Method and system for pricing financial derivatives

a technology of derivatives and pricing methods, applied in the field of financial instruments, can solve the problems of requiring substantial expertise and experience, affecting the accuracy of the and only losing the cost of the option itself, so as to achieve accurate bid-offer spread of the option

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

[0047]A preferred embodiment of the present invention is described in the context of a model for calculating the market value (market price) of a foreign exchange (FX) exotic option. It should be appreciated, however, that models in accordance with the invention may be applied to other financial markets, and the invention is not limited to foreign exchange options or exotic options. One skilled in the art may apply the present invention to other options, e.g., stock options, or other option-like financial instruments, e.g., options on futures, or commodities, or non-asset instruments, such as options on weather, etc., with variation as may be necessary to adapt for factors unique to a given financial instrument.

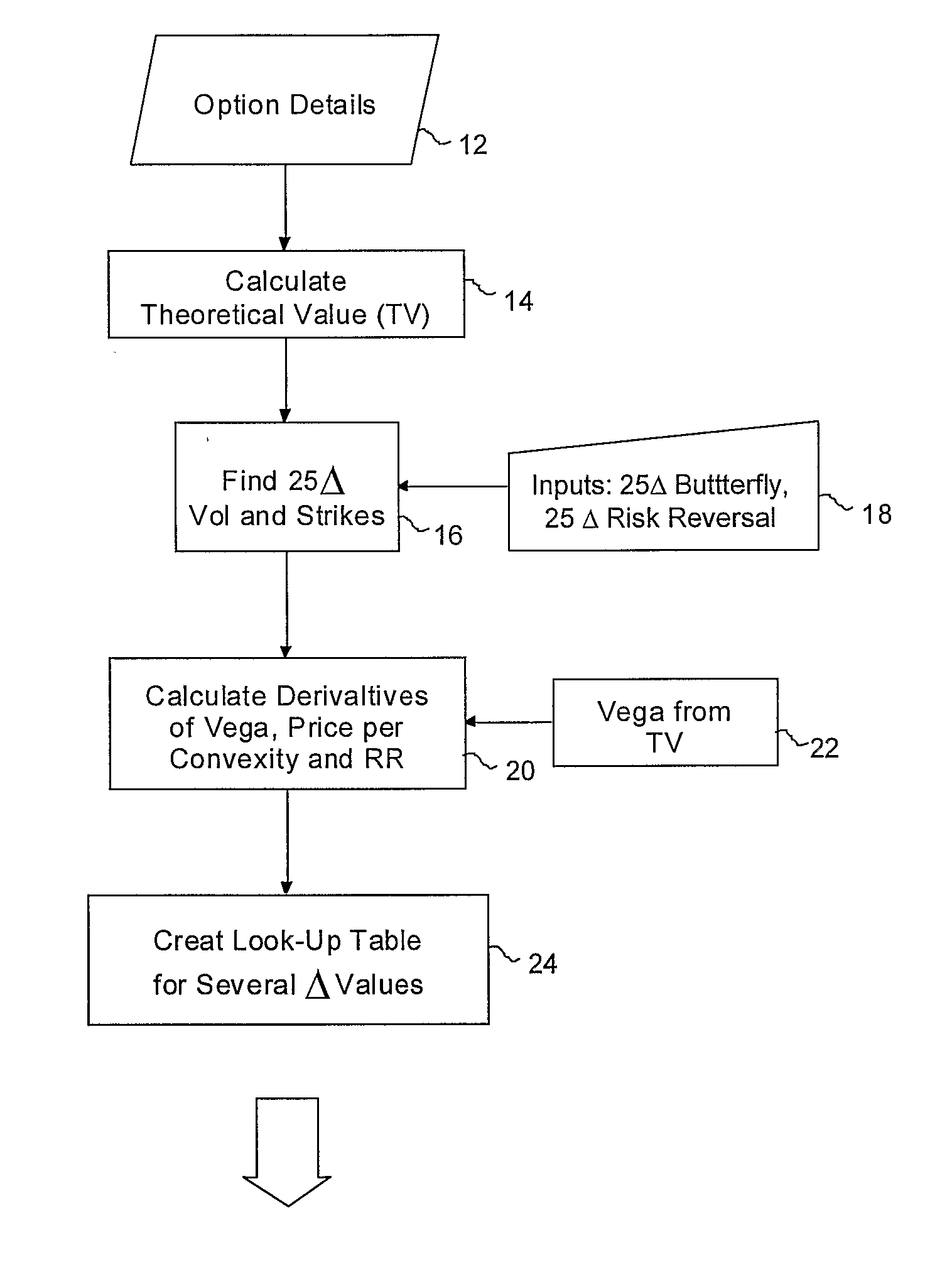

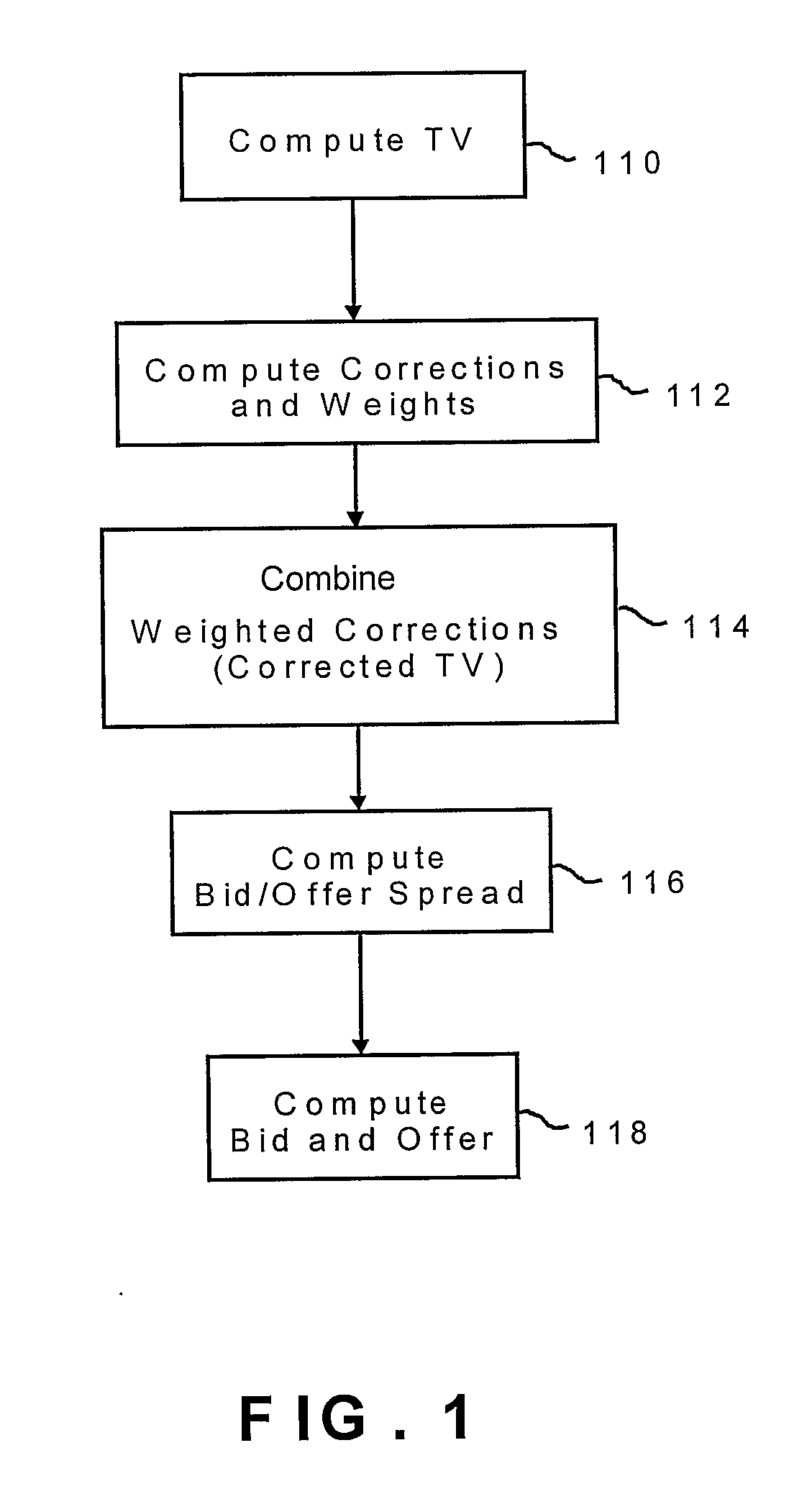

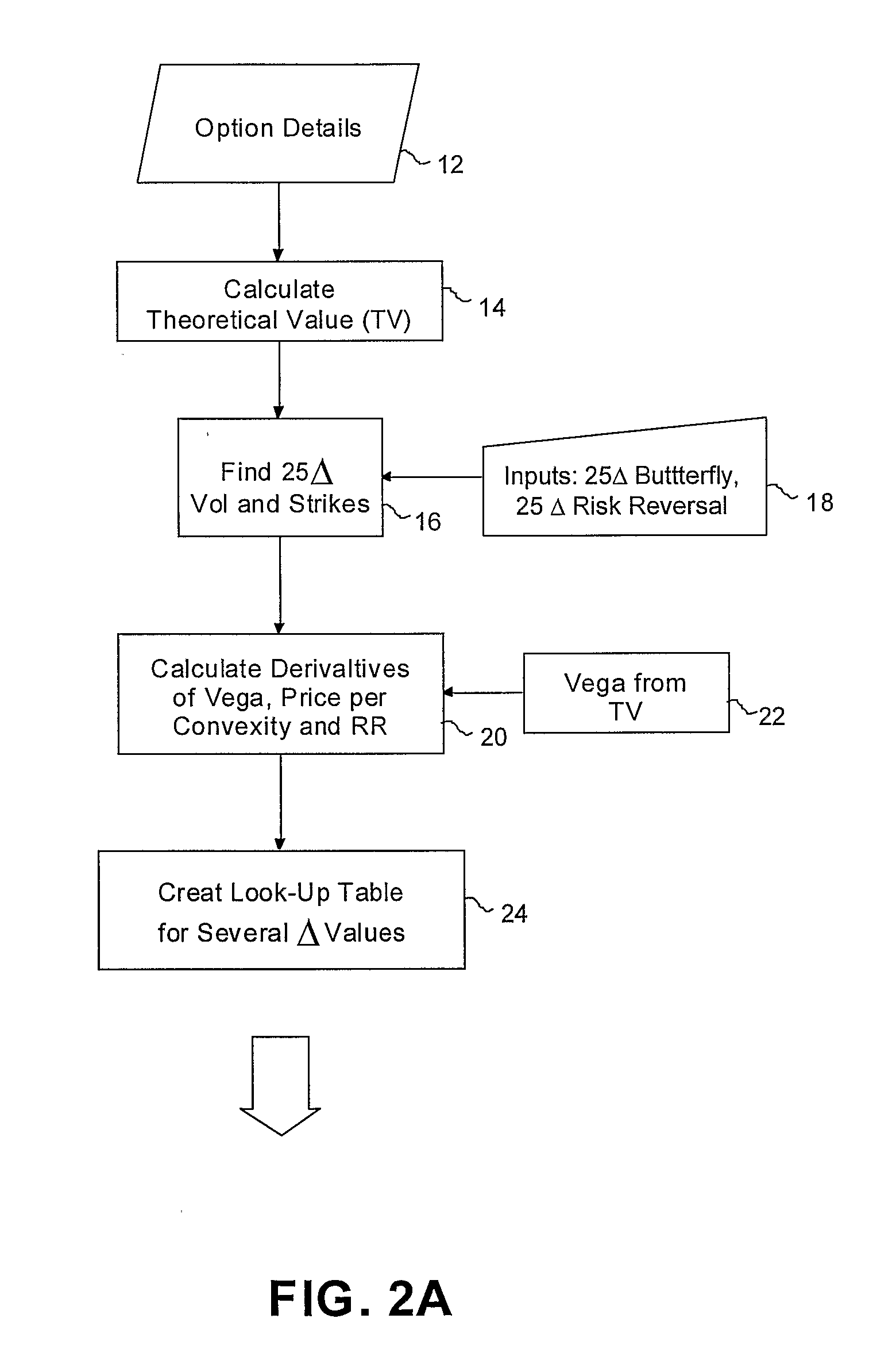

[0048]In the embodiment described herein below, bid / offer prices are computed from a corrected theoretical value (TV) of an option and the bid / offer spread for that option. Computations for the corrected TV and bid / offer spread apply derivatives (partial derivatives up to sec...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com