Method, device and equipment for batch intelligent processing of cross-border value-added tax based on cloud network

A technology of intelligent processing and value-added tax, applied in the field of data processing, can solve problems such as low efficiency and high error rate, and achieve the effect of reducing error rate, reducing the burden of accountants, and facilitating query and retrieval

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

[0058] The characteristics and exemplary embodiments of various aspects of the present invention will be described in detail below. In order to make the purpose, technical solutions and advantages of the present invention more clear, the present invention will be further described in detail below in conjunction with the accompanying drawings and embodiments. It should be understood that the specific embodiments described here are only configured to explain the present invention, not to limit the present invention. It will be apparent to one skilled in the art that the present invention may be practiced without some of these specific details. The following description of the embodiments is only to provide a better understanding of the present invention by showing examples of the present invention.

[0059] It should be noted that in this article, relational terms such as first and second are only used to distinguish one entity or operation from another entity or operation, and ...

Embodiment 2

[0163] see Figure 7 , an embodiment of the present invention provides a cloud network-based cross-border value-added tax batch intelligent processing device, the device includes:

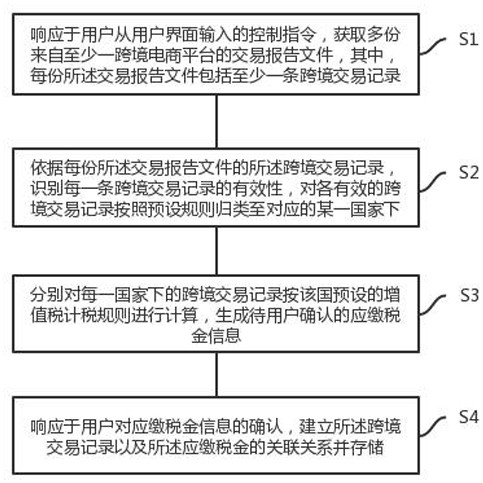

[0164] A transaction report file obtaining module, configured to obtain a plurality of transaction report files from at least one cross-border e-commerce platform in response to a control instruction input by the user from the user interface, wherein each transaction report file includes at least one cross-border transaction Record;

[0165] The cross-border transaction record classification module is used to identify the validity of each cross-border transaction record based on the cross-border transaction records in each transaction report file, and classify each valid cross-border transaction record according to preset rules. Classify to a corresponding country;

[0166] The payable tax information generation module is used to calculate the cross-border transaction records in each country acco...

Embodiment 3

[0187] see Figure 8 , the embodiment of the present invention also discloses a cloud network-based cross-border value-added tax batch intelligent processing device, including: at least one processor 301, at least one memory 302, and computer program instructions stored in the storage area 302 shown, when When the computer program instructions are executed by the processor 301, the methods described in the foregoing embodiments are implemented.

[0188] Specifically, the processor 301 may include a central processing unit (CPU), or an application specific integrated circuit (Application Specific Integrated Circuit, ASIC), or may be configured to implement one or more integrated circuits in the embodiments of the present invention.

[0189] Memory 302 may include mass storage for data or instructions. By way of example and not limitation, memory 302 may include a hard disk drive (Hard Disk Drive, HDD), a floppy disk drive, a flash memory, an optical disk, a magneto-optical dis...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com