Real-time anonymous P2P borrowing method

A real-name, loan technology, applied in the field of Internet finance, can solve problems such as increasing bad debt risk, P2P platform running away, risk, etc., to reduce business risks, expand coverage, and protect privacy.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0024] The specific implementation modes provided by the present invention will be described in detail below in conjunction with the accompanying drawings and specific embodiments.

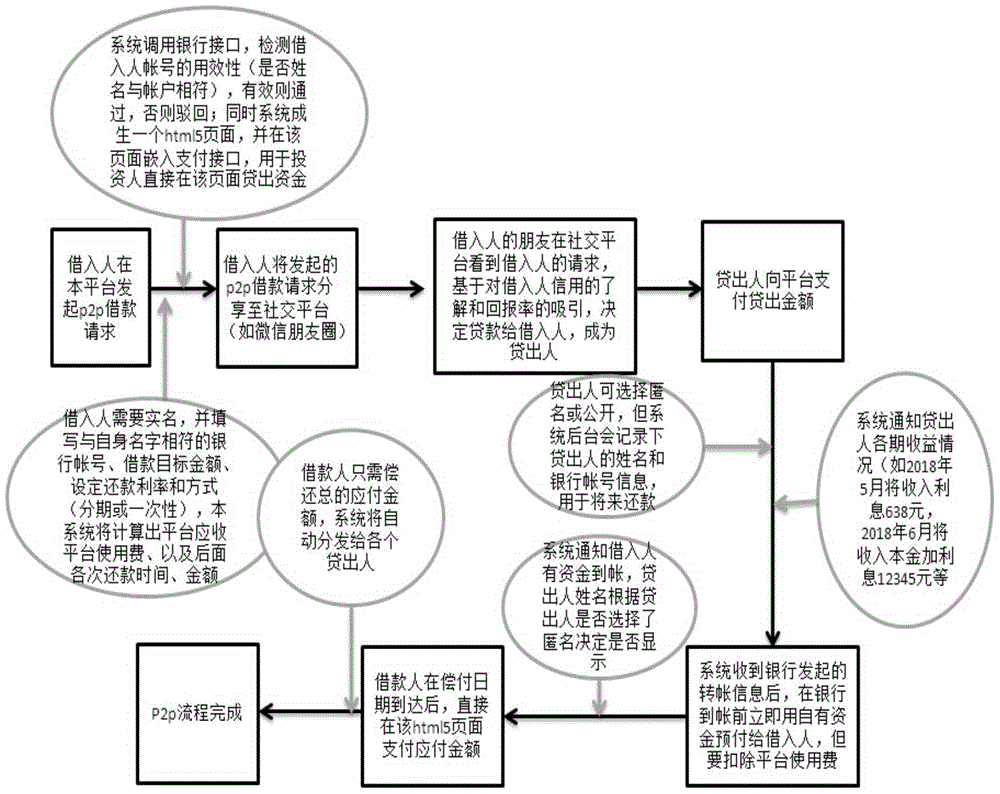

[0025] as attached figure 1 as shown,

[0026] A real-time anonymous P2P lending method, comprising the following steps:

[0027] a. The borrower initiates a P2P loan request on the lending platform, publishes and shares the loan request to the social platform, attracts lenders, and initiates a loan. When the borrower initiates a loan, he needs to fill in the bank account number that matches his own name, the minimum target amount of the loan, the upper limit of the loan and the deadline, and set the repayment rate and method. At the same time, the platform calculates the receivable platform usage fee, and the following The repayment time and amount are displayed to the user, and then the validity of the borrower's account is checked by calling the bank interface. If it is valid, it is passed, o...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com