Insurance fraud detection method and system

A technology of insurance fraud and risk, applied in the field of big data distributed computing analysis, can solve the problems of weak risk identification ability, inaccurate positioning of data analysis, and low audit efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

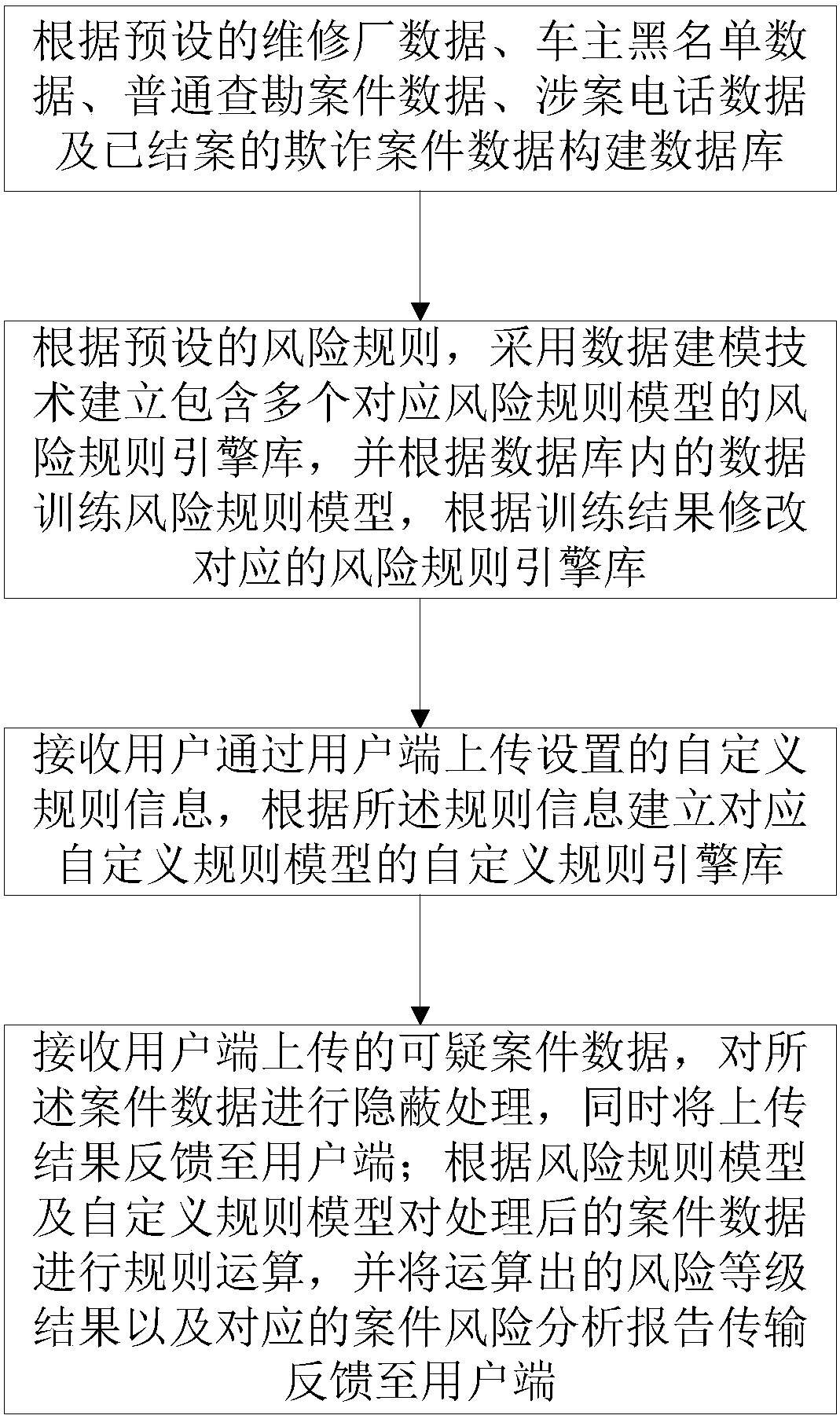

Method used

Image

Examples

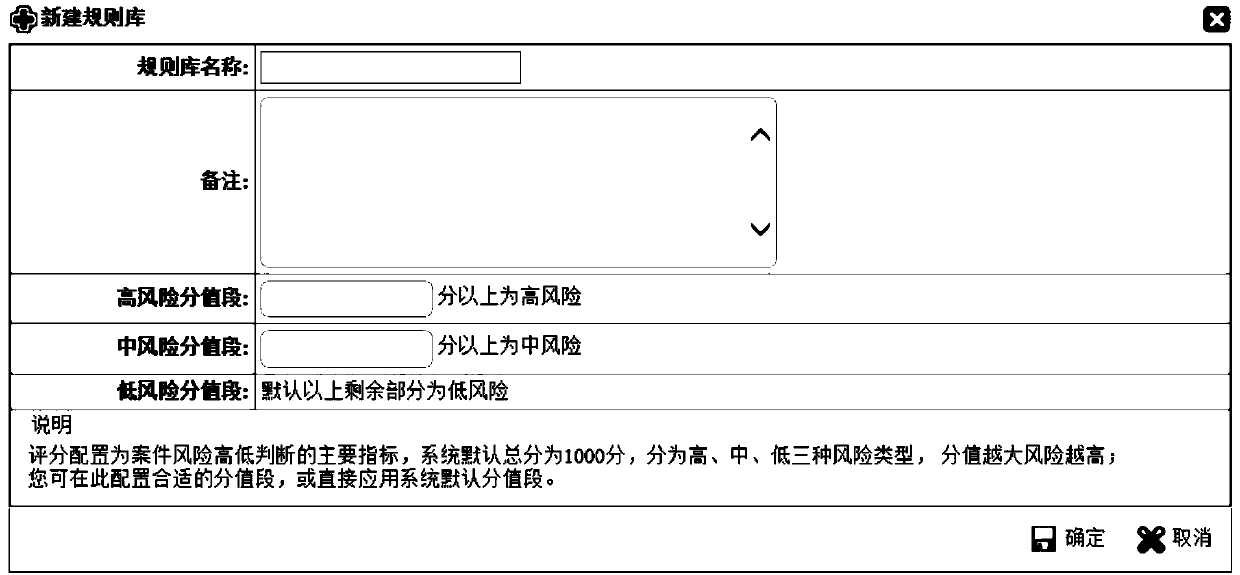

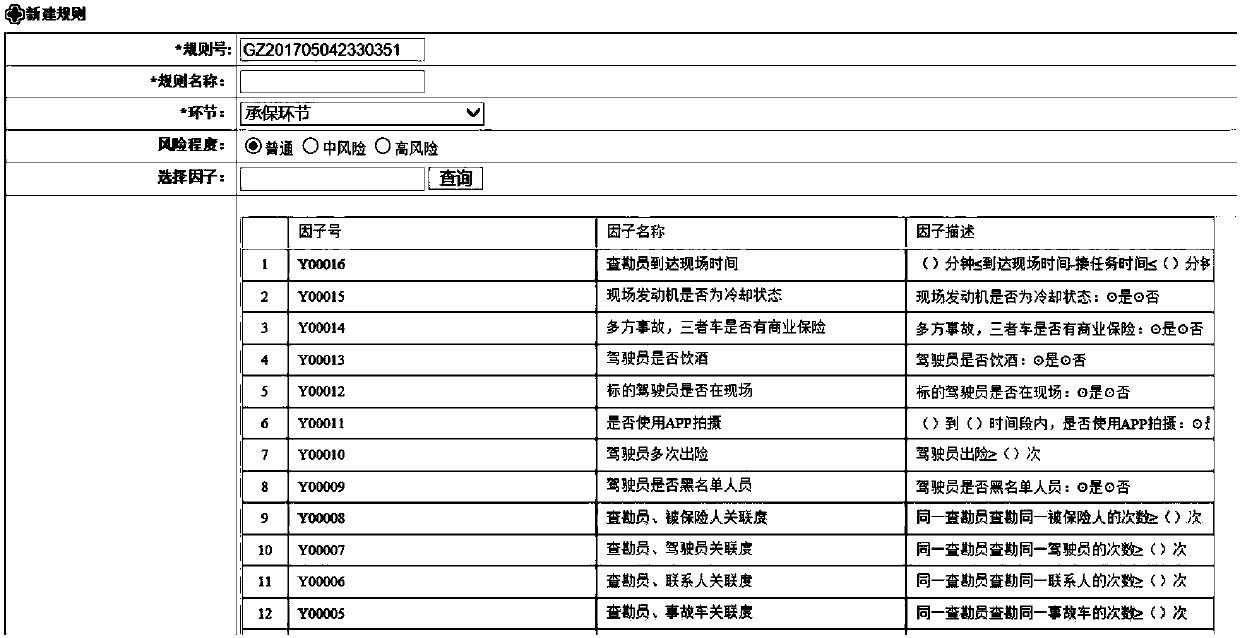

Embodiment approach

[0050] As an implementation manner, after the batch audit sub-step, it also includes:

[0051] Learning sub-step: train the risk rule model according to the closed cases uploaded by users in batches, modify the corresponding risk rule model according to the training results, and save it to the risk rule engine library.

[0052] As an implementation manner, the receiving calculation step further includes a desensitization sub-step and an encryption sub-step.

[0053] Desensitization sub-step: desensitize the case data according to preset desensitization rules. In the case of user security data or some commercially sensitive data, without violating risk rules and custom rules, the real data of the case is transformed and provided for testing, such as ID number, mobile phone number, card number, Personal information such as customer numbers need to be desensitized.

[0054] Encryption sub-step: sequentially encrypt, label and ID the sensitive part of the case data for concealme...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com