Intelligent financial analysis method and system based on big data of automatic bookkeeping

A technology of intelligent analysis and big data, which is applied in the field of financial intelligent analysis method and its system, can solve problems such as single function of financial bookkeeping system, enterprise financial situation, enterprise loss, etc., so as to avoid too cluttered data and improve the efficiency of tax declaration , to reduce the effect of human influence

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

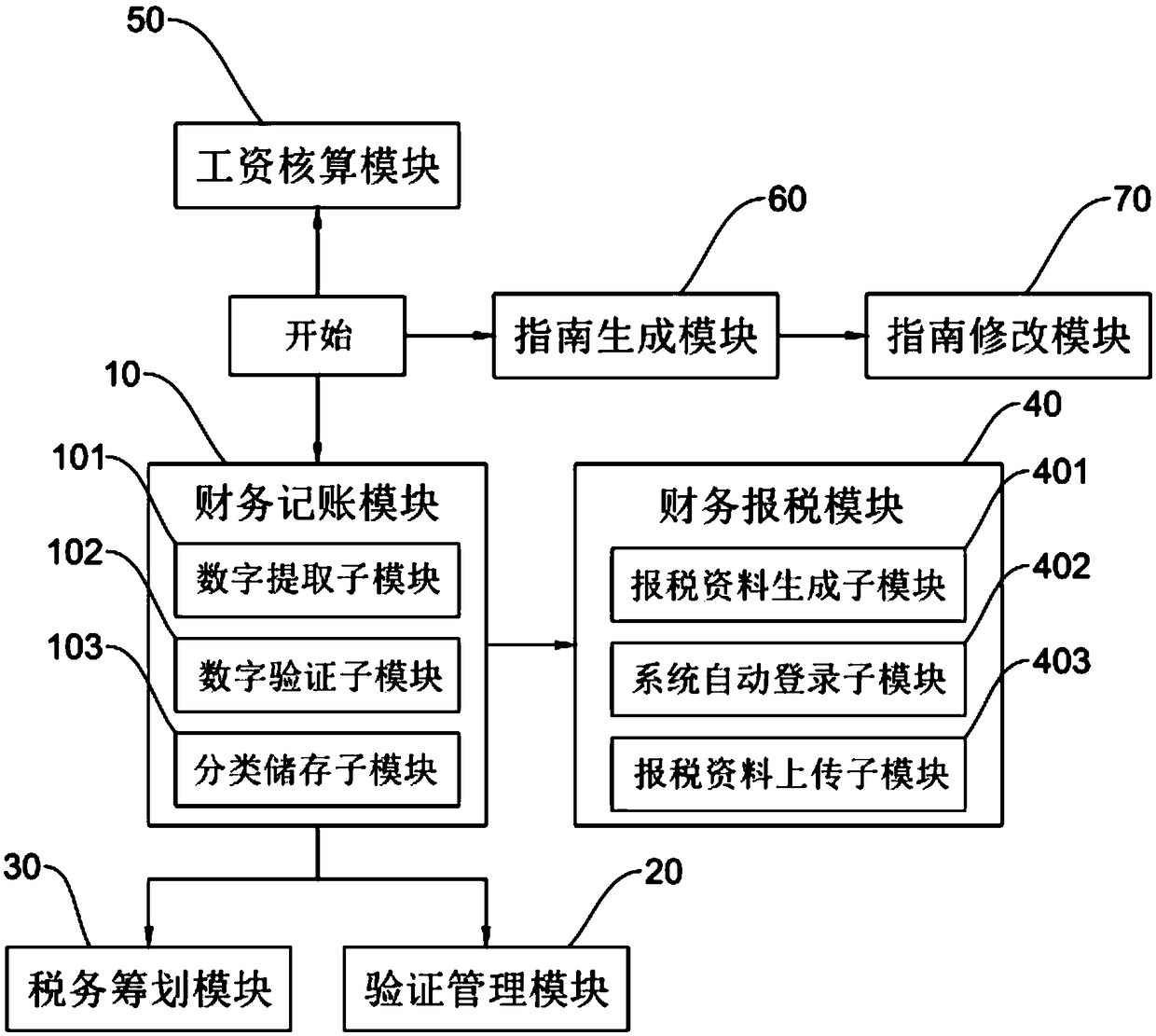

[0060] like figure 1 As shown, a financial intelligence analysis method based on automatic bookkeeping big data includes the following steps:

[0061] S10. Extract digital information for bookkeeping, and classify and record the bookkeeping content into the corresponding database of the enterprise;

[0062] S20. Extract the data in the corresponding database according to the requirements, and verify the financial data of the enterprise. If the data is wrong, delete the wrong data from the database and re-book; if the data is correct, continue to store in the database. ;

[0063] S30. Extract and analyze the data in the corresponding database according to the requirements, generate the tax report of the enterprise, and carry out tax planning;

[0064] S40. Extract the data in the corresponding database according to the requirements, and upload the tax declaration materials.

[0065] In this embodiment, operations such as bookkeeping, tax declaration, background management, a...

Embodiment 2

[0067] In this embodiment, on the basis of Embodiment 1, the accounting step S10 specifically includes the following steps:

[0068] S101. After scanning, perform image recognition, and extract corresponding digital information through OCR text recognition;

[0069] S102. Calculate the extracted digital information, verify whether the extracted digital information is correct, if yes, perform accounting; if not, do not perform accounting;

[0070] S103. Classify and record the accounting content into a database corresponding to the enterprise.

[0071] When keeping accounts, first use a scanner to scan, and after being recognized by the image recognition system, the OCR character recognition system extracts the corresponding numbers according to the accounting template, and then performs algorithmic operations on the extracted numbers to verify the correctness of the extracted numbers. After correctness, classify and enter the accounting content into the corresponding database...

Embodiment 3

[0073] In this embodiment, on the basis of Embodiment 2, the tax declaration step S40 specifically includes the following steps:

[0074] S401. Extract the data of the corresponding database according to the requirements, and generate the required tax declaration materials according to the tax declaration template;

[0075] S402. Link to the network tax declaration port, extract the account information and password information in the relevant enterprise database, and automatically extract the mobile phone verification code, and log in to the tax declaration system;

[0076] S403. Upload the generated tax declaration materials to the tax declaration system.

[0077] In this embodiment, the tax declaration is carried out for the data of the enterprise, the database data is extracted, and the materials required for tax declaration are generated according to the tax declaration template; then, the network tax declaration port is linked, the account number and password of the enter...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com