Customer post-loan management method, system and equipment based on voiceprint recognition technology and medium

A voiceprint recognition and customer technology, applied in the computer field, can solve the problems of misjudgment and operational risk, time-consuming, restricting the development of online credit, etc., and achieve the effect of prompting risks and avoiding operational risks

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

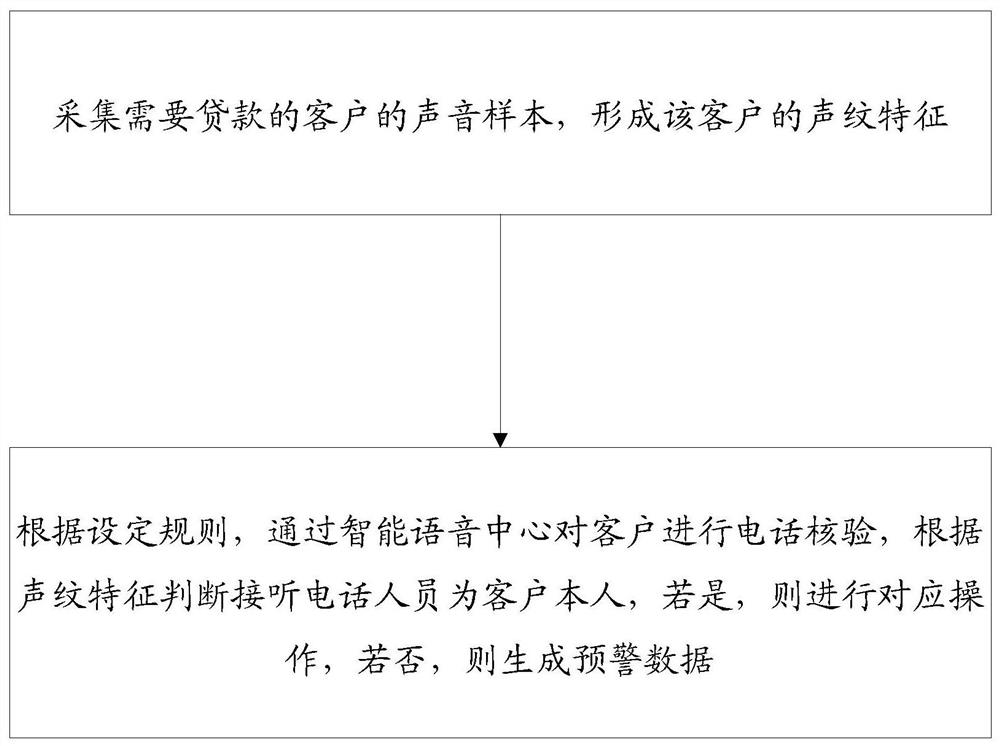

[0034] Such as figure 1 As shown, this embodiment provides a customer post-loan management method based on voiceprint recognition technology, including:

[0035] Step 1. Collect the voice sample of the customer who needs a loan to form the voiceprint feature of the customer;

[0036] Step 2. According to the pre-set verification ratio, randomly select the list of customers to be verified, and form an AI robot phone verification list according to the speech template. The intelligent voice interaction center will conduct phone verification on the customers in the list according to the speech content. The voiceprint feature confirms the consistency of the user and the accuracy of the data, and returns the result; if the voiceprint is inconsistent, the first warning message will be generated;

[0037] According to the set requirements, the target customer loan invitation script will be generated, and the intelligent voice interaction center will make a telephone invitation to the...

Embodiment 2

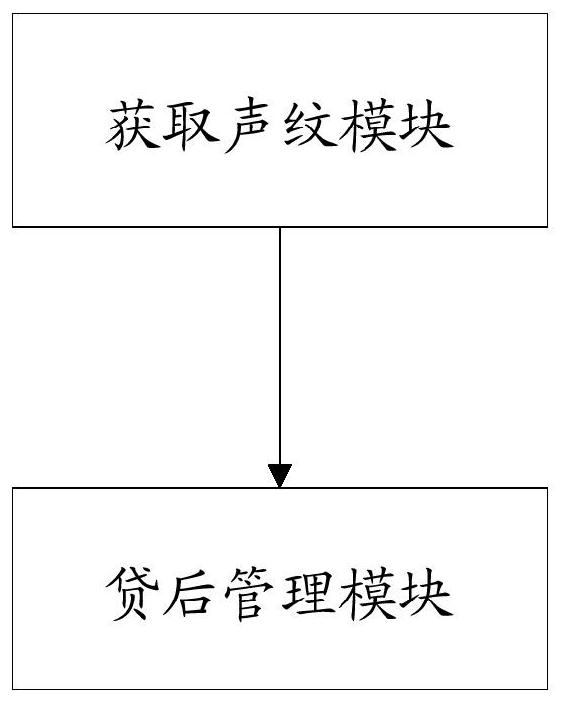

[0041] Such as figure 2 As shown, the second aspect is provided in this embodiment. The present invention provides a customer post-loan management system based on voiceprint recognition technology, including:

[0042] Acquire the voiceprint module, collect the voice sample of the customer who needs a loan, and form the voiceprint feature of the customer;

[0043] The post-loan management module, according to the pre-set verification ratio, randomly selects a list of customers to be verified, and forms an AI robot phone verification list according to the script template, and the intelligent voice interaction center conducts phone verification on the customers in the list according to the content of the script , confirm the consistency of the user and the accuracy of the data according to the characteristics of the voiceprint, and return the result; if the voiceprint is inconsistent, generate the first warning message;

[0044] According to the set requirements, the target cus...

Embodiment 3

[0049] This embodiment provides an electronic device, including a memory, a processor, and a computer program stored in the memory and operable on the processor. When the processor executes the computer program, any implementation manner in Embodiment 1 can be implemented.

[0050] Since the electronic device introduced in this embodiment is the device used to implement the method in Embodiment 1 of this application, based on the method described in Embodiment 1 of this application, those skilled in the art can understand the electronic device of this embodiment. Specific implementation methods and various variations thereof, so how the electronic device implements the method in the embodiment of the present application will not be described in detail here. As long as a person skilled in the art implements the equipment used by the method in the embodiment of the present application, it all belongs to the protection scope of the present application.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - Generate Ideas

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com