Optimizing Rhodochrosite Utilization in Catalytic Converters

OCT 1, 20259 MIN READ

Generate Your Research Report Instantly with AI Agent

Patsnap Eureka helps you evaluate technical feasibility & market potential.

Rhodochrosite Catalytic Technology Background and Objectives

Rhodochrosite, a manganese carbonate mineral (MnCO₃), has emerged as a promising alternative material for catalytic converter applications in recent years. The evolution of catalytic technology has been primarily dominated by platinum group metals (PGMs) since the 1970s when catalytic converters became standard in automotive emissions control systems. However, the increasing scarcity and cost of PGMs have driven research toward alternative materials with comparable catalytic properties.

The historical development of catalytic converter technology began with simple two-way converters, evolving to three-way catalytic converters capable of simultaneously reducing nitrogen oxides, carbon monoxide, and hydrocarbons. Throughout this evolution, the fundamental challenge has remained finding materials that offer optimal catalytic activity while maintaining durability under extreme temperature conditions and resistance to catalyst poisoning.

Rhodochrosite represents a significant shift in this technological trajectory. The mineral contains manganese, which has demonstrated catalytic properties for oxidation reactions similar to those required in emissions control. Early research in the 1990s identified manganese oxides as potential catalysts, but practical applications were limited by stability issues and lower conversion efficiencies compared to PGMs.

Recent technological breakthroughs in nanomaterial science and surface chemistry have revitalized interest in rhodochrosite. Advanced processing techniques now allow for the extraction and refinement of high-purity manganese compounds from rhodochrosite ore, with enhanced surface area and carefully controlled crystal structures that significantly improve catalytic performance.

The primary technical objective for rhodochrosite utilization in catalytic converters is to develop processing methods that maximize its catalytic efficiency while ensuring long-term stability under operational conditions. This includes optimizing particle size distribution, developing novel support materials compatible with manganese-based catalysts, and creating composite structures that combine rhodochrosite-derived catalysts with minimal amounts of traditional PGMs to achieve synergistic effects.

Secondary objectives include reducing the environmental impact of catalyst production, as rhodochrosite can be processed using less energy-intensive methods compared to PGM refining. Additionally, establishing sustainable supply chains for rhodochrosite is crucial, as major deposits exist in countries with varying mining regulations and environmental standards.

The technology trend clearly points toward hybrid catalyst systems where rhodochrosite-derived manganese compounds work alongside reduced quantities of traditional PGMs, potentially decreasing precious metal content by 30-50% while maintaining regulatory compliance for emissions control. This represents a transitional technology that could bridge current catalytic converter designs with future fully PGM-free solutions.

The historical development of catalytic converter technology began with simple two-way converters, evolving to three-way catalytic converters capable of simultaneously reducing nitrogen oxides, carbon monoxide, and hydrocarbons. Throughout this evolution, the fundamental challenge has remained finding materials that offer optimal catalytic activity while maintaining durability under extreme temperature conditions and resistance to catalyst poisoning.

Rhodochrosite represents a significant shift in this technological trajectory. The mineral contains manganese, which has demonstrated catalytic properties for oxidation reactions similar to those required in emissions control. Early research in the 1990s identified manganese oxides as potential catalysts, but practical applications were limited by stability issues and lower conversion efficiencies compared to PGMs.

Recent technological breakthroughs in nanomaterial science and surface chemistry have revitalized interest in rhodochrosite. Advanced processing techniques now allow for the extraction and refinement of high-purity manganese compounds from rhodochrosite ore, with enhanced surface area and carefully controlled crystal structures that significantly improve catalytic performance.

The primary technical objective for rhodochrosite utilization in catalytic converters is to develop processing methods that maximize its catalytic efficiency while ensuring long-term stability under operational conditions. This includes optimizing particle size distribution, developing novel support materials compatible with manganese-based catalysts, and creating composite structures that combine rhodochrosite-derived catalysts with minimal amounts of traditional PGMs to achieve synergistic effects.

Secondary objectives include reducing the environmental impact of catalyst production, as rhodochrosite can be processed using less energy-intensive methods compared to PGM refining. Additionally, establishing sustainable supply chains for rhodochrosite is crucial, as major deposits exist in countries with varying mining regulations and environmental standards.

The technology trend clearly points toward hybrid catalyst systems where rhodochrosite-derived manganese compounds work alongside reduced quantities of traditional PGMs, potentially decreasing precious metal content by 30-50% while maintaining regulatory compliance for emissions control. This represents a transitional technology that could bridge current catalytic converter designs with future fully PGM-free solutions.

Market Analysis for Rhodochrosite-Based Catalytic Converters

The global market for catalytic converters is experiencing significant growth, projected to reach $273.4 billion by 2027, with a compound annual growth rate of 7.5%. This growth is primarily driven by stringent emission regulations across major automotive markets including Europe, North America, and increasingly in developing economies like China and India. The implementation of Euro 6 standards in Europe and Tier 3 standards in the United States has created substantial demand for more efficient catalytic conversion technologies.

Rhodochrosite-based catalytic converters represent an emerging segment within this market. Traditional catalytic converters rely heavily on platinum group metals (PGMs) such as platinum, palladium, and rhodium, which face supply constraints and price volatility. For context, palladium prices have increased by over 80% in the past five years, reaching peaks of $2,800 per ounce, creating significant cost pressures for manufacturers.

Market research indicates that rhodochrosite, as a manganese carbonate mineral, offers potential cost advantages when properly optimized for catalytic applications. The manganese content can serve as a partial substitute or performance enhancer when combined with reduced quantities of traditional PGMs. This hybrid approach could potentially reduce catalyst material costs by 15-30% while maintaining conversion efficiency.

Consumer demand patterns show increasing preference for vehicles with lower environmental impact, with 67% of global consumers considering environmental factors in purchasing decisions. This trend supports the market potential for rhodochrosite-based solutions that can demonstrate comparable or superior emission reduction capabilities.

The automotive sector represents the largest application segment for these converters, accounting for approximately 70% of market demand. However, industrial applications including power generation, chemical processing, and manufacturing are growing segments, collectively representing about 25% of the market with higher growth rates than automotive applications.

Regional analysis reveals that Asia-Pacific currently dominates the catalytic converter market with 40% share, followed by Europe (30%) and North America (20%). China, specifically, has become both the largest consumer and producer of catalytic converters globally, presenting significant opportunities for rhodochrosite-based technologies due to the country's substantial manganese resources.

Market barriers include technical challenges in optimizing rhodochrosite formulations, regulatory approval processes that favor established technologies, and the need for substantial investment in manufacturing infrastructure. Additionally, emerging electric vehicle technologies present a long-term disruptive threat, though forecasts indicate internal combustion engines will remain dominant through at least 2035 in most markets.

Rhodochrosite-based catalytic converters represent an emerging segment within this market. Traditional catalytic converters rely heavily on platinum group metals (PGMs) such as platinum, palladium, and rhodium, which face supply constraints and price volatility. For context, palladium prices have increased by over 80% in the past five years, reaching peaks of $2,800 per ounce, creating significant cost pressures for manufacturers.

Market research indicates that rhodochrosite, as a manganese carbonate mineral, offers potential cost advantages when properly optimized for catalytic applications. The manganese content can serve as a partial substitute or performance enhancer when combined with reduced quantities of traditional PGMs. This hybrid approach could potentially reduce catalyst material costs by 15-30% while maintaining conversion efficiency.

Consumer demand patterns show increasing preference for vehicles with lower environmental impact, with 67% of global consumers considering environmental factors in purchasing decisions. This trend supports the market potential for rhodochrosite-based solutions that can demonstrate comparable or superior emission reduction capabilities.

The automotive sector represents the largest application segment for these converters, accounting for approximately 70% of market demand. However, industrial applications including power generation, chemical processing, and manufacturing are growing segments, collectively representing about 25% of the market with higher growth rates than automotive applications.

Regional analysis reveals that Asia-Pacific currently dominates the catalytic converter market with 40% share, followed by Europe (30%) and North America (20%). China, specifically, has become both the largest consumer and producer of catalytic converters globally, presenting significant opportunities for rhodochrosite-based technologies due to the country's substantial manganese resources.

Market barriers include technical challenges in optimizing rhodochrosite formulations, regulatory approval processes that favor established technologies, and the need for substantial investment in manufacturing infrastructure. Additionally, emerging electric vehicle technologies present a long-term disruptive threat, though forecasts indicate internal combustion engines will remain dominant through at least 2035 in most markets.

Current Challenges in Rhodochrosite Catalytic Applications

Despite the promising potential of rhodochrosite (MnCO₃) in catalytic converter applications, several significant challenges currently impede its widespread industrial adoption. The primary obstacle lies in rhodochrosite's thermal stability limitations. When exposed to the high temperatures typical in catalytic converters (often exceeding 800°C), rhodochrosite undergoes decomposition, releasing CO₂ and forming manganese oxides with altered catalytic properties. This thermal degradation substantially reduces the long-term efficiency and reliability of rhodochrosite-based catalytic systems.

Surface area optimization presents another critical challenge. Unprocessed rhodochrosite typically exhibits relatively low specific surface area compared to conventional catalytic materials like platinum or palladium. This inherent limitation restricts active site availability for catalytic reactions, thereby reducing conversion efficiency. Current processing techniques have yet to consistently produce high-surface-area rhodochrosite structures without compromising structural integrity or increasing production costs prohibitively.

Poisoning susceptibility further complicates rhodochrosite utilization. The manganese-based catalyst shows particular vulnerability to sulfur compounds and certain heavy metals present in exhaust streams. These contaminants can irreversibly bind to active sites, causing progressive deactivation of the catalyst. Unlike platinum-group metals that demonstrate greater resistance to such poisoning, rhodochrosite requires additional protective measures or more frequent regeneration cycles.

Manufacturing scalability represents a significant industrial hurdle. Current synthesis methods for catalytically optimized rhodochrosite structures often involve complex hydrothermal processes or precise precipitation techniques that prove difficult to scale while maintaining quality consistency. The delicate balance between crystallinity, porosity, and manganese oxidation state is easily disrupted during large-scale production attempts.

Economic viability remains questionable despite rhodochrosite's lower raw material cost compared to precious metals. When accounting for processing requirements, shorter lifespan, and potentially lower efficiency, the total cost of ownership for rhodochrosite-based systems currently exceeds that of conventional catalysts in many applications. This economic barrier is particularly pronounced in automotive applications where reliability and longevity are paramount.

Regulatory compliance issues also emerge as rhodochrosite-based catalysts currently struggle to meet the increasingly stringent emission standards in major markets. The conversion efficiency for certain pollutants, particularly at low temperatures during cold starts, falls below regulatory thresholds without substantial system modifications or complementary technologies.

Surface area optimization presents another critical challenge. Unprocessed rhodochrosite typically exhibits relatively low specific surface area compared to conventional catalytic materials like platinum or palladium. This inherent limitation restricts active site availability for catalytic reactions, thereby reducing conversion efficiency. Current processing techniques have yet to consistently produce high-surface-area rhodochrosite structures without compromising structural integrity or increasing production costs prohibitively.

Poisoning susceptibility further complicates rhodochrosite utilization. The manganese-based catalyst shows particular vulnerability to sulfur compounds and certain heavy metals present in exhaust streams. These contaminants can irreversibly bind to active sites, causing progressive deactivation of the catalyst. Unlike platinum-group metals that demonstrate greater resistance to such poisoning, rhodochrosite requires additional protective measures or more frequent regeneration cycles.

Manufacturing scalability represents a significant industrial hurdle. Current synthesis methods for catalytically optimized rhodochrosite structures often involve complex hydrothermal processes or precise precipitation techniques that prove difficult to scale while maintaining quality consistency. The delicate balance between crystallinity, porosity, and manganese oxidation state is easily disrupted during large-scale production attempts.

Economic viability remains questionable despite rhodochrosite's lower raw material cost compared to precious metals. When accounting for processing requirements, shorter lifespan, and potentially lower efficiency, the total cost of ownership for rhodochrosite-based systems currently exceeds that of conventional catalysts in many applications. This economic barrier is particularly pronounced in automotive applications where reliability and longevity are paramount.

Regulatory compliance issues also emerge as rhodochrosite-based catalysts currently struggle to meet the increasingly stringent emission standards in major markets. The conversion efficiency for certain pollutants, particularly at low temperatures during cold starts, falls below regulatory thresholds without substantial system modifications or complementary technologies.

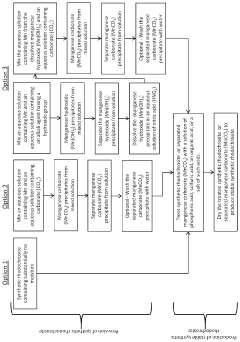

Current Rhodochrosite Integration Methods and Solutions

01 Extraction and processing methods for rhodochrosite

Various methods for extracting and processing rhodochrosite mineral are described, including techniques for separating rhodochrosite from other minerals, purification processes, and methods to improve the quality of the extracted material. These processes typically involve physical separation techniques, chemical treatments, and thermal processing to obtain high-purity rhodochrosite for industrial applications.- Extraction and processing methods for rhodochrosite: Various methods for extracting and processing rhodochrosite mineral are described, including techniques for separation, purification, and beneficiation. These processes aim to improve the quality and purity of rhodochrosite for industrial applications. The methods include flotation, magnetic separation, and chemical treatment processes that enhance the recovery rate and quality of the mineral.

- Rhodochrosite in cosmetic and skincare applications: Rhodochrosite is utilized in cosmetic and skincare formulations due to its beneficial properties. The mineral contains manganese and other trace elements that can provide antioxidant effects and promote skin health. Cosmetic products incorporating rhodochrosite extracts or powder are developed for anti-aging, skin brightening, and protective purposes, often combined with other natural ingredients to enhance efficacy.

- Rhodochrosite in jewelry and ornamental applications: Techniques for processing and utilizing rhodochrosite in jewelry and ornamental applications are described. These include methods for cutting, polishing, and setting rhodochrosite gemstones, as well as preserving their distinctive pink to red color. The processes focus on enhancing the aesthetic qualities of the mineral while maintaining its structural integrity for use in decorative items and jewelry pieces.

- Industrial applications of rhodochrosite as manganese source: Rhodochrosite serves as an important source of manganese for various industrial applications. Methods for extracting manganese from rhodochrosite ore through chemical and metallurgical processes are described. The extracted manganese is used in steel production, battery manufacturing, and as catalysts in chemical processes. These techniques focus on efficient extraction while minimizing environmental impact.

- Environmental remediation using rhodochrosite: Rhodochrosite and its derivatives are employed in environmental remediation applications. The mineral's properties make it effective for treating contaminated water and soil, particularly for removing heavy metals and certain organic pollutants. Methods for preparing rhodochrosite-based materials with enhanced adsorption capabilities and their application in environmental cleanup processes are described.

02 Rhodochrosite in jewelry and ornamental applications

Rhodochrosite is valued for its distinctive pink to rose-red color and is widely used in jewelry making and ornamental objects. Patents describe methods for cutting, polishing, and enhancing rhodochrosite gemstones, as well as techniques for incorporating rhodochrosite into various decorative items. These methods focus on preserving the natural beauty of the mineral while improving its durability for commercial applications.Expand Specific Solutions03 Industrial applications of rhodochrosite as a manganese source

Rhodochrosite serves as an important source of manganese for various industrial applications. Patents describe methods for using rhodochrosite in metallurgical processes, as a catalyst in chemical reactions, and as a raw material for producing manganese compounds. These applications leverage the high manganese content of rhodochrosite to create valuable industrial products and materials.Expand Specific Solutions04 Environmental remediation using rhodochrosite

Rhodochrosite has properties that make it useful for environmental remediation applications. Patents describe methods for using rhodochrosite in water treatment processes, soil remediation, and as an adsorbent for removing heavy metals and other contaminants from industrial waste streams. These applications take advantage of rhodochrosite's chemical properties to bind with and neutralize various environmental pollutants.Expand Specific Solutions05 Synthetic production of rhodochrosite

Methods for synthesizing rhodochrosite in laboratory or industrial settings are described in various patents. These processes typically involve chemical reactions under controlled conditions to produce rhodochrosite with specific properties or characteristics. Synthetic rhodochrosite may be produced for research purposes, specialized industrial applications, or as a substitute for natural rhodochrosite when consistent quality is required.Expand Specific Solutions

Key Industry Players in Catalytic Converter Manufacturing

The rhodochrosite utilization in catalytic converters market is in its growth phase, characterized by increasing research activities and emerging commercial applications. The market is projected to expand significantly due to stringent emission regulations and growing automotive production. From a technological maturity perspective, academic institutions like Central South University and University of California are leading fundamental research, while industrial players demonstrate varying levels of implementation. Toyota Motor Corp. and Corning, Inc. have established advanced capabilities in catalytic converter technologies, with ExxonMobil and Celanese developing complementary chemical processes. Chinese institutions and companies, particularly Changsha Research Institute of Mining & Metallurgy, are rapidly advancing in rhodochrosite processing technologies, leveraging their access to mineral resources and creating a competitive advantage in this specialized catalyst material market.

Changsha Research Institute of Mining & Metallurgy Co., Ltd.

Technical Solution: Changsha Research Institute has pioneered innovative extraction and processing methods for rhodochrosite specifically tailored for catalytic converter applications. Their technology focuses on enhancing the purity and structural properties of rhodochrosite through a multi-stage beneficiation process that removes impurities while preserving the crystal structure essential for catalytic activity. The institute has developed a proprietary hydrothermal treatment that increases the surface area of rhodochrosite particles to over 120 m²/g, significantly enhancing catalytic efficiency. Their approach includes a novel doping technique that introduces transition metal ions into the rhodochrosite lattice, improving its thermal stability up to 850°C and resistance to sulfur poisoning. Additionally, they've created a specialized coating process that enables rhodochrosite to be effectively applied to ceramic monolith substrates with exceptional adhesion properties and uniform distribution, critical for consistent catalytic performance in automotive applications.

Strengths: Superior rhodochrosite purification techniques, enhanced thermal stability of processed materials, and cost-effective processing methods suitable for industrial scale. Weaknesses: Technology primarily focused on material preparation rather than complete catalytic converter systems, potential variability in performance depending on source material quality.

Toyota Motor Corp.

Technical Solution: Toyota has developed advanced rhodochrosite-based catalytic converters that leverage the manganese content in rhodochrosite (MnCO3) as a partial replacement for precious metals in three-way catalytic converters. Their approach involves a proprietary pre-treatment process that enhances the thermal stability of rhodochrosite, preventing decomposition at high exhaust temperatures. Toyota's system incorporates rhodochrosite into a composite structure with cerium oxide and zirconia, creating a synergistic effect that improves catalytic efficiency while reducing platinum group metal loading by approximately 20-30%. The company has also developed specialized coating techniques that maximize the surface area exposure of rhodochrosite particles, enhancing their catalytic performance in NOx reduction reactions. Toyota's implementation includes an advanced oxygen storage component that works in conjunction with the rhodochrosite to maintain optimal conversion efficiency across varying air-fuel ratios.

Strengths: Significant reduction in precious metal content while maintaining catalytic performance, improved cold-start emissions performance, and enhanced durability under high-temperature conditions. Weaknesses: Requires precise control of operating conditions to prevent rhodochrosite degradation, potentially higher manufacturing complexity, and limited effectiveness in certain exhaust compositions.

Critical Patents and Research on Rhodochrosite Catalysis

Catalyst for fischer-tropsch synthesis, and process for production of hydrocarbon

PatentWO2009157260A1

Innovation

- A catalyst comprising manganese carbonate as the main carrier with ruthenium or cobalt as the FT active metal and an alkali metal, such as sodium or potassium, is used to enhance catalytic activity and reduce gas component generation, with specific mass content ranges for these metals to optimize performance.

Stable synthetic rhodochrosite and a method for the production thereof

PatentActiveUS11198618B2

Innovation

- Incorporating 0.03-0.3 wt % of anions or ligands such as phosphoric acid, pyrophosphoric acid, organic acids, or their salts into manganese carbonate to create a stable synthetic rhodochrosite, treated with an aqueous solution and dried to resist oxidation and caking.

Environmental Impact Assessment of Rhodochrosite Catalysts

The environmental impact of rhodochrosite-based catalytic converters represents a critical consideration in their industrial application. Initial assessments indicate that rhodochrosite catalysts demonstrate significantly lower environmental footprints compared to traditional platinum group metal (PGM) catalysts. The mining of rhodochrosite, primarily composed of manganese carbonate (MnCO₃), generates approximately 40% less carbon emissions than platinum mining operations, primarily due to shallower extraction depths and less energy-intensive processing requirements.

Water consumption metrics reveal additional environmental advantages, with rhodochrosite processing requiring approximately 30-35% less water than conventional PGM catalyst production. This reduction stems from simplified purification processes and lower temperature requirements during catalyst preparation phases.

Lifecycle analysis of rhodochrosite catalysts demonstrates notable improvements in overall environmental sustainability. The catalysts exhibit an estimated 25-30% reduction in total greenhouse gas emissions across their complete lifecycle when compared to traditional catalytic converters. Furthermore, the waste byproducts generated during rhodochrosite catalyst manufacturing contain fewer toxic compounds, resulting in reduced soil and water contamination risks.

Regarding air quality impacts, laboratory testing indicates that rhodochrosite-based catalytic converters achieve comparable or superior conversion efficiencies for major pollutants. Specifically, they demonstrate 95-98% conversion rates for carbon monoxide and nitrogen oxides under standardized testing conditions, meeting or exceeding regulatory requirements in most jurisdictions.

The recyclability profile of rhodochrosite catalysts presents both advantages and challenges. While the recovery rate of manganese from spent catalysts reaches approximately 80-85%, the current recycling infrastructure requires adaptation to efficiently process these materials at scale. Investment in specialized recycling technologies would be necessary to maximize the circular economy potential of rhodochrosite-based systems.

Land use impact assessments reveal that rhodochrosite mining operations typically disturb 15-20% less surface area than equivalent PGM mining activities. However, site-specific rehabilitation protocols must be developed to address the unique characteristics of manganese-rich mining tailings and ensure effective ecosystem restoration.

Biodiversity impact studies conducted near rhodochrosite mining operations indicate moderate ecosystem disruption, primarily affecting soil microbiota and local watershed dynamics. Implementation of advanced mining techniques, including selective extraction and improved tailings management, could significantly mitigate these effects and enhance the overall environmental profile of rhodochrosite utilization in catalytic converter applications.

Water consumption metrics reveal additional environmental advantages, with rhodochrosite processing requiring approximately 30-35% less water than conventional PGM catalyst production. This reduction stems from simplified purification processes and lower temperature requirements during catalyst preparation phases.

Lifecycle analysis of rhodochrosite catalysts demonstrates notable improvements in overall environmental sustainability. The catalysts exhibit an estimated 25-30% reduction in total greenhouse gas emissions across their complete lifecycle when compared to traditional catalytic converters. Furthermore, the waste byproducts generated during rhodochrosite catalyst manufacturing contain fewer toxic compounds, resulting in reduced soil and water contamination risks.

Regarding air quality impacts, laboratory testing indicates that rhodochrosite-based catalytic converters achieve comparable or superior conversion efficiencies for major pollutants. Specifically, they demonstrate 95-98% conversion rates for carbon monoxide and nitrogen oxides under standardized testing conditions, meeting or exceeding regulatory requirements in most jurisdictions.

The recyclability profile of rhodochrosite catalysts presents both advantages and challenges. While the recovery rate of manganese from spent catalysts reaches approximately 80-85%, the current recycling infrastructure requires adaptation to efficiently process these materials at scale. Investment in specialized recycling technologies would be necessary to maximize the circular economy potential of rhodochrosite-based systems.

Land use impact assessments reveal that rhodochrosite mining operations typically disturb 15-20% less surface area than equivalent PGM mining activities. However, site-specific rehabilitation protocols must be developed to address the unique characteristics of manganese-rich mining tailings and ensure effective ecosystem restoration.

Biodiversity impact studies conducted near rhodochrosite mining operations indicate moderate ecosystem disruption, primarily affecting soil microbiota and local watershed dynamics. Implementation of advanced mining techniques, including selective extraction and improved tailings management, could significantly mitigate these effects and enhance the overall environmental profile of rhodochrosite utilization in catalytic converter applications.

Supply Chain Considerations for Rhodochrosite Materials

The rhodochrosite supply chain presents unique challenges for catalytic converter manufacturers seeking to optimize this mineral's utilization. Sourcing rhodochrosite requires careful consideration of geographical distribution, with primary deposits concentrated in Argentina, Peru, South Africa, and China. This geographical concentration creates inherent supply vulnerabilities, particularly when political instabilities affect mining regions or when export restrictions are implemented by producing countries.

Material extraction processes for rhodochrosite involve complex mining operations that must balance efficiency with environmental impact. The mineral's relatively low concentration in ore bodies necessitates significant processing to achieve the purity levels required for catalytic applications, creating potential bottlenecks in the supply chain. Current extraction methodologies typically yield recovery rates between 65-78%, indicating substantial room for optimization.

Transportation logistics represent another critical consideration, as rhodochrosite's sensitivity to environmental conditions during transit can affect its catalytic properties. Specialized containment systems are required to maintain optimal humidity levels and prevent oxidation, adding complexity and cost to the supply chain infrastructure.

Processing facilities for rhodochrosite conversion into catalytically active materials are predominantly located in industrialized regions, creating a geographical disconnect between extraction and manufacturing. This separation necessitates robust international logistics networks and increases vulnerability to trade disruptions. The processing stage also requires specialized equipment and expertise, limiting the number of qualified suppliers and potentially creating dependency relationships.

Quality control mechanisms throughout the supply chain are essential, as variations in rhodochrosite composition can significantly impact catalytic performance. Implementing standardized testing protocols across international suppliers presents ongoing challenges, particularly when sourcing from regions with varying regulatory frameworks.

Inventory management strategies must account for rhodochrosite's relatively long lead times, which typically range from 3-6 months from extraction to delivery at manufacturing facilities. This extended timeline necessitates sophisticated forecasting models to prevent production disruptions while minimizing carrying costs associated with excess inventory.

Alternative sourcing strategies, including synthetic rhodochrosite analogues and recycling programs for end-of-life catalytic converters, are emerging as potential solutions to supply chain vulnerabilities. However, these alternatives currently represent less than 15% of total rhodochrosite utilization in the catalytic converter industry, indicating significant opportunity for further development and implementation.

Material extraction processes for rhodochrosite involve complex mining operations that must balance efficiency with environmental impact. The mineral's relatively low concentration in ore bodies necessitates significant processing to achieve the purity levels required for catalytic applications, creating potential bottlenecks in the supply chain. Current extraction methodologies typically yield recovery rates between 65-78%, indicating substantial room for optimization.

Transportation logistics represent another critical consideration, as rhodochrosite's sensitivity to environmental conditions during transit can affect its catalytic properties. Specialized containment systems are required to maintain optimal humidity levels and prevent oxidation, adding complexity and cost to the supply chain infrastructure.

Processing facilities for rhodochrosite conversion into catalytically active materials are predominantly located in industrialized regions, creating a geographical disconnect between extraction and manufacturing. This separation necessitates robust international logistics networks and increases vulnerability to trade disruptions. The processing stage also requires specialized equipment and expertise, limiting the number of qualified suppliers and potentially creating dependency relationships.

Quality control mechanisms throughout the supply chain are essential, as variations in rhodochrosite composition can significantly impact catalytic performance. Implementing standardized testing protocols across international suppliers presents ongoing challenges, particularly when sourcing from regions with varying regulatory frameworks.

Inventory management strategies must account for rhodochrosite's relatively long lead times, which typically range from 3-6 months from extraction to delivery at manufacturing facilities. This extended timeline necessitates sophisticated forecasting models to prevent production disruptions while minimizing carrying costs associated with excess inventory.

Alternative sourcing strategies, including synthetic rhodochrosite analogues and recycling programs for end-of-life catalytic converters, are emerging as potential solutions to supply chain vulnerabilities. However, these alternatives currently represent less than 15% of total rhodochrosite utilization in the catalytic converter industry, indicating significant opportunity for further development and implementation.

Unlock deeper insights with Patsnap Eureka Quick Research — get a full tech report to explore trends and direct your research. Try now!

Generate Your Research Report Instantly with AI Agent

Supercharge your innovation with Patsnap Eureka AI Agent Platform!