Curve risk management method, device and storage medium

A risk control and curve technology, applied in instruments, finance, data processing applications, etc., can solve the problems of random settings and inability to use quantitative transactions, and achieve the effect of reducing experience dependence and good risk control.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

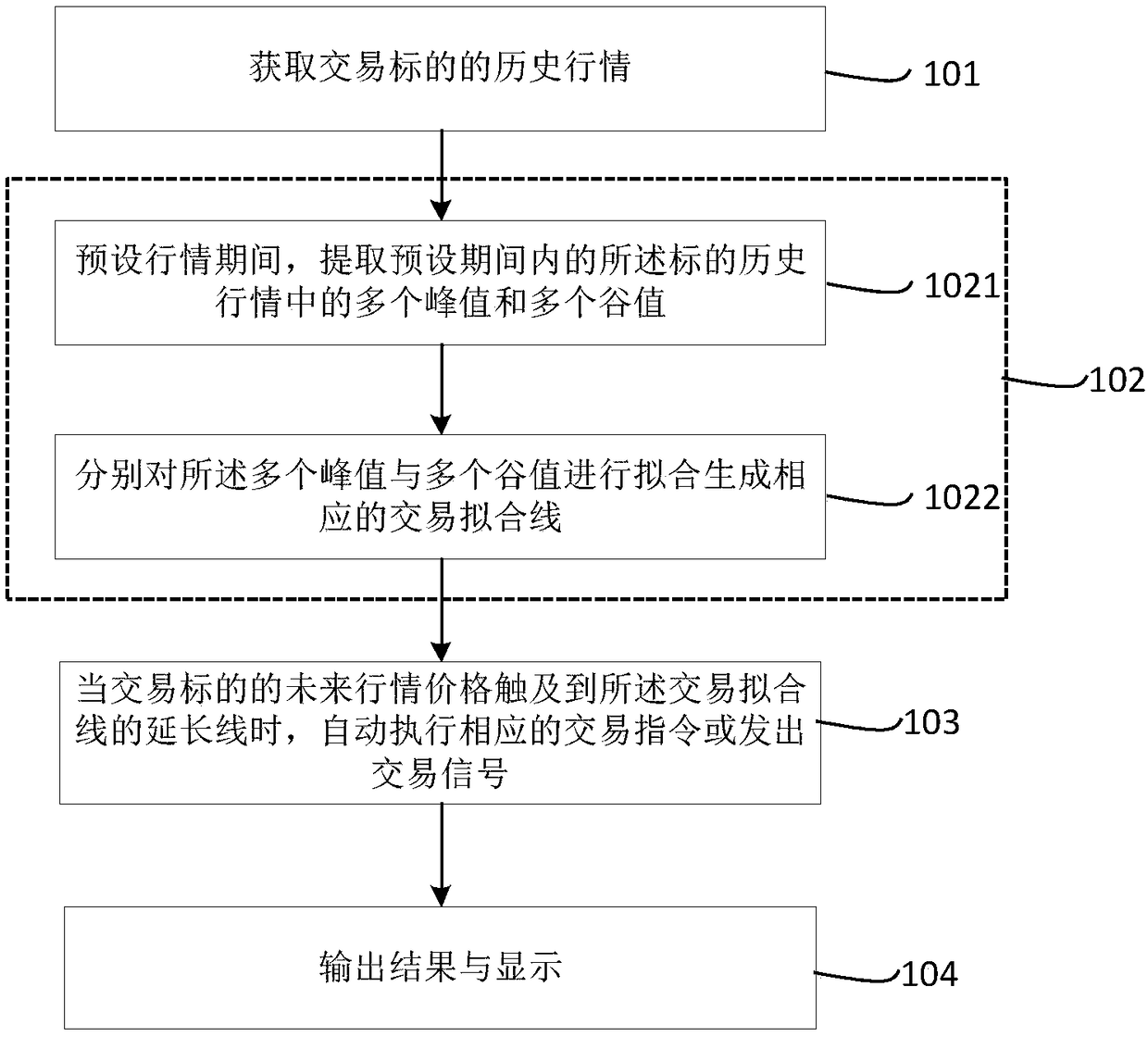

[0044] The invention provides a curve risk control method, which is suitable for execution in computing equipment. refer to figure 1 , shows the flow chart of the curve risk control method of the present invention, including the following steps:

[0045] Step 101, obtain the historical quotation of the transaction target.

[0046] The trading targets described in this embodiment include stocks, futures, funds, bonds, gold, and related financial derivatives with price fluctuations. Historical quotations include but are not limited to any one or a combination of multiple periods of opening price, highest price, lowest price, and closing price of each target. This historical quotation can be connected to a third-party platform, such as from various securities exchange obtained. The period described in this embodiment includes any one of the minute line, hourly line, daily line, weekly line, monthly line, and annual line of any one of the opening price, the highest price, the l...

Embodiment 2

[0062] This embodiment provides a curve risk control method. This embodiment can be understood as a specific application method for risk control based on the above embodiments, and the method is suitable for execution in a computing device.

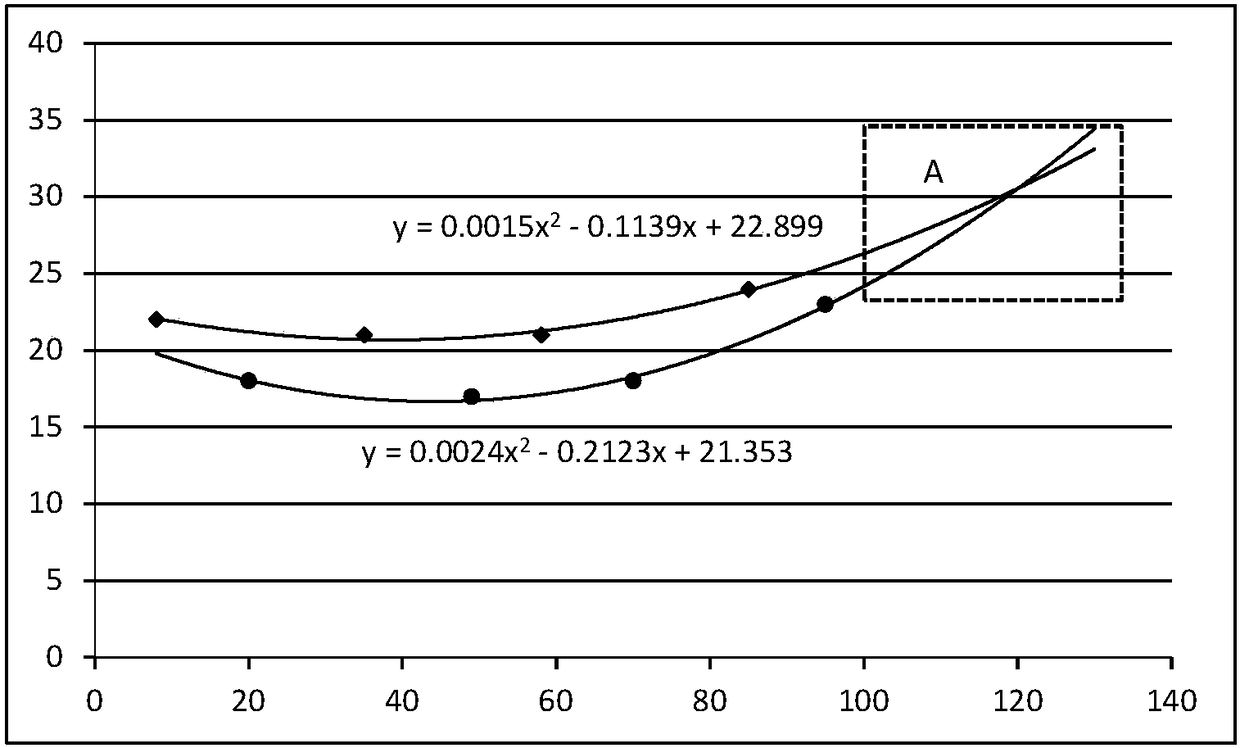

[0063] still refer to figure 2 , shows the fitting curve of multiple peaks and multiple valleys that appeared in the historical market of a certain target in the first 100 days of the current cycle. Perform polynomial fitting on the peak points of the closing price of the above four days with time as the abscissa to generate a peak trading fitting line y=0.0015x 2 -0.1139x+22.899, at the same time, polynomial fitting is performed on the above four daily closing price valley points with time as the abscissa to generate a valley fitting curve y=0.0024x 2 -0.2123x+21.353.

[0064] Take this target as the trading target, and use the point on the extension line of the above two fitting curves as the preset threshold for automatic trading. T...

Embodiment 3

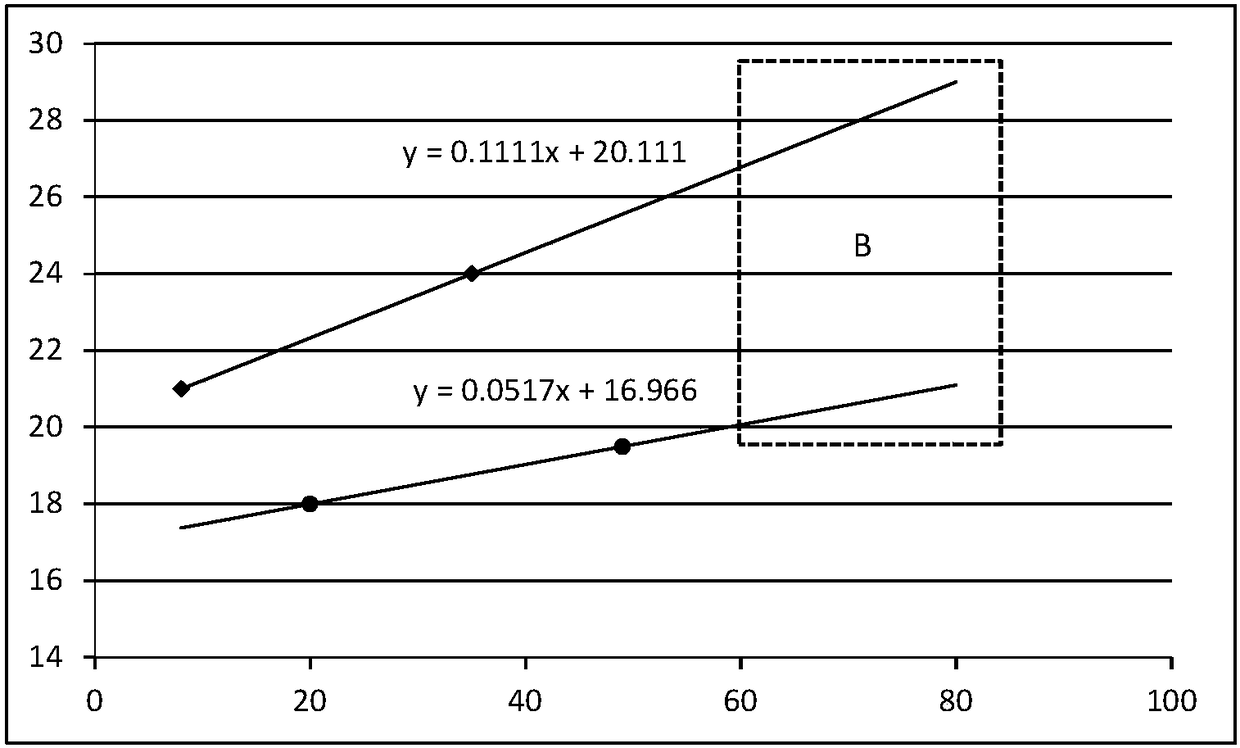

[0081] This embodiment provides a curve risk control method, the method is suitable for execution in computing equipment, refer to Figure 4 , shows the flow chart of the curve risk control method of the present invention, including the following steps:

[0082] Step 201, obtain the historical quotation of the transaction object.

[0083] The trading targets described in this embodiment include stocks, futures, funds, bonds, gold, and related financial derivatives with price fluctuations. Historical quotations include but are not limited to any one or a combination of multiple periods of opening price, highest price, lowest price, and closing price of each target. This historical quotation can be connected to a third-party platform, such as from various securities exchange obtained. The period described in this embodiment includes any one of the minute line, hourly line, daily line, weekly line, monthly line, and annual line of any one of the opening price, the highest price...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com