A credit evaluation method for loan users based on fuzzy logistic regression

A logistic regression and credit evaluation technology, applied in data processing applications, finance, instruments, etc., can solve the problem that logistic regression cannot quantitatively use credit evaluation results for qualitative credit indicators, and achieve the effect of accurate judgment standards

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

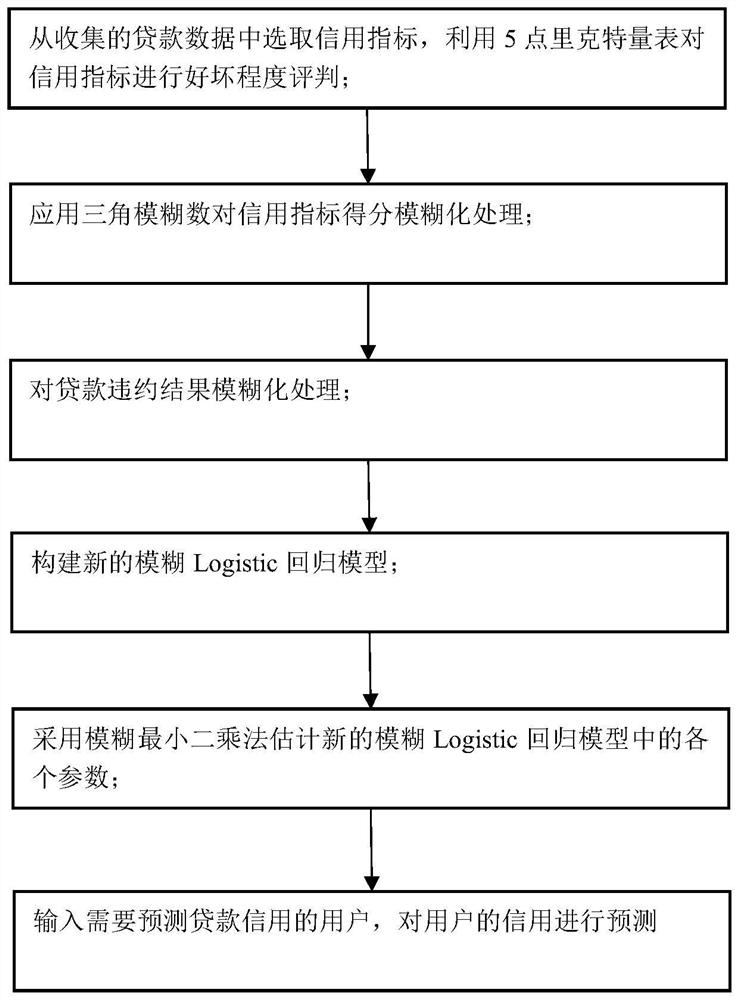

Method used

Image

Examples

Embodiment 1

[0060] Step 1: According to the collected loan user data, here only 12 indicators that affect user credit are extracted and evaluated as a reference. The names of each indicator are shown in Table 1:

[0061] Table 1 User Index Table

[0062]

[0063]

[0064] Evaluate each indicator using a 5-point Likert scale for selected credit indicators The specific score is: use a set of statements to express the quality of each indicator. Each set of statements has {"very poor", "poor", "moderate", "good", "very good"}, respectively Denoted as {1,2,3,4,5};

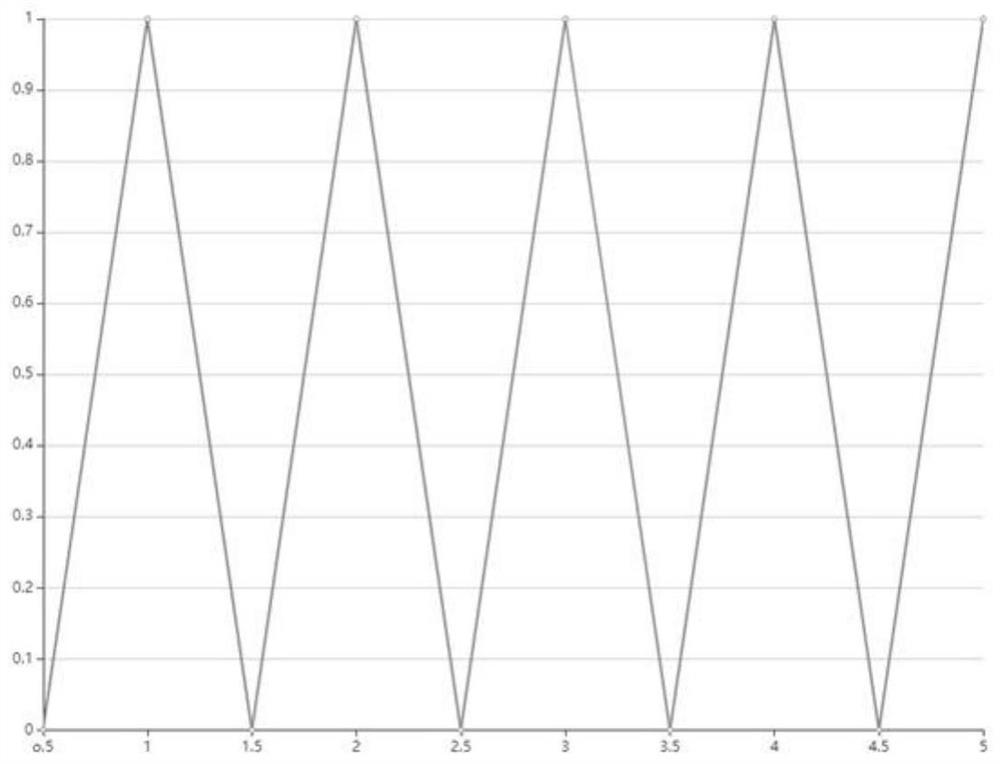

[0065] Step 2: Let the fuzzy number on the universe R be M, if the membership function of M is u M Make R→[0,1], expressed as the following formula:

[0066]

[0067] where, u M (x) is the triangular fuzzy function; where M is represented as (s, m, u), s and u represent the fuzzy infimum and supremum, respectively; m is the median value of the membership degree of M is 1, when When x=m, x completely belongs to M; the...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com