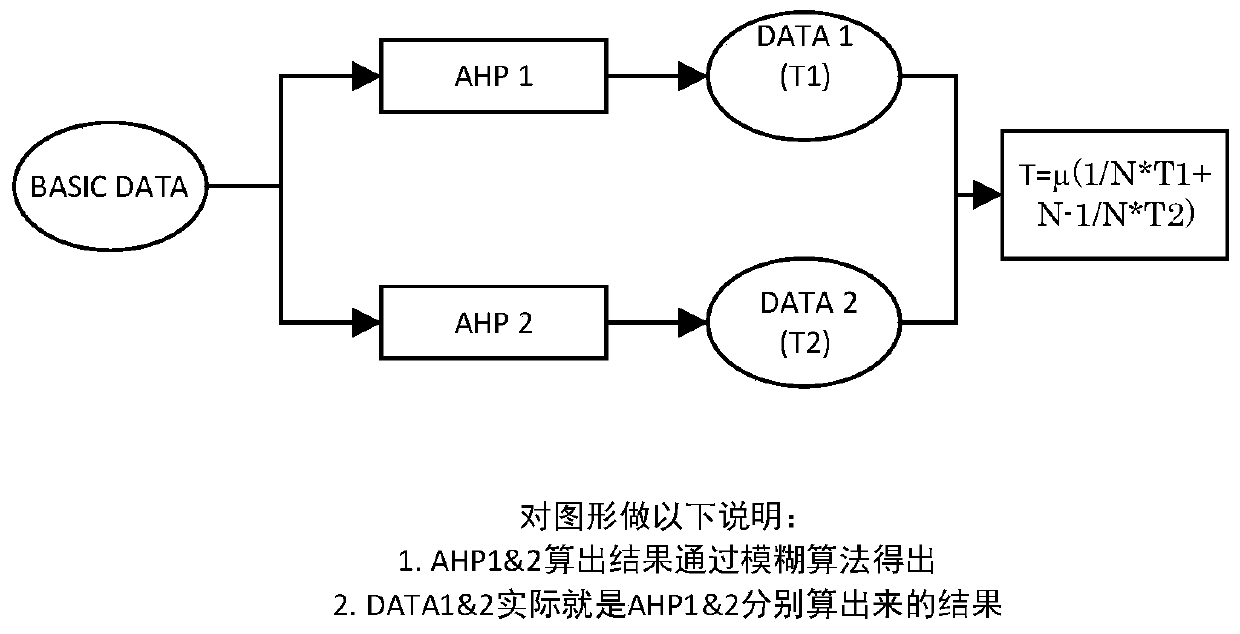

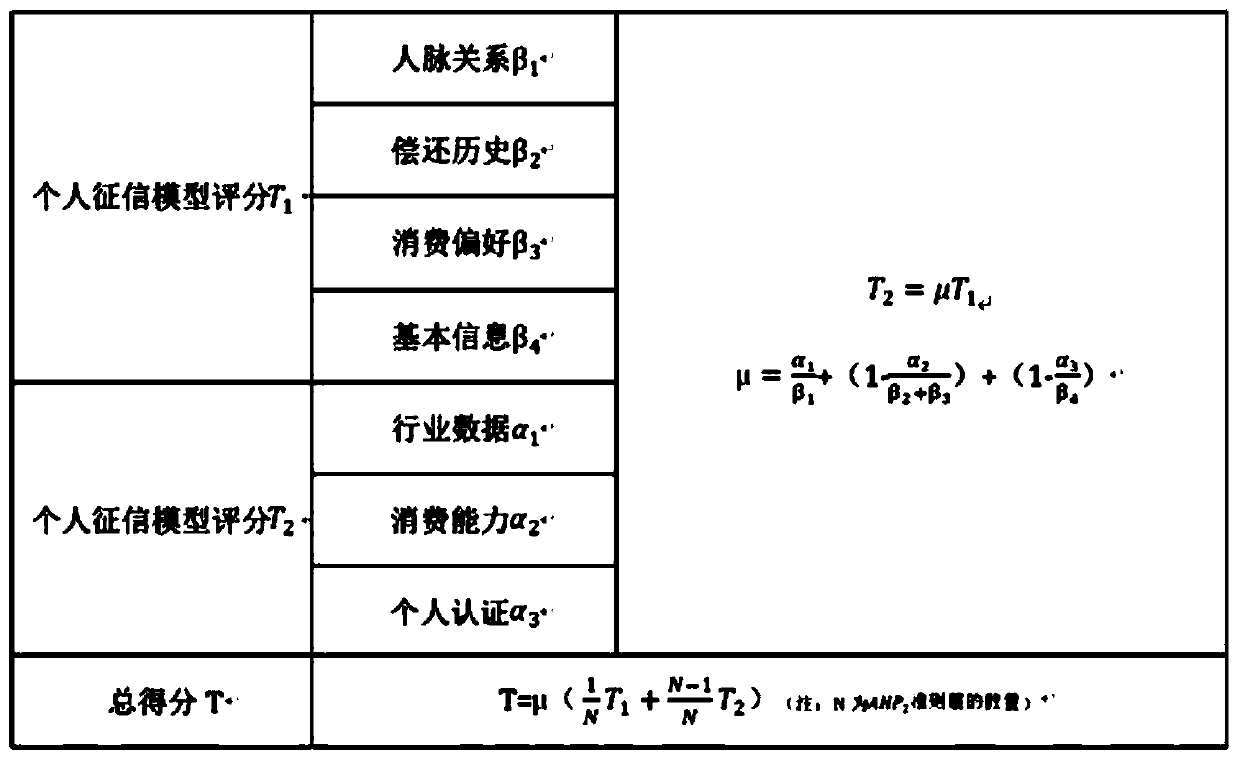

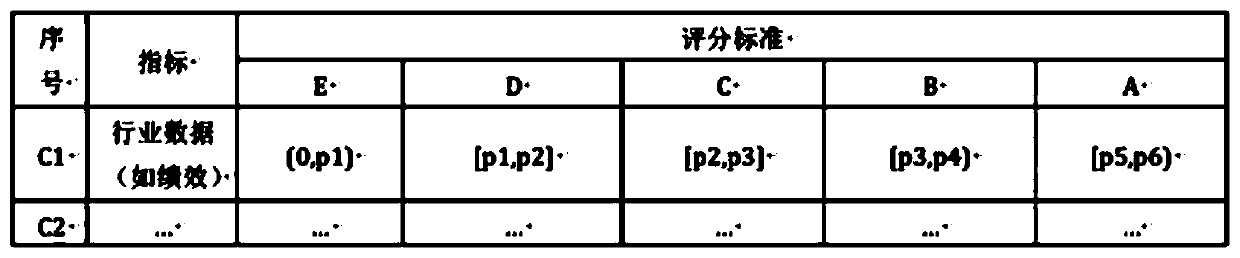

[0029] The present invention uses the AHP-fuzzy comprehensive evaluation method, first uses AHP to determine the proportion of each sub-influencing factor and index, and then uses the fuzzy comprehensive evaluation method to evaluate the personal credit level

[0030] The weight is determined by AHP using the weighted data and the geometric mean method. The present invention adopts two different angles of AHP, and determines the relationship between the two. After calculating the score through fuzzy evaluation, the final result is finally obtained.

[0031] The main terms in the text are defined as follows:

[0032] 1. Networking relationships

[0033] It mainly evaluates the work stability of users' social network influence, such as the number of likes and comments on Weibo, the number of friends in the circle of friends, etc., and reflects their social scope through work stability;

[0034] 2. Repayment history

[0035] It mainly evaluates users' consumption feedback and r...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com