A method of automatically generating a transaction policy over a time series

A time-series, automatic generation technology, applied in the field of financial technology, can solve a large number of labor costs and other problems, achieve the effect of reducing workload and improving research efficiency

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

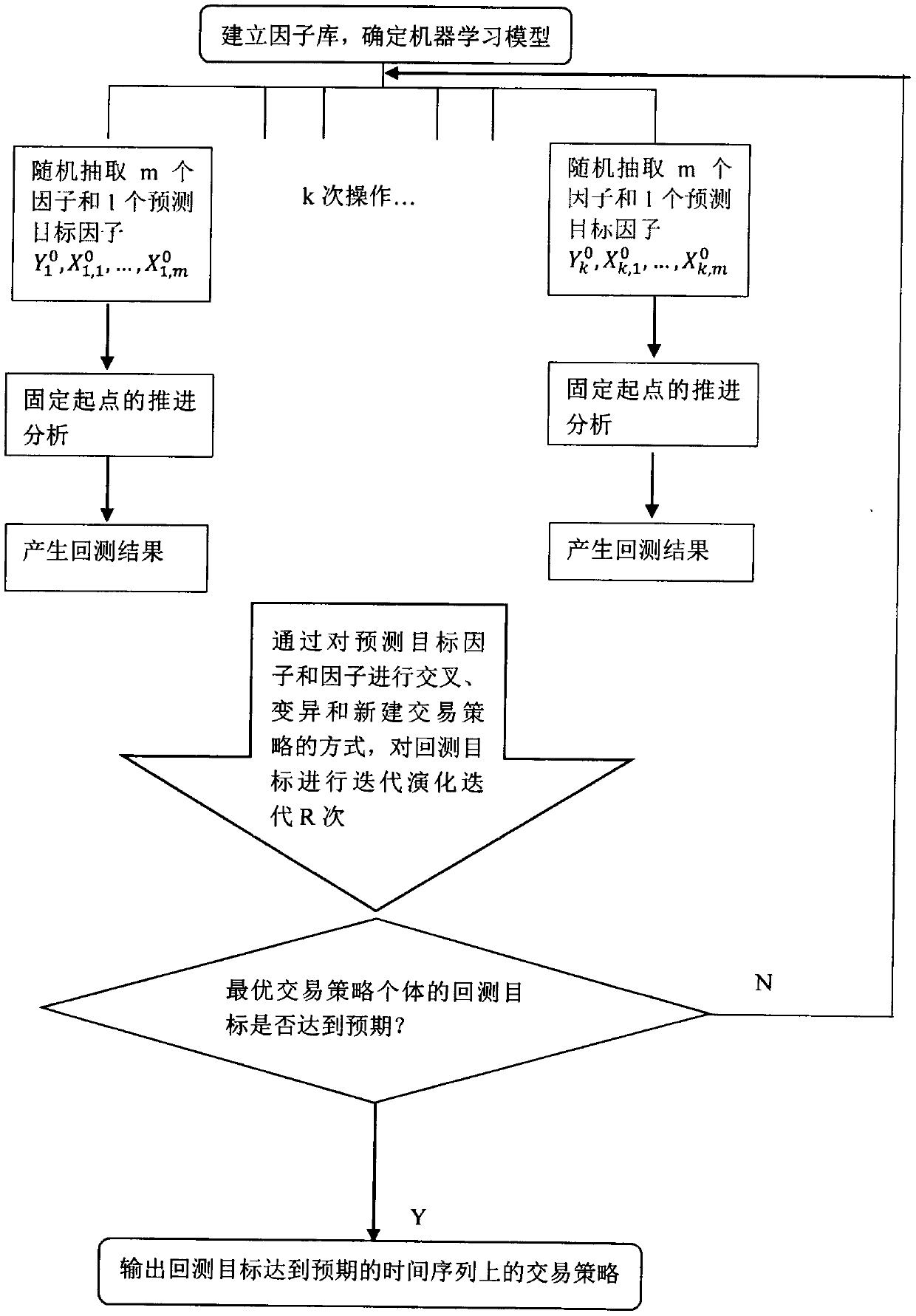

[0045] Such as figure 1 , this embodiment provides a mechanism for automatically generating a time series-based trading strategy based on machine learning:

[0046] (1) Establish a factor library and determine the use of a neural network model.

[0047] (2) Given that the target is the one-hour line of the Shanghai Composite Index, first randomly select 5 factors X from the factor library 1,1, , X 1,2 , X 1,3 , X 1,4 , X 1,5, which are MA (real, time period), head and shoulders pattern (open, high, low, close), MA (real, time period), price change rate (close), ATR (high, low, close, time period). After the factor is instantiated, it is MA (close, timeperiod=5), head and shoulders pattern (open, high, low, close), MA (open, timeperiod=10), price change rate (close), ATR (high, low, close, timeperiod=8); Randomly select a prediction target factor Y 1 is SharpeRatio(close, timeperiod). After instantiation, it is SharpeRatio(close, timeperiod=4).

[0048] MA factor: real...

Embodiment 2

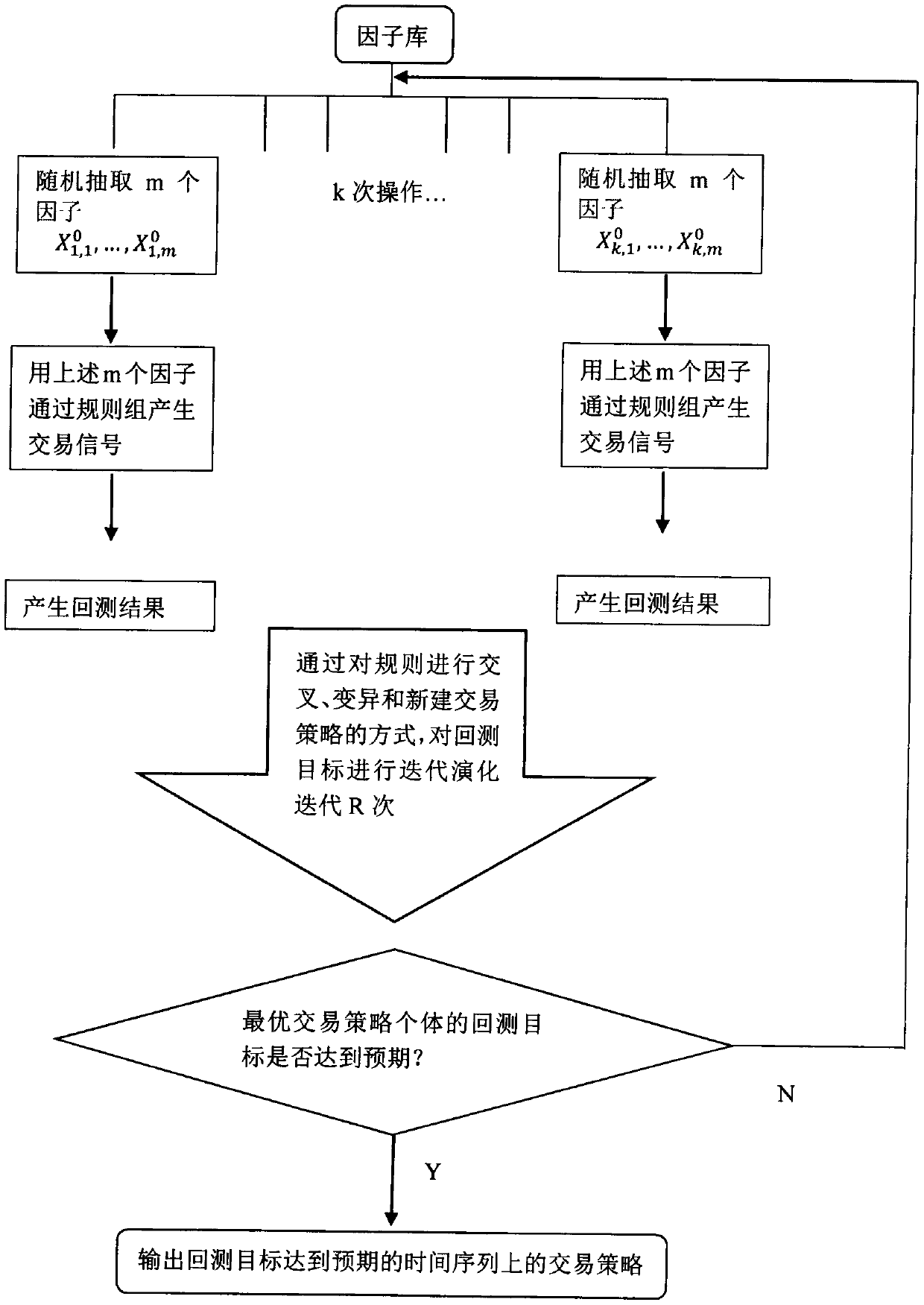

[0077] Such as image 3 , this embodiment provides a mechanism for automatically generating a rule-based trading strategy on time series:

[0078] (1) Establish factor library.

[0079] (2) Given the one-hour line of the Shanghai Composite Index, first randomly select 5 factors X from the factor library 1,1, , X 1,2 , X 1,3 , X 1,4 , X 1,5 , which are MA (real, time period), head and shoulders pattern (open, high, low, close), MA (real, time period), price change rate (close), ATR (high, low, close, time period). After the factor is instantiated, it is MA (close, timeperiod=5), head and shoulders pattern (open, high, low, close), MA (open, timeperiod=10), price change rate (close), ATR (high, low, close, timeperiod=8).

[0080] MA factor: real is an unspecified vector, which can randomly take values such as open, high, low, close, volume, amount, etc. timeperiod is an unspecified scalar of int type, so an int value is taken randomly. The output value of the MA facto...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com