Credit evaluation method and device, storage medium and server

A credit evaluation and credit scoring technology, applied in instruments, data processing applications, finance, etc., can solve problems such as inaccurate loan amount, low efficiency of credit scoring, inaccurate credit scoring, etc., and achieve the effect of improving accuracy

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment Construction

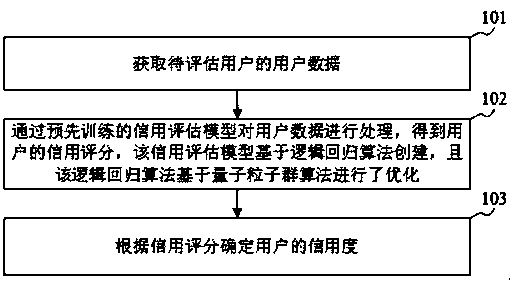

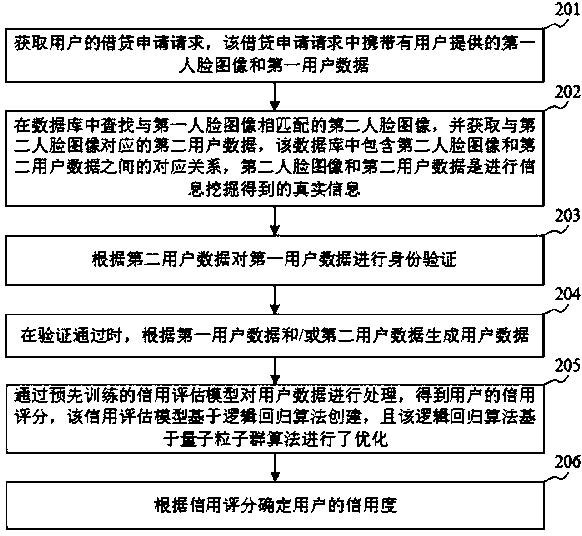

[0024] In order to make the purpose, technical solutions and advantages of the embodiments of the present application clearer, the following will further describe the embodiments of the present application in detail in conjunction with the accompanying drawings.

[0025] The lending business in Internet finance can reasonably collect private capital and effectively alleviate the problem of private financing difficulties. However, the current lending business has the following problems: 1) The lending business lacks a guarantee mechanism for final repayment. If the borrower is unable to repay the loan, it is difficult to protect the interests of the borrower; 2) Fraudulent loans are more frequent. Analysis shows that the reason for the above problems is the inaccurate assessment of the user's loan amount (that is, the credit score), and the loan amount is determined according to the credit score, so the accuracy of the credit score needs to be improved.

[0026] In the related ...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D Engineer

- R&D Manager

- IP Professional

- Industry Leading Data Capabilities

- Powerful AI technology

- Patent DNA Extraction

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2024 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com