System and method for specified pool trading

a technology of specified pool and system, applied in the field of system and method for specified pool trading, can solve the problems of inability to truly customize the security of the buyer, the cost of specified pool trading is generally higher than tba trading, and the lack of liquidity to adequately meet the needs of a growing focus on this type of trading, so as to reduce risk and increase availability and liquidity.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Benefits of technology

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

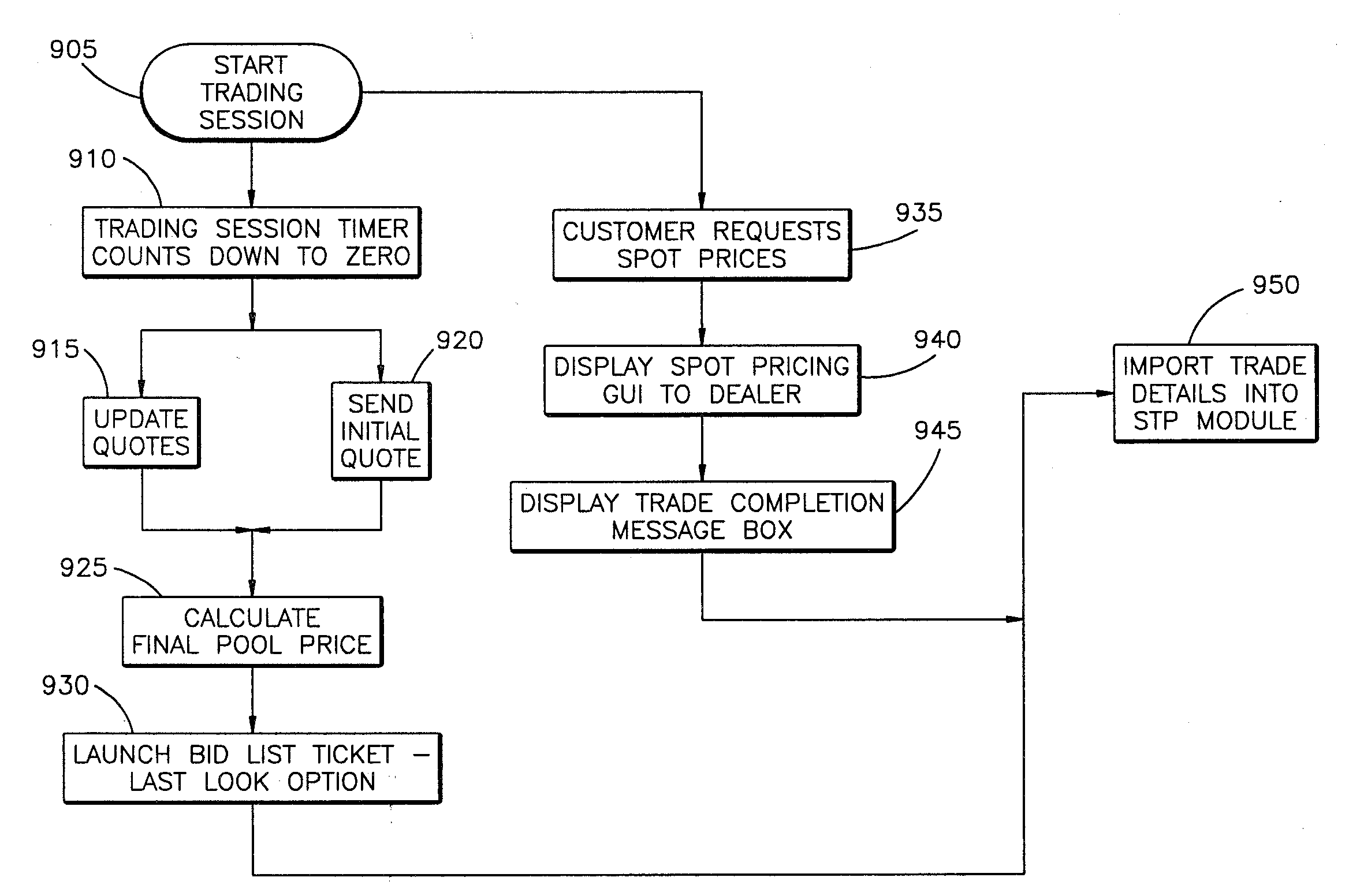

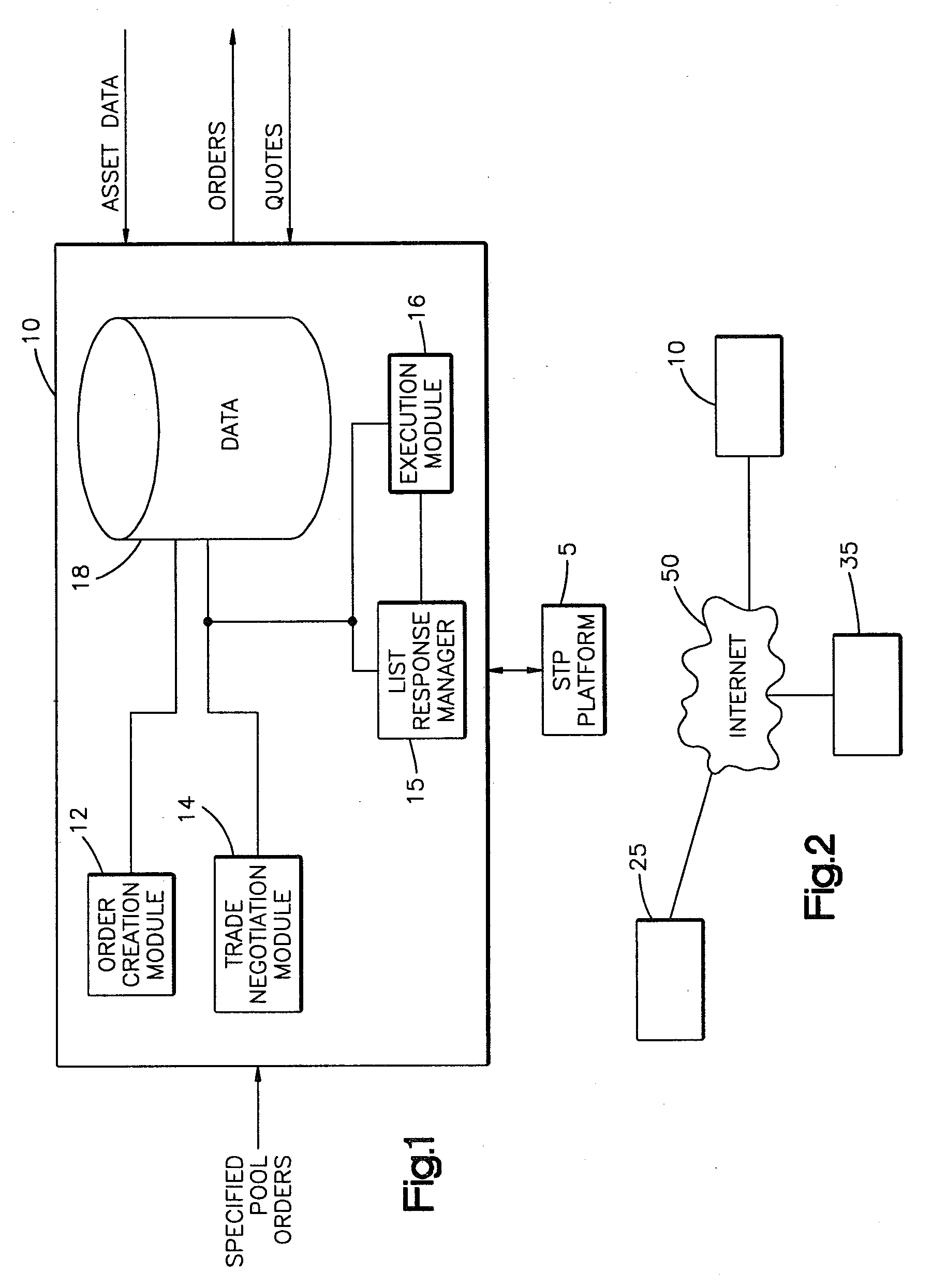

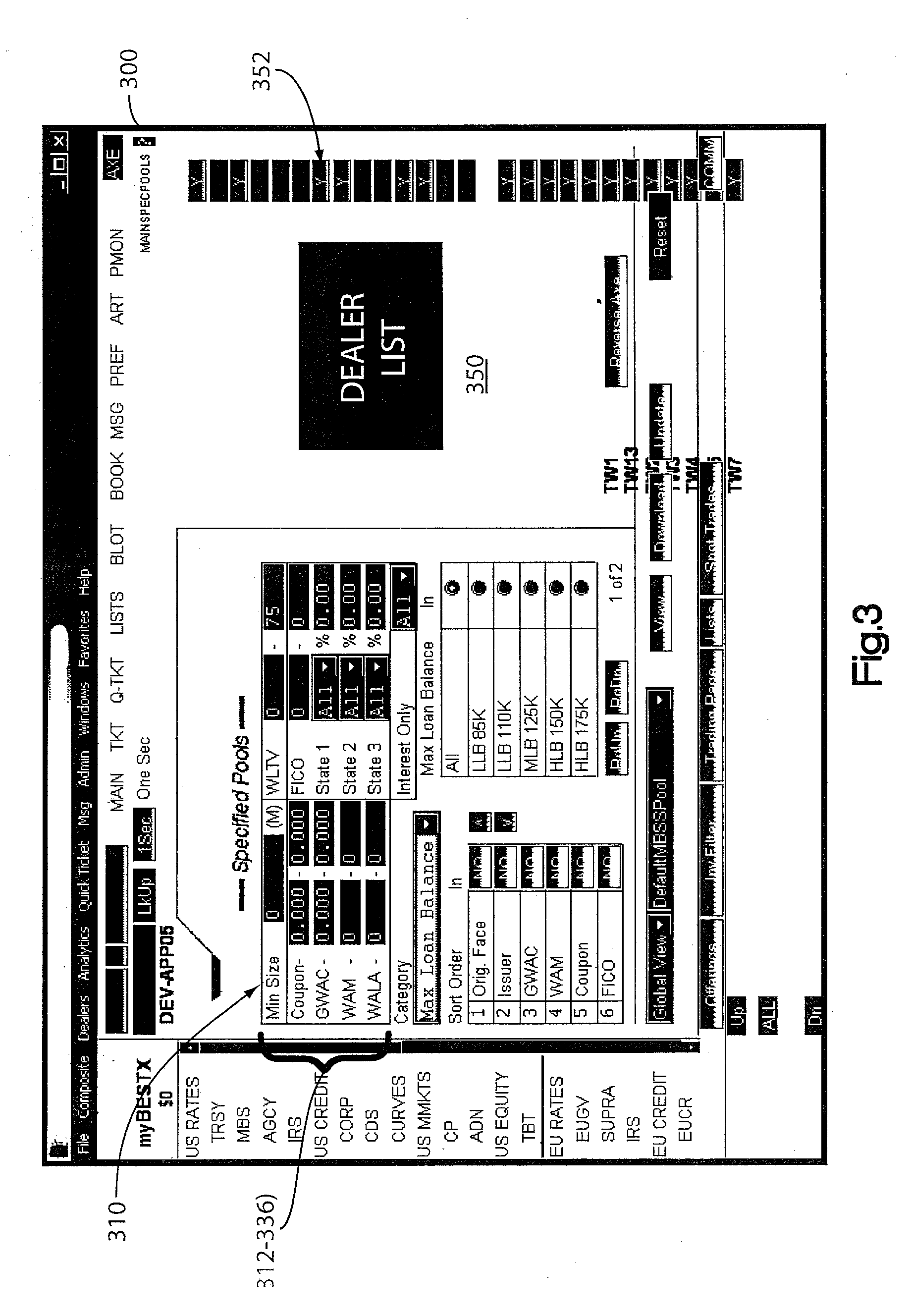

[0010]Embodiments of the present invention generally comprise a computer-implemented method for creating specified pools lists of asset-backed security pools, or alternatively creating characteristic sets for a customized specified pool to be created, and thereafter communicating, exchanging price quotations, and executing trades for specified pools of asset-backed securities using a system capable of communication with a buyer computer and a plurality of seller computers. Although certain examples provided herein describe the embodiments of the invention in the context of mortgages, persons skilled in the art will recognize that other assets may be utilized within the scope of the invention. One advantage, among others, of the present invention is that it reduces risk on the operational side of the trading, purchase or sale of asset-backed securities, and provides increased availability and liquidity in such products.

[0011]Generally speaking, as known to industry and market partici...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com