Method for determining enterprise credit increment based on enterprise employee data

A technology for enterprise employees and data determination, applied in data processing applications, instruments, finance, etc., can solve problems such as inconsistent business conditions of enterprise credit lines, inaccurate evaluation of enterprise collateral value, high risk of bank loan bad debts, etc., to reduce the risk of bank loans The effect of lending risk, improving efficiency and accuracy, and reducing financing difficulty

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0020] In order to make the technical solutions and advantages of the present invention clearer, the present invention will be further described below in conjunction with the drawings and specific embodiments, but it is not a limitation of the present invention.

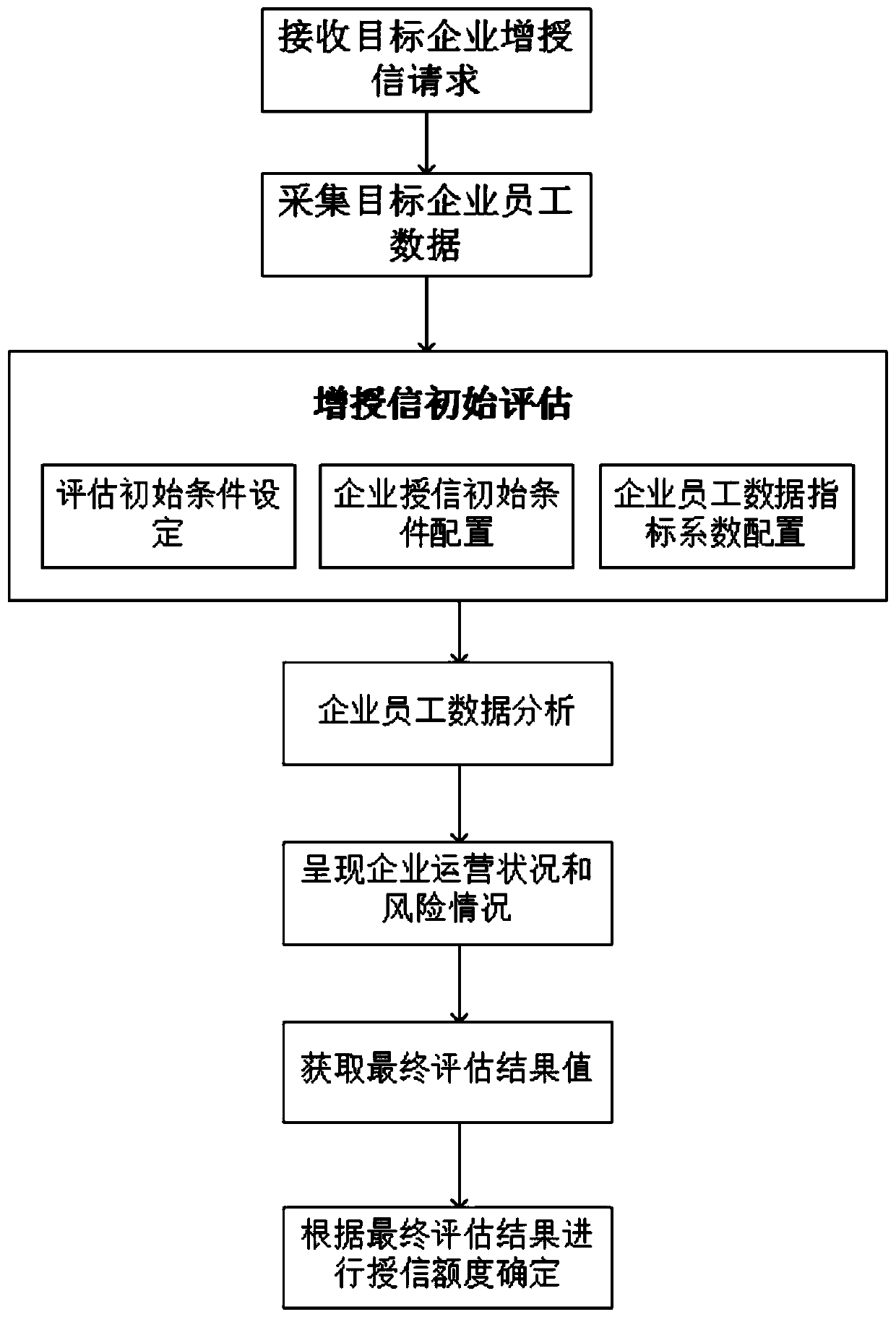

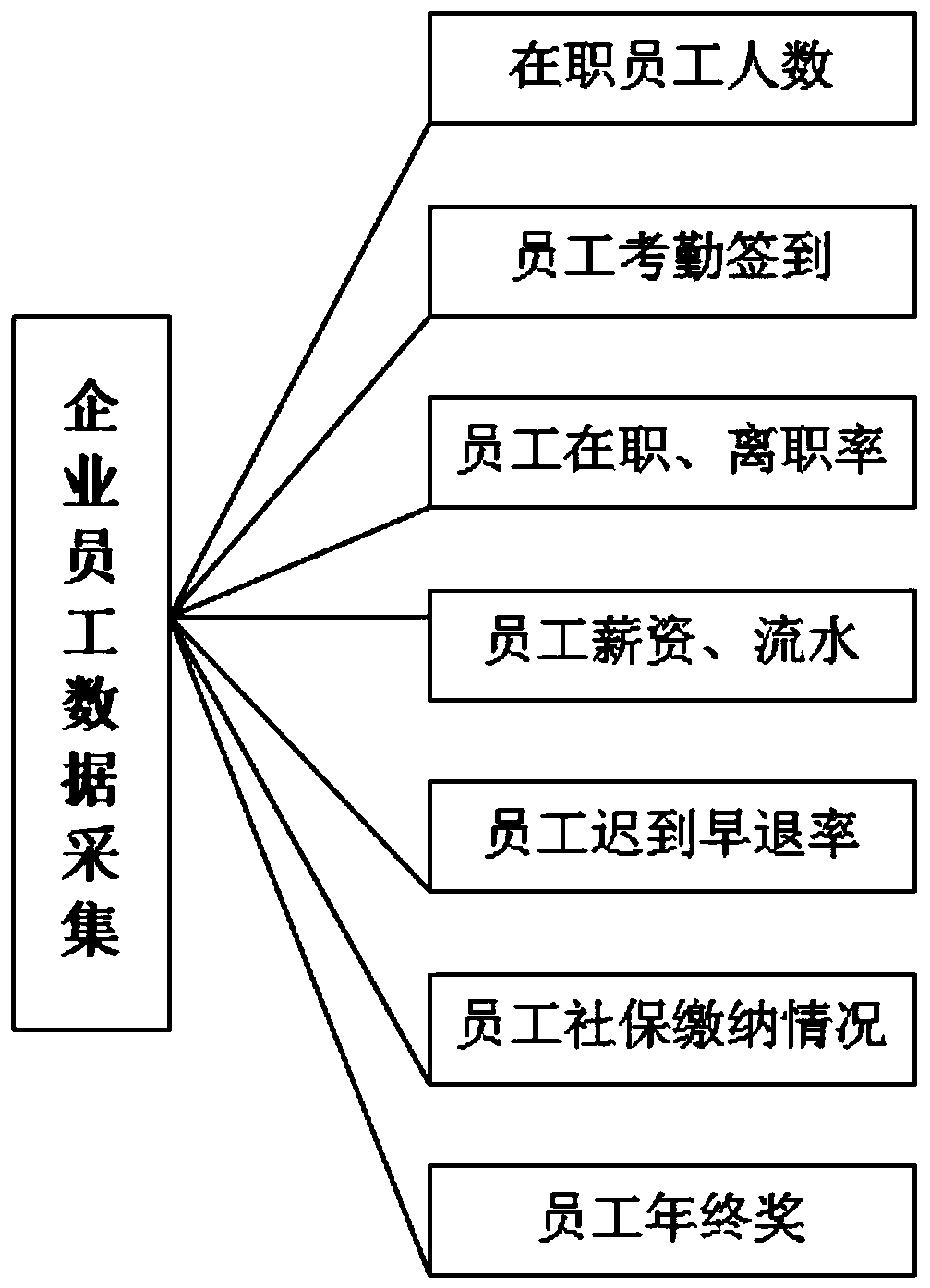

[0021] Such as Figure 1-2 As shown, this embodiment provides a method for determining the amount of credit increase in an enterprise based on enterprise employee data. The operation steps include the steps of receiving a credit increase request sent by the target company, understanding target company information, and collecting target company employee data; Credit evaluation, the credit increase evaluation includes evaluation initial condition setting, enterprise credit initial condition configuration and enterprise employee data index coefficient configuration; enterprise employee data analysis; obtain the final result value of the target company’s credit increase evaluation, showing the company’s operation and risk si...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com