High-frequency time sequence volatility estimation method

A technology of time series and volatility, applied in calculation, instrumentation, finance, etc., can solve problems such as large differences in the real volatility of volatility, large data interference, and inability to reflect intraday fluctuations

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0090] The present invention will be further described below in conjunction with the accompanying drawings and embodiments.

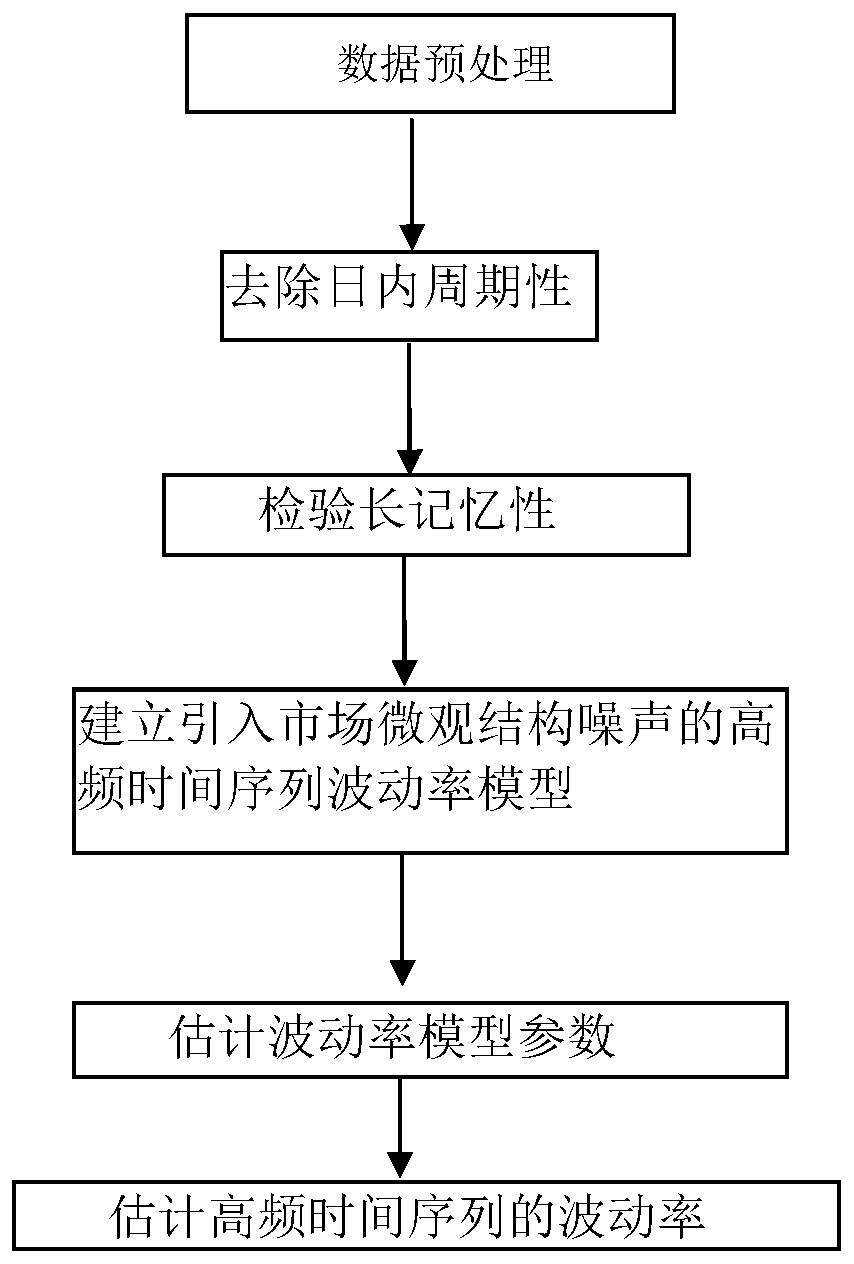

[0091] Refer to attached figure 1 , this embodiment includes the following steps: a method for estimating volatility of high-frequency time series, including the following steps:

[0092] Step 1. Data preprocessing to obtain the original high-frequency yield sequence:

[0093] 1.1 Data acquisition: Obtain the closing price of the stock market with an intraday interval ≤ 60 minutes, and obtain high-frequency time series;

[0094] 1.2 Remove the closing price recorded beyond the trading time;

[0095] 1.3 Eliminate the first observed value of the closing price in each day, and calculate the original high-frequency yield sequence.

[0096] Step 2. Remove the intraday periodicity to obtain the high-frequency yield sequence with the intraday periodicity removed:

[0097] Use the FFF regression method to quantitatively calculate the cycle factor: generali...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com