Enterprise lending credit evaluation system

A technology for evaluating systems and credit ratings, applied in data processing applications, instruments, finance, etc., can solve the problems of low availability of evaluation results, neglect of corporate debt repayment creditworthiness, etc., and achieve the effects of avoiding low authenticity, reducing risks, and not being easy to falsify

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

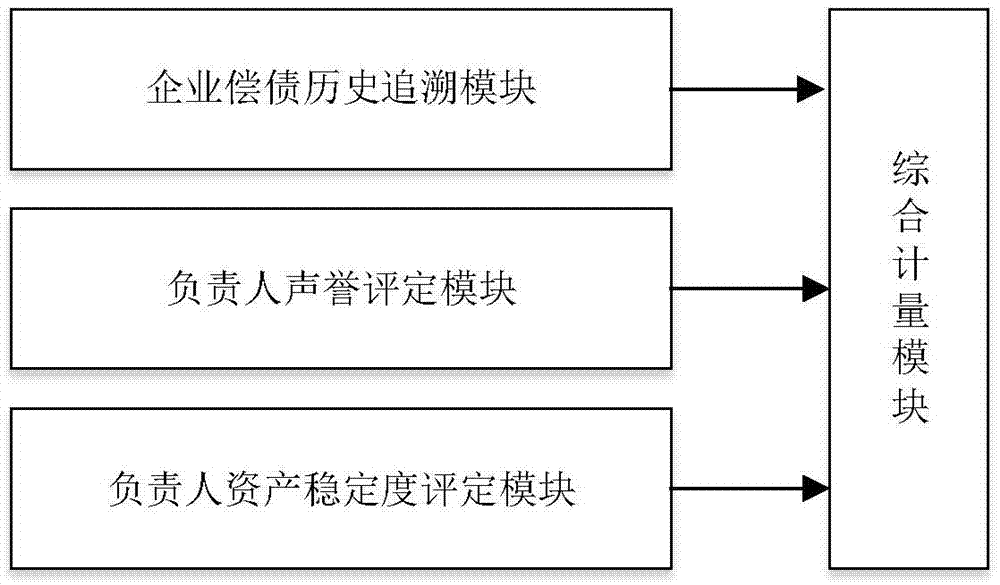

[0024] refer to figure 1 , a credit evaluation system for enterprise loans proposed by the present invention, including a traceability module of enterprise debt repayment history, a responsible person's reputation evaluation module, a responsible person's asset stability evaluation module and a comprehensive measurement module.

[0025] The enterprise debt repayment history tracing module is used to obtain the enterprise debt repayment history data, and evaluate the enterprise debt repayment credit threshold a according to the enterprise debt repayment history data. Specifically, the enterprise’s debt repayment history traceability module counts three categories of on-schedule repayment times A, overdue repayment times B and unpaid times C according to the company’s historical debt repayment data, and imports the three types of data into the preset first calculation model to calculate the enterprise Debt service credit threshold.

[0026] The first calculation model is:

[0...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com