Method of monitoring enterprise false deduction invoice through commodity composition and system thereof

A commodity and invoice technology, which is applied in the fields of instruments, finance, and data processing applications, can solve problems such as false sales, violations of laws and regulations, and inconsistent deductions, and achieve the effect of standardizing normal production and operation and avoiding illegal and irregular operations

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0030] The above and other technical features and advantages of the present invention will be described in more detail below in conjunction with the accompanying drawings.

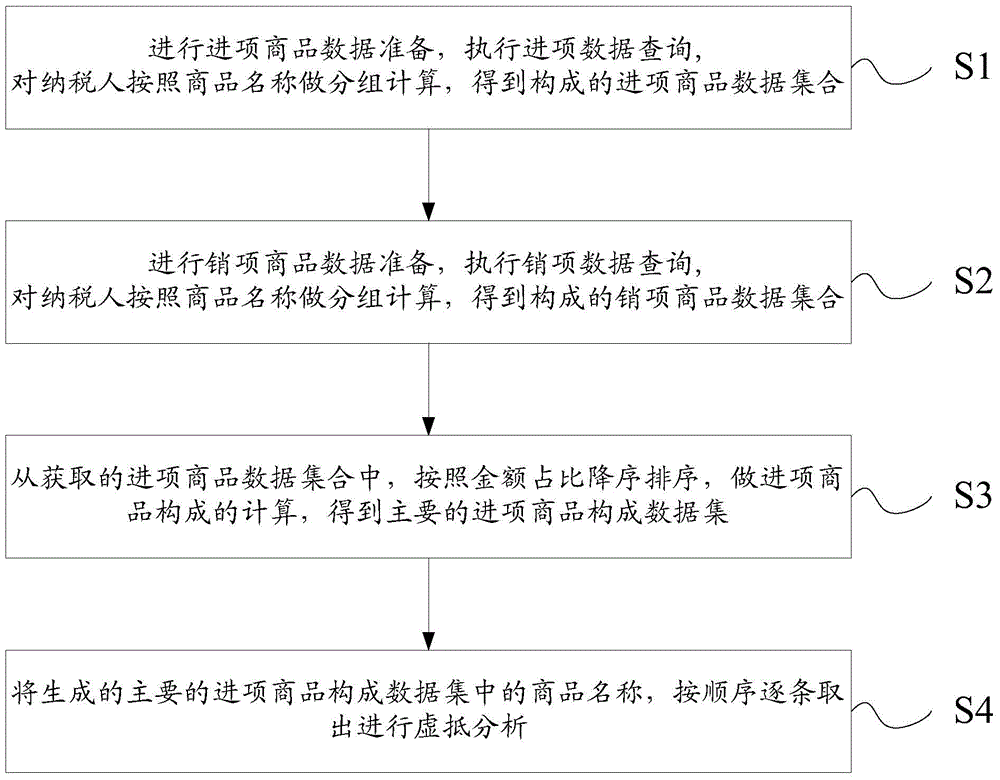

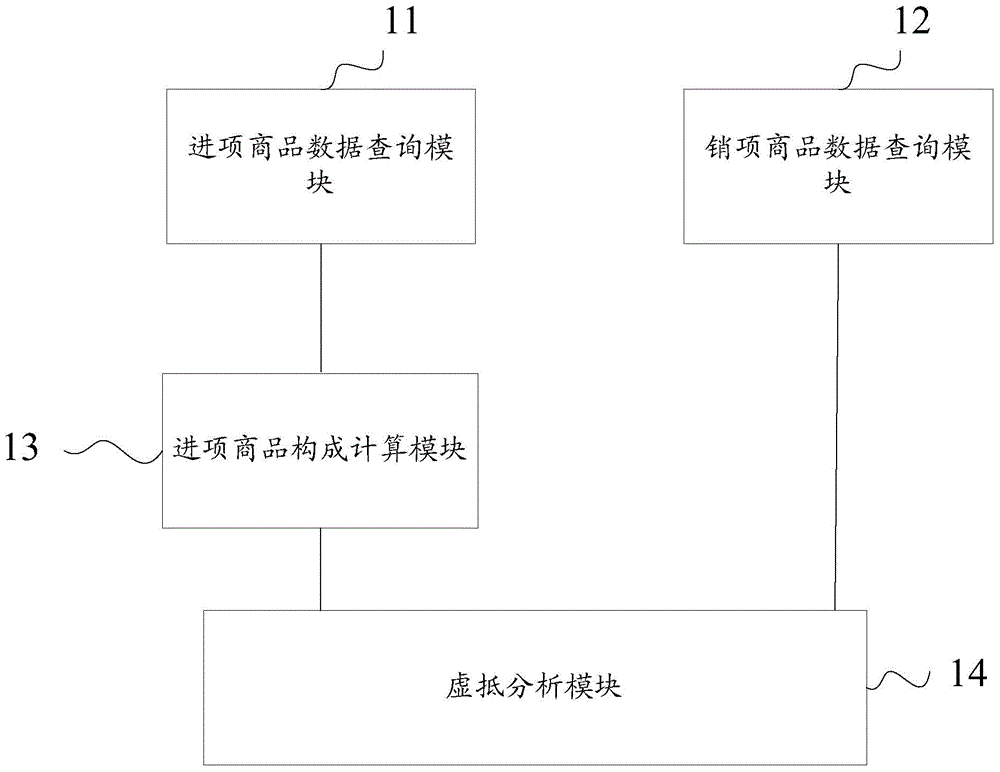

[0031] Such as figure 1 As shown, it is a method for monitoring false invoices of enterprises through commodity composition provided by the embodiment of the present invention. A method of monitoring false invoices of enterprises through commodity composition of the present invention includes the following steps:

[0032] Step S1: Prepare input commodity data, perform input data query, and group and calculate taxpayers according to commodity names to obtain a set of input commodity data.

[0033] In the above step S1, in the process of executing input data query, the taxpayer is grouped and calculated by product name in the input invoice detail data according to the query conditions "period scope" and "taxpayer identification number", The output result is an input product data set consisting of product na...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com