A credit assessment method for tax-paying enterprises based on generalized maximum flow

A credit evaluation, maximum flow technology, applied in data processing applications, digital data information retrieval, special data processing applications, etc., can solve the problem of not considering the interaction between affiliated enterprises and the transmission path selection and impact attenuation, without considering the interaction of affiliated enterprises. relationship issues

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0076] In order to illustrate the technical solution of the present invention more clearly, the following describes in detail the method of reflecting the credit status of taxpayers by establishing a social relationship model between the taxpayer itself and the taxpayer in conjunction with the accompanying drawings and specific embodiments.

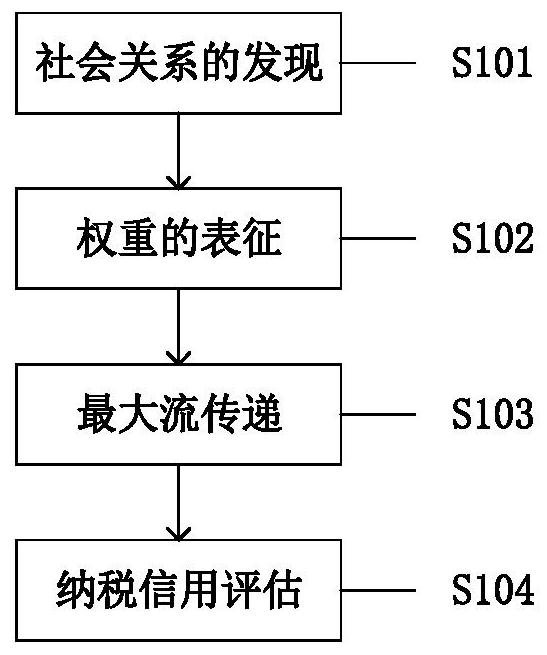

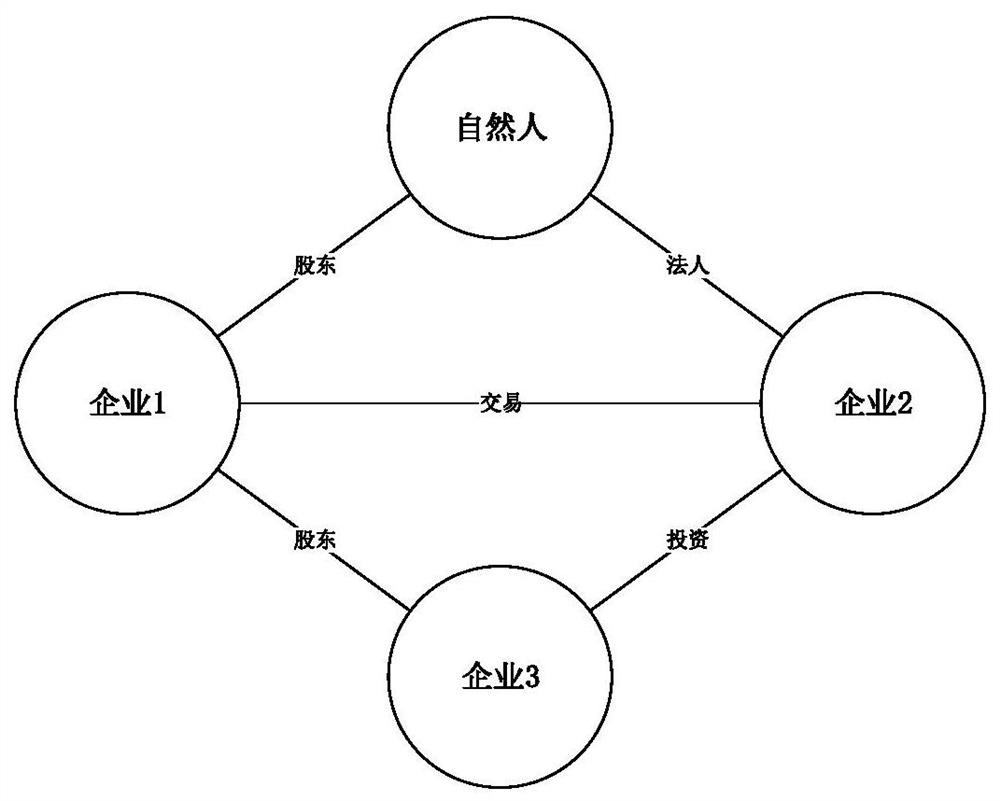

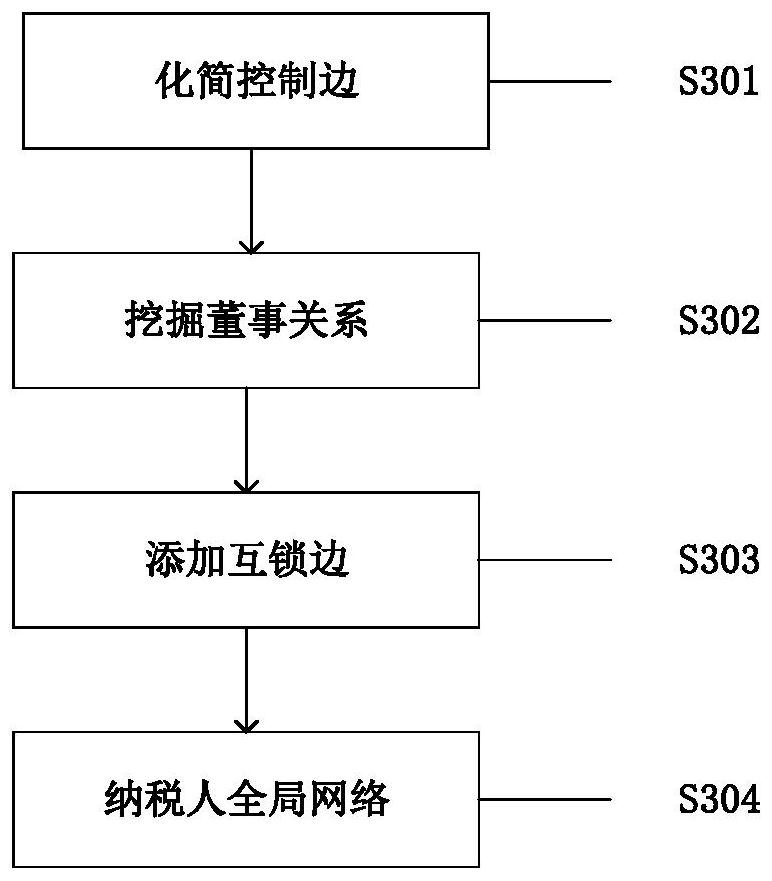

[0077] Such as figure 1 As shown, the present invention provides a taxpayer enterprise credit evaluation method based on generalized maximum flow. Firstly, the taxpayer’s explicit historical tax-related information and taxpayer social relationship are network represented, and at the same time, the constructed network is used to mine the taxpayer’s relationship. Implicit social relations, improving the modeling of interactive relations among affiliated enterprises, constructing a taxpayer global network (Taxpayer Global Network, TGN) through the discovery of explicit social relations among taxpaying enterprises and mining of implicit social...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com