Credit risk-based credit decision-making method for small, medium and micro enterprises

A decision-making method and enterprise technology, applied in the field of credit risk management, which can solve the problems of easy mistakes, low decision-making efficiency, and the inability of small and micro enterprises to modify or reset in time with changes in the market environment.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0057] The specific embodiments of the present invention will be further described in detail by describing the embodiments below with reference to the accompanying drawings, so as to help those skilled in the art have a more complete, accurate and in-depth understanding of the inventive concepts and technical solutions of the present invention.

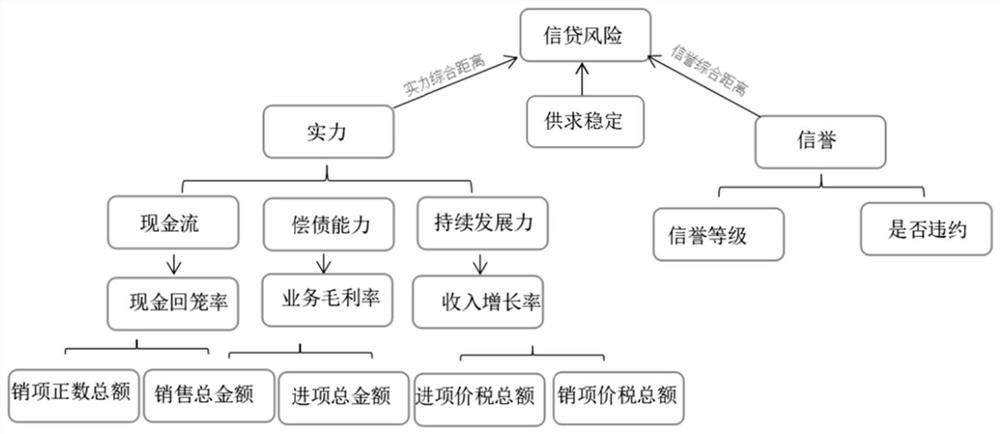

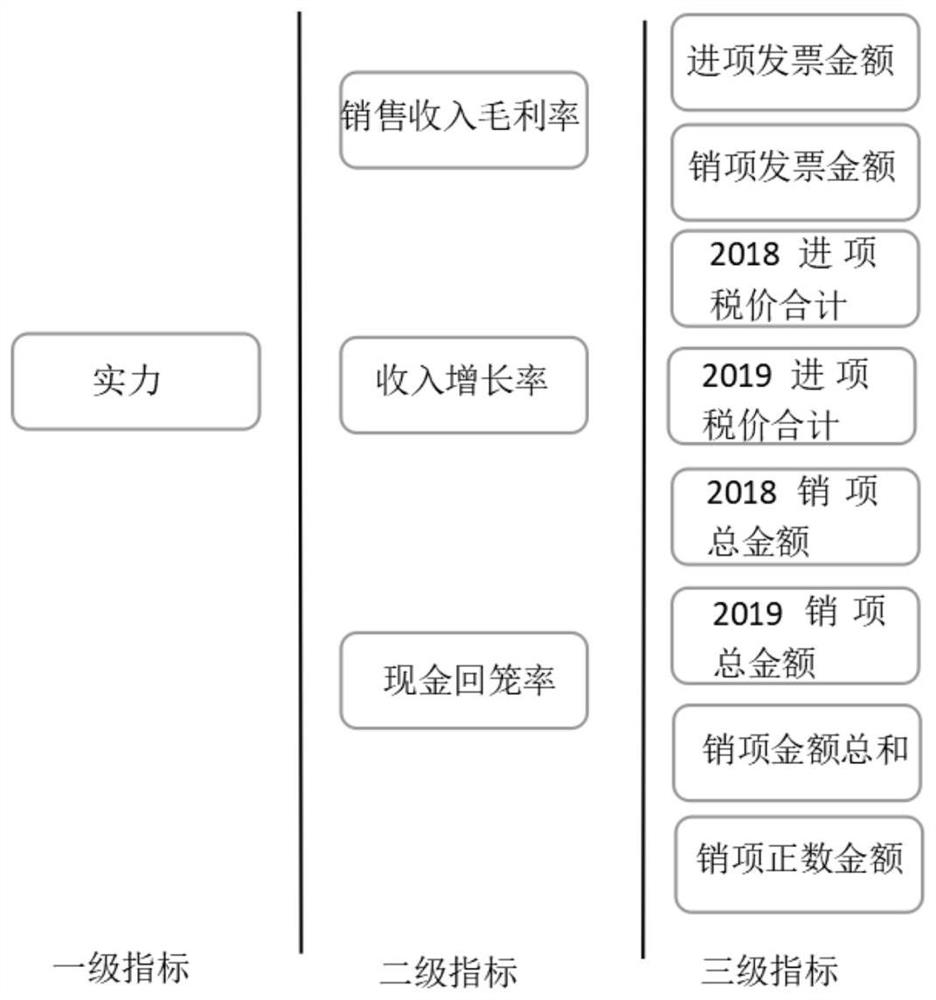

[0058] Such as Figure 1-4 As shown, the present invention provides a credit decision-making method for small, medium and micro enterprises based on credit risk, including the following steps: Carry out quantitative scoring to the strength of the enterprise: calculate the gross profit rate and capital of the main business of the enterprise for a period of time according to the collected data; The return rate and the growth rate of income are three factors that affect the strength of the enterprise. The weights of the above factors are analyzed and calculated through the analytic hierarchy process of pairwise comparison, and finally the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com