Automated claims processing system

A technology of automation system and processing system, which is applied in the field of insurance policy claim processing, and can solve problems such as rising insurance premiums

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

example 1

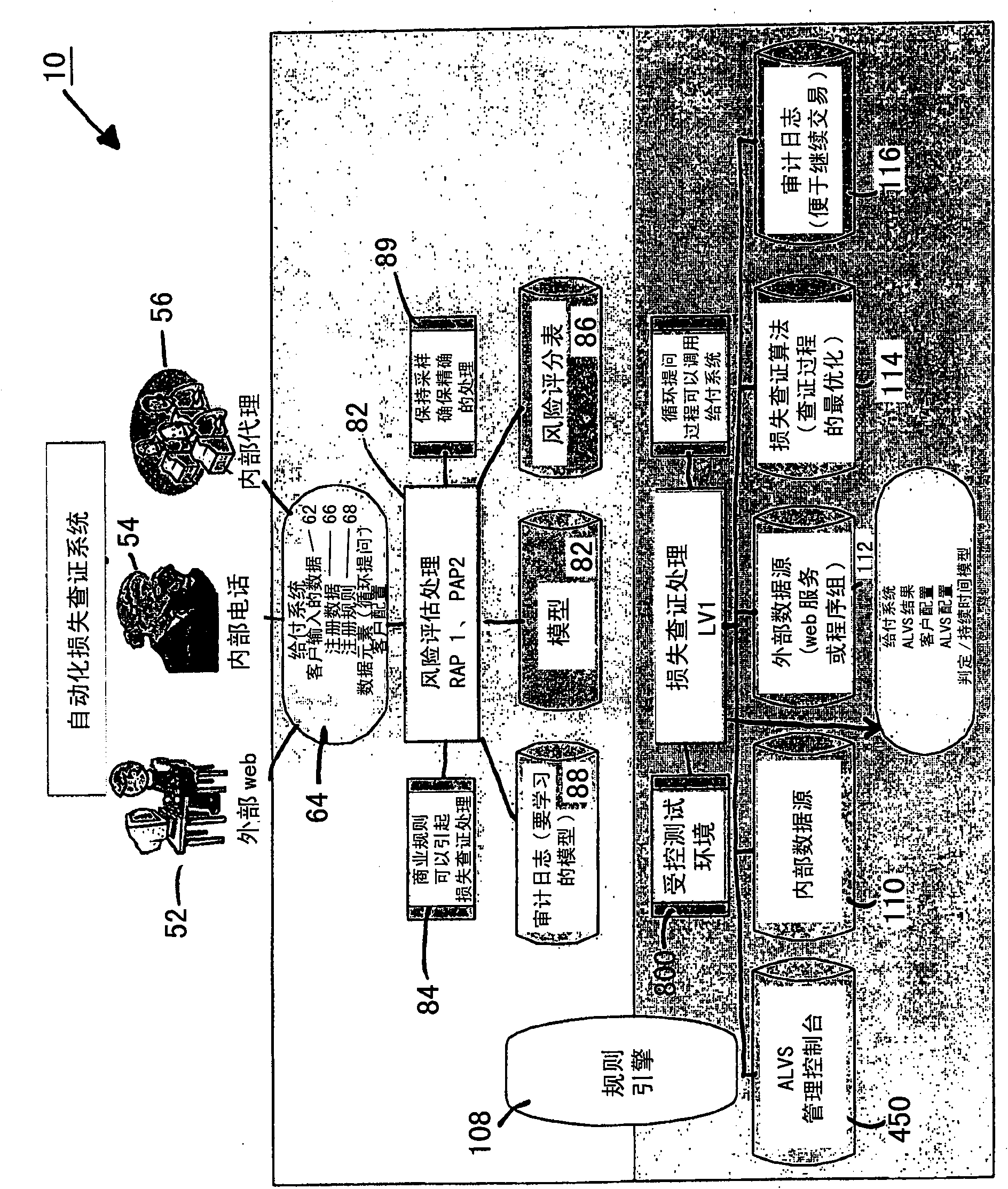

[0122] An application example of the ALV processing tool of the present invention is Figure 5 Life insurance policy claim shown. For life insurance policy claims 150 , ALV processing pre-assigns two sources of corroborating data: the Social Security Death Index (“SSDI”) 152 and the Obituary Index 154 administered by the Federal Social Security Administration.

[0123] The rules engine of the ALV processing tool contains a TCL conversion table 156 pre-built by the insurance company issuing the life insurance policy. The table indicates that for a life insurance policy of the type that is the subject of a benefit claim, a Risk Assessment Score ("RAS") 158 equal to 1 translates to a TCL Score 159 equal to 30% to validate the claimed loss. On the other hand, a RAS equal to 2 requires a TCL score equal to 40%. Under the exemplary ALV treatment, the corresponding RAS values of 3, 4, and 5 converted to required TCL scores of 75%, 85%, and 100%, respectively.

[0124] According ...

example 2

[0129] Figure 6 An example of applying the ALV processing of the present invention to an inactive unemployment insurance ("IUI") claim is provided. The rules engine has pre-assigned the TALX TPA Occupational Verification Database 172 as a source of corroborating data for verifying IUI claims. This database will be accessed by all clients who file unemployment claims. Not all employers are part of the database, so the ALV process first checks the TALX TPA occupation verification against the employer name. The match did not contribute confidence to the claim's AVV, allowing ALV processing to proceed.

[0130] Next, the ALV process checks the TALX TPA database against the unemployed person's name, social security number, and termination date. If this information in the database record matches that provided by the claimant, ALV processing contributes a 100% confidence value to the claim's AVV score. In this case, the claim will be verified (despite the claim's RAS score of 17...

example 3

[0133] Figure 7 An example of applying the ALV processing of the present invention to a disability insurance policy claim is provided. Disability insurance policy claim 190 is associated with a lookup table 192 containing predetermined RAS scores 194 and associated TCL values 196 . Insurance companies also provide multiple sources of substantiated data for the purpose of verifying disability insurance policies under ALV processing198.

[0134] For example, physicians and other medical service providers providing services to patients may have access to the medical provider listing database 200 . A 30% confidence level is contributed to the claim's AVV score if the health care provider's name and phone number match the information provided by the claimant. In this case, claims with an RAS score of 1 will be verified, while claims with an RAS score of 2-5 will require additional contributing sources to prove the veracity of these claims.

[0135] The ICD9 diagnosis / speciali...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com