Method and system for issuing multi-tax rate value added tax invoice for tax included sales

A technology of sales order and value-added tax, which is applied in the field of electronic invoices to achieve the effect of strengthening and regulating the management of value-added tax invoices, promoting the issuance of invoices, and improving the efficiency of issuance.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0022] Specific embodiments of the present invention will be described in detail below in conjunction with the accompanying drawings. It should be understood that the specific embodiments described here are only used to illustrate and explain the present invention, and are not intended to limit the present invention.

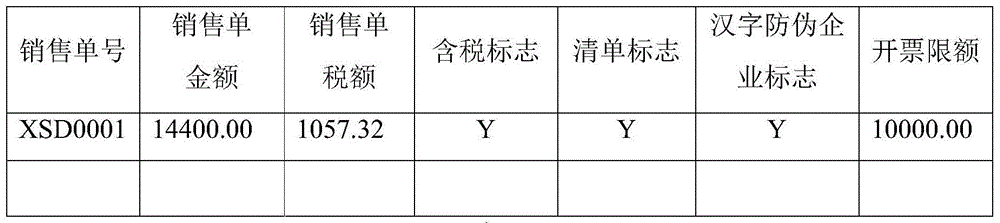

[0023] Multiple tax rates refer to the fact that there can be multiple tax rates in the product details on a value-added tax invoice; the tax-included sales slip is a type of sales slip of an enterprise. According to the needs of financial management, the enterprise has already entered the tax rate in the sales slip before the invoice is issued. The tax amount for this sales order is calculated. The characteristic of this kind of sales slip data is that the tax rate is not identified in the sales slip master data, but the tax amount is marked; in the sales slip detailed data, both tax rates and tax amount are marked.

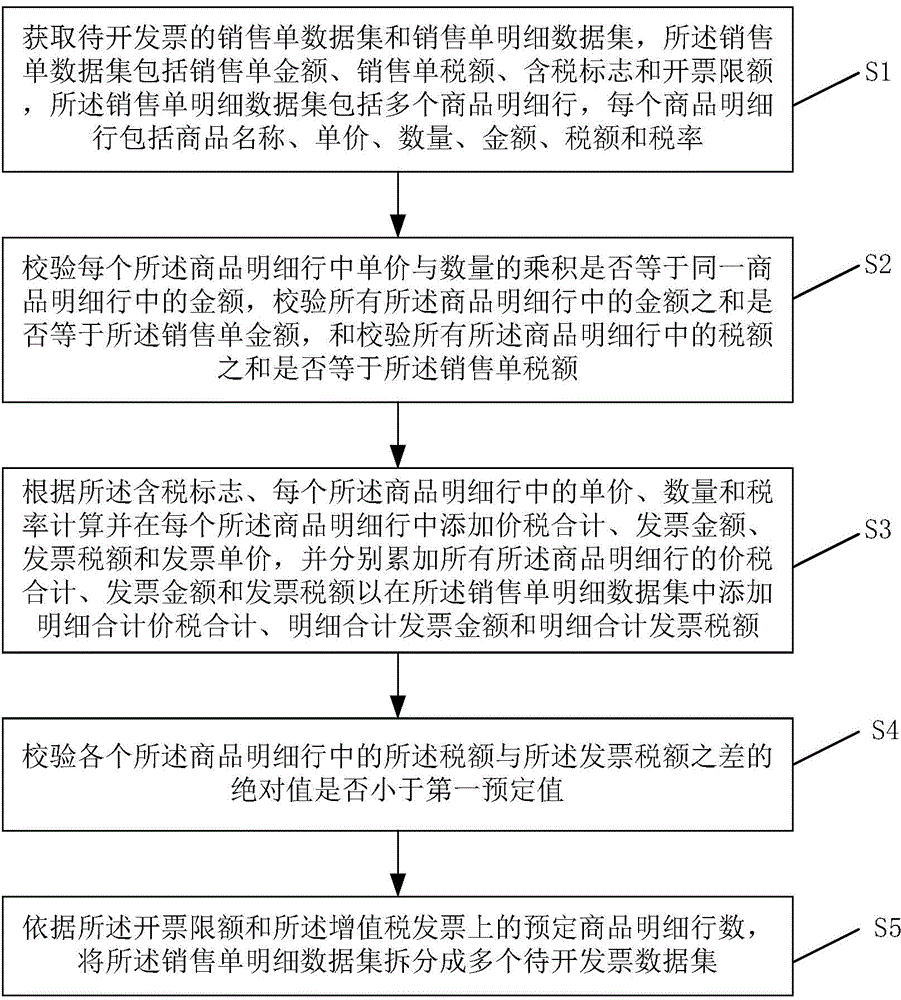

[0024] Such as figure 1 As shown, accordi...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com