Tax data anomaly analysis method and system

A data exception and tax technology, applied in relational databases, database models, network data retrieval, etc., can solve the problems of low efficiency and high cost, and achieve the effect of high efficiency and saving screening costs.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

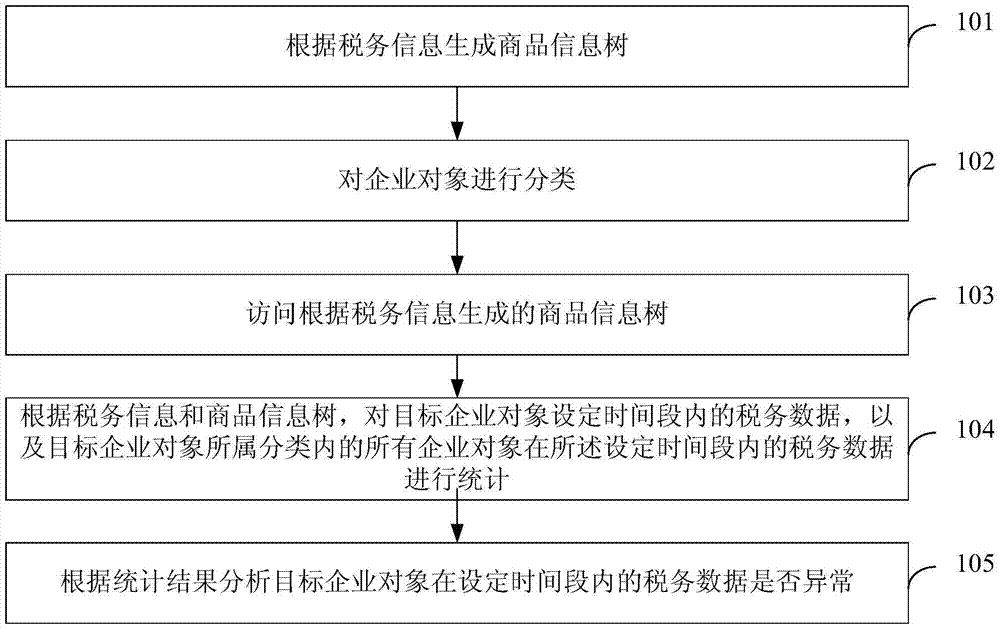

[0015] refer to figure 1 , shows a flow chart of steps of a method for analyzing tax data anomalies according to Embodiment 1 of the present invention.

[0016] The tax data anomaly analysis method in this embodiment includes the following steps:

[0017] Step S101: Generate a commodity information tree according to the tax information.

[0018] Wherein, the commodity information tree is commodity information stored in a tree-like data structure, and the commodity information tree at least stores a commodity name and a category to which the commodity belongs. But not limited to this, information related to the commodity can be saved, such as price, place of origin, manufacturer and so on.

[0019] A feasible way to generate a product information tree based on tax information includes: obtaining meta-tax data from the tax data database, and obtaining product detail information according to the meta-tax data, wherein the product detail information includes the product name; cr...

Embodiment 2

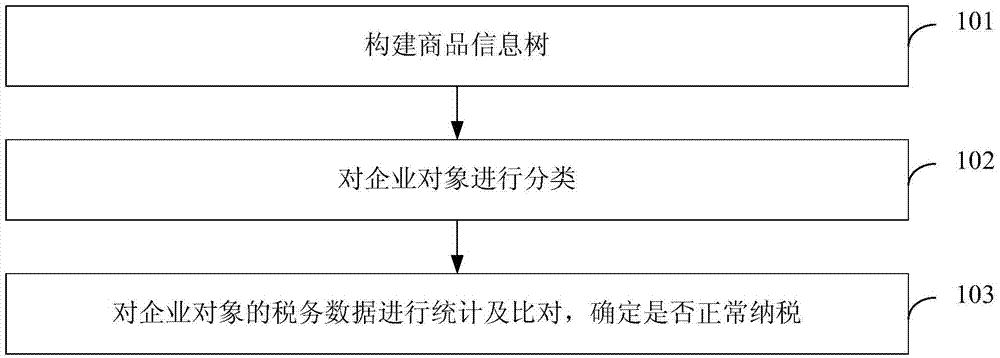

[0038] refer to figure 2 , shows a flow chart of steps of a method for analyzing tax data anomalies according to Embodiment 2 of the present invention. This embodiment illustrates the tax data anomaly analysis method of the present invention in the form of a specific example. Those skilled in the art should understand that this embodiment is only an exemplary description. Those skilled in the art can refer to this embodiment in practical applications. , to replace or modify the technical means in this embodiment in other appropriate ways, all within the protection scope of the present invention.

[0039] The tax data anomaly analysis method in this embodiment includes the following steps:

[0040]Step S201: Construct a commodity information tree.

[0041] The details of all commodities in the invoice (including but not limited to commodity header, commodity line, invoice code, time, amount, unit name, Tax number. Unit information, credit degree, etc.), classify each produc...

Embodiment 3

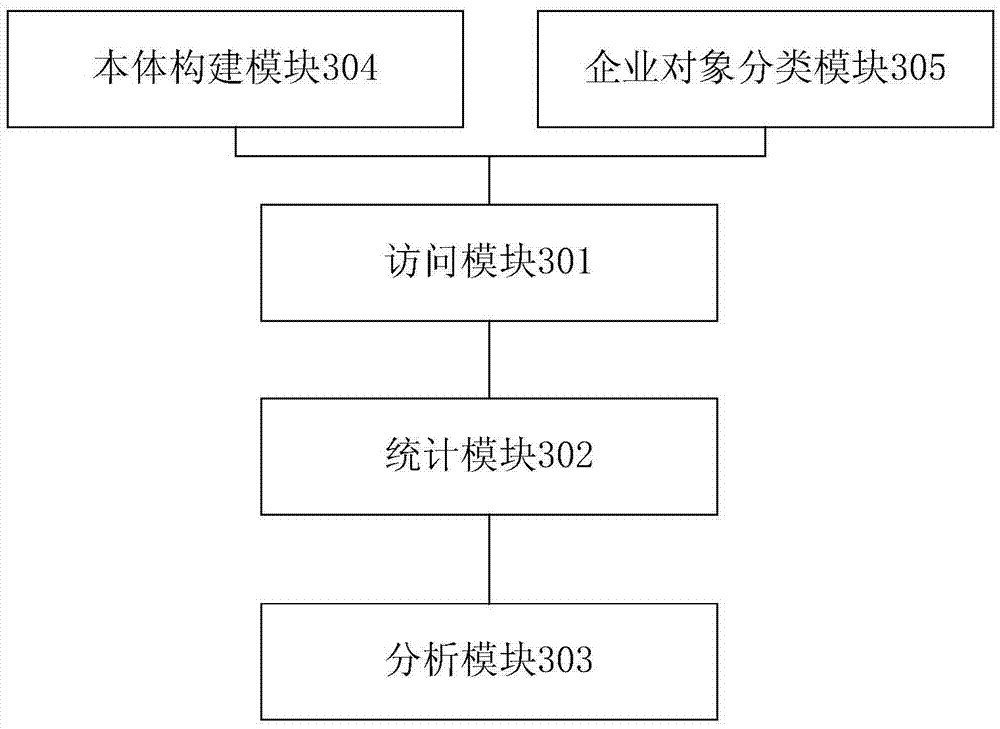

[0064] refer to image 3 , shows a structural block diagram of a tax data anomaly analysis system according to Embodiment 3 of the present invention.

[0065] The tax data anomaly analysis system of this embodiment includes: an access module 301 for accessing the product information tree generated according to the tax information, wherein at least the product name and the category to which the product belongs are stored in the product information tree; The tax information and the commodity information tree are used to count the tax data of the target enterprise object within the set time period, and the tax data of all enterprise objects within the category to which the target enterprise object belongs within the set time period; analyze Module 303, configured to analyze whether the tax data of the target enterprise object within the set time period is abnormal according to statistical results.

[0066] Preferably, the tax data anomaly analysis system of this embodiment furth...

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com