Method and system for risk early warning by calculating fluctuation ratio index based on options

A risk warning and volatility technology, applied in the field of option trading algorithms, can solve problems such as deviation, fewer samples that can be calculated, and increase calculation results, so as to prevent normal operation, optimize user experience, and improve computing power distribution.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

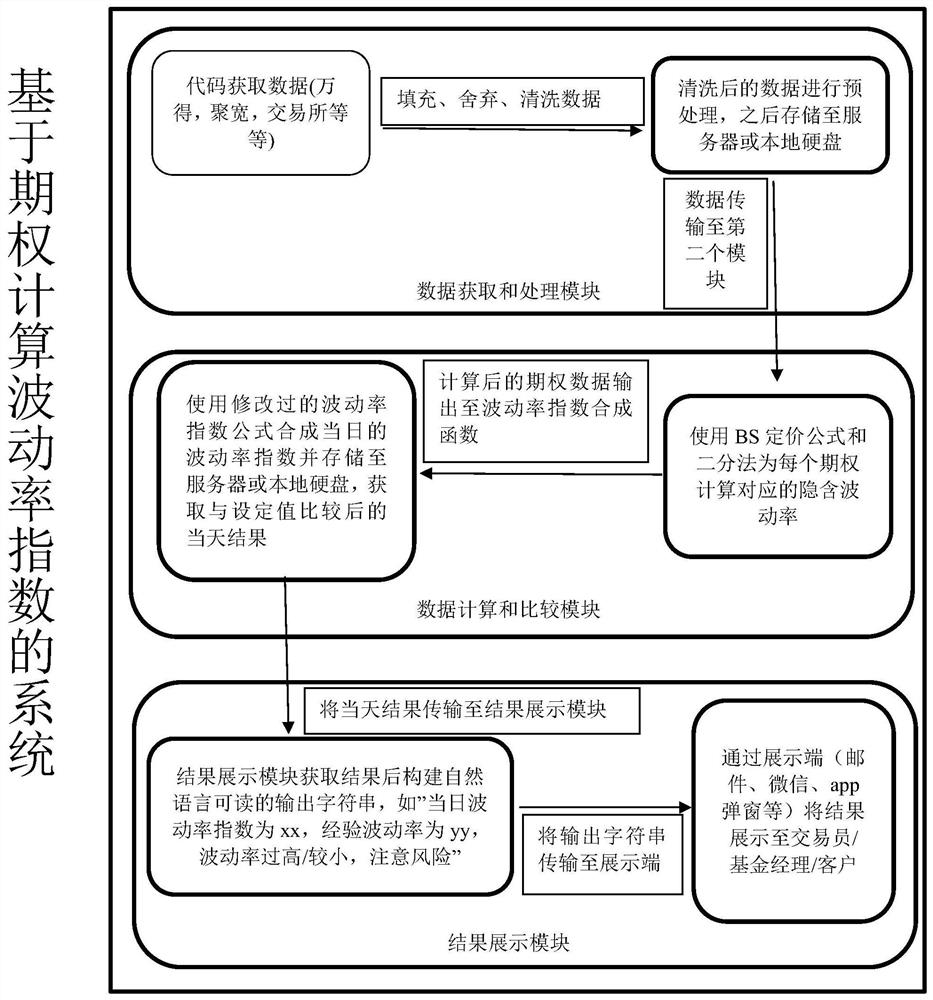

[0063] According to a method for calculating volatility index based on options to carry out risk early warning provided by the present invention, it includes: figure 1 as shown,

[0064] Step M1: Use Internet intelligent information collection technology and data interface to obtain all options data that meet the preset requirements from data service providers and exchanges;

[0065] Step M2: Preprocess the collected option data that meets the preset requirements and store the preprocessed option data in the server or local hard disk;

[0066] Step M3: Calculate the corresponding implied volatility for each option using the option data stored on the server or local hard disk using the BS option pricing formula and dichotomy;

[0067] Step M4: According to the corresponding implied volatility of each option, calculate the volatility index of the day, and store the calculated volatility index of the day to the server or local hard disk;

[0068] Step M5: According to whether ...

Embodiment 2

[0127] Embodiment 2 is a modification of embodiment 1

[0128] For option 10002690, its closing price on July 27, 2020 was 0.5598, its trading volume was 87, the price of 50ETF at that time was 3.211, the strike price of the option was 3.7, and the implied volatility calculated by the dichotomy method was 0.3255 , and the distance from the option to the exercise date is 0.4 (years), so the contribution of the option to IPvix is as follows:

[0129] molecular part:

[0130] Volume*StrikeWeight*ImpVol*MaturityWeight=87*0.859*0.3255*1=24.325

[0131] Denominator part:

[0132] Volume*StrikeWeight**MaturityWeight=87*0.859*1=74.733

[0133] Go through all the options that can be traded that day, and know that its volatility index is: 28.09. However, IPvix has a certain mean regression property, and its high probability should be between 15 and 25. Therefore, the volatility index of the day is relatively high, and the risk of sharp rise and fall should be guarded against.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com