An investment and financing method utilizing a venture capital and financing system and a venture capital and financing system

An investment and financing, investor technology, applied in the field of investment and financing, can solve problems such as restricting investment returns, inability to implement projects, and low risk resistance.

- Summary

- Abstract

- Description

- Claims

- Application Information

AI Technical Summary

Problems solved by technology

Method used

Image

Examples

Embodiment 1

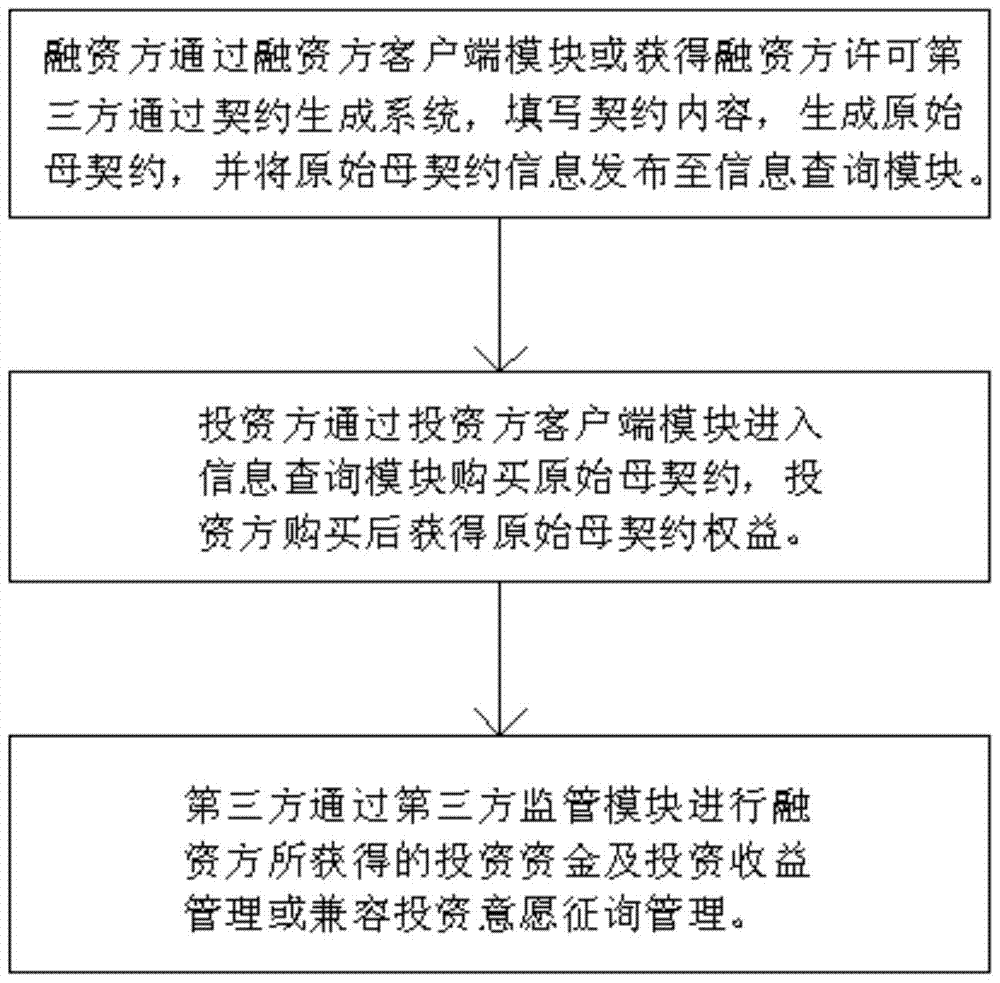

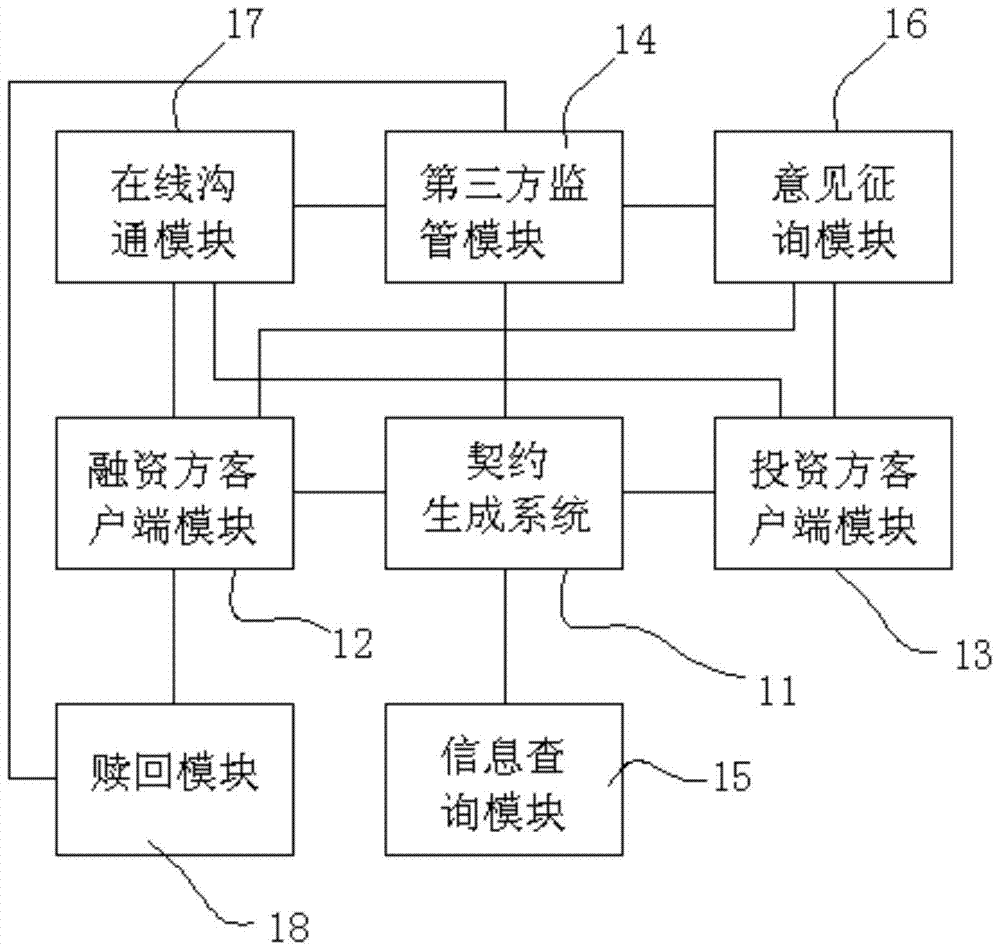

[0091] Such as figure 1 As shown, the present invention provides an investment and financing method utilizing a venture investment and financing system, including:

[0092] In the first step, the financier fills in the contract content through the financier client module 12 or a third party approved by the financier through the contract generation system 11, generates the original parent contract, and publishes the original parent contract information to the information query module 15. The financier sets the subscription amount, share, unit price, rate of return or return equity, total subscription amount, collateral and other rights and responsibilities related information.

[0093] In the second step, the investor enters the information query module 15 through the investor client module 13 to purchase the original parent contract, and the investor obtains the rights and interests of the original parent contract after purchasing.

[0094]After the investor purchases the ori...

Embodiment 2

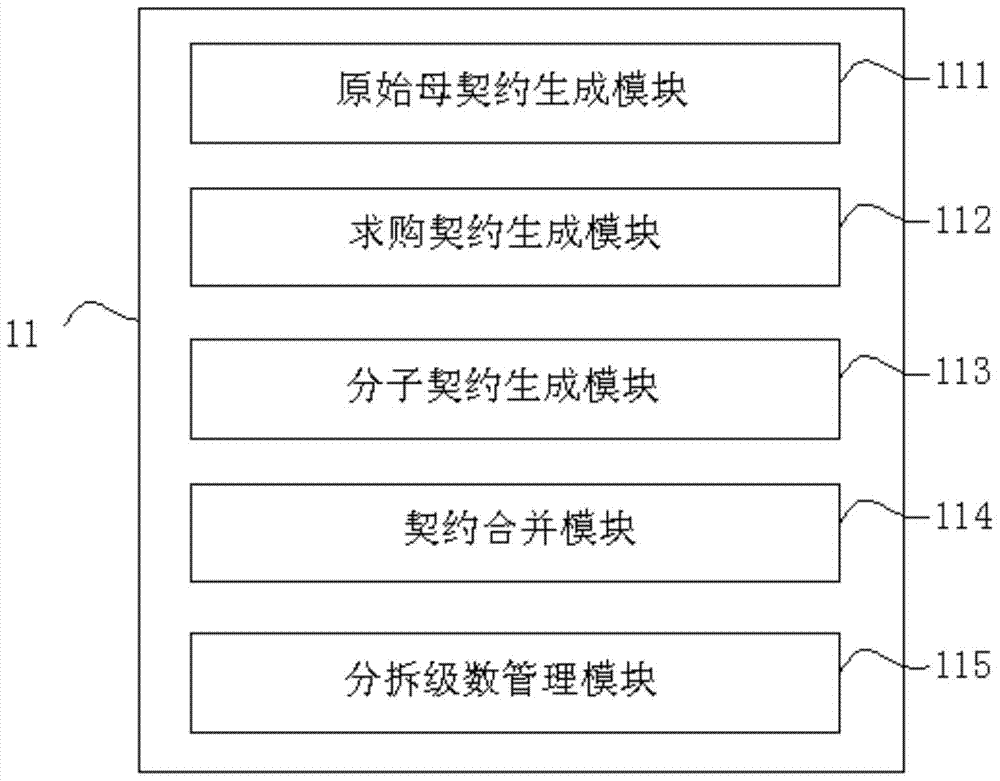

[0123] The investment and financing method using the risk investment and financing system of the present invention also provides another embodiment, which differs from Embodiment 1 in that the investor can also generate a purchase contract through the contract generation system 11, and the purchase contract can be generated There is no limit to the purchase price of the equity purchase price according to the pricing unit, and the total purchase quota can also be set. After the purchase contract is generated, it is published in the information query module 15; investors or financiers who hold the contract conduct targeted split contracts with investors corresponding to the purchase contract; the contract after the split is sent to the investor for subscription; At the same time, the contract that cannot be subscribed is returned; and the contract after the directional split is before the investor subscribes, the contract splitter can withdraw the split contract at any time.

PUM

Login to View More

Login to View More Abstract

Description

Claims

Application Information

Login to View More

Login to View More - R&D

- Intellectual Property

- Life Sciences

- Materials

- Tech Scout

- Unparalleled Data Quality

- Higher Quality Content

- 60% Fewer Hallucinations

Browse by: Latest US Patents, China's latest patents, Technical Efficacy Thesaurus, Application Domain, Technology Topic, Popular Technical Reports.

© 2025 PatSnap. All rights reserved.Legal|Privacy policy|Modern Slavery Act Transparency Statement|Sitemap|About US| Contact US: help@patsnap.com